The Nifty 50 narrowly missed the 25,000 mark, closing flat but at a new high on July 29. A bearish candlestick pattern formed on the daily charts suggests potential consolidation, with key support at 24,600. If the index holds 24,800 on a closing basis, 25,000-25,200 may be possible in upcoming sessions. On the NSE, 1,369 shares advanced while 1,028 shares declined. Here are some trading ideas for the near term:

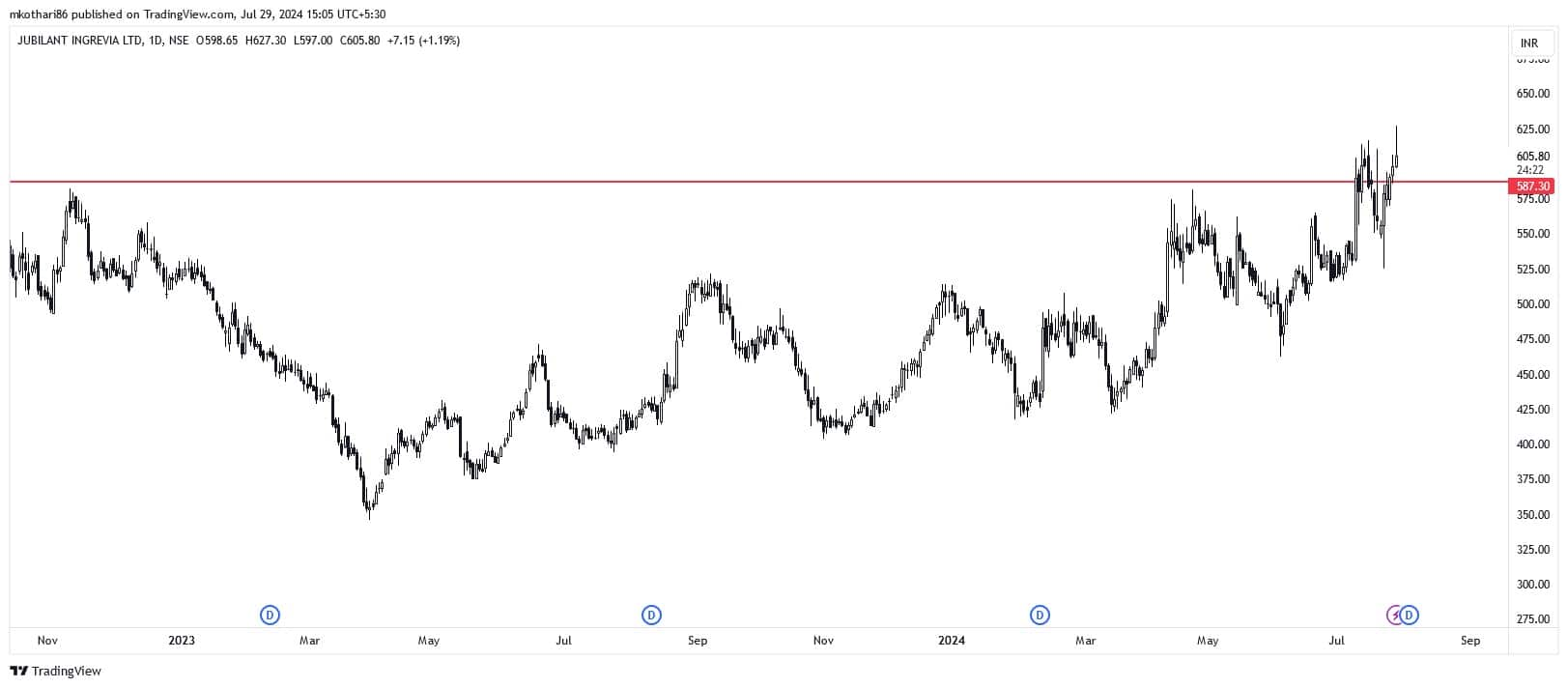

Mehul Kothari, DVP – Technical Research at Anand RathiJubilant Ingrevia | CMP: Rs 607

After some consolidation and a corrective move, we are witnessing a range breakout in the long-term charts of Jubilant Ingrevia. The price action resembles a bullish inverse Head and Shoulder pattern, with a theoretical target around Rs 750. Along with the price, we are witnessing a range breakout in the monthly RSI (Relative Strength Index), indicating fresh momentum. Thus, we advise traders to go long in the stock near Rs 610–620, with a stop-loss of Rs 555 and a target of Rs 735 in the coming months.

Strategy: Buy

Target: Rs 735

Stop-Loss: Rs 555

Bharat Dynamics | CMP: Rs 1,469.4

Bharat Dynamics has been in a strong uptrend along with other defense stocks. However, there was some profit booking from higher levels, and the stock dipped below the Rs 1,400 mark. We are witnessing a reversal candlestick pattern on the daily chart, indicating that the stock might resume its uptrend. Hence, we advise traders to go long in the stock near Rs 1,460 for a target of Rs 1,660 in a few weeks.

Strategy: Buy

Target: Rs 1,660

Stop-Loss: Rs 1,360

Ideaforge Technology | CMP: Rs 858

Recently, Ideaforge Technology recovered from the lows around Rs 650 and rallied towards the Rs 850 mark. After some consolidation, it is now on the verge of a fresh breakout. The price action resembles a bullish Flag breakout above Rs 865. Thus, we advise traders to go long in the stock near Rs 860 for a target of Rs 925 in the coming weeks.

Strategy: Buy

Target: Rs 925

Stop-Loss: Rs 825

Pravesh Gour, Senior Technical Analyst at Swastika InvestmartJindal Saw | CMP: Rs 601.75

On the longer timeframe, Jindal Saw has witnessed a breakout from a long consolidation formation with strong volume, closing above Rs 600. On the daily chart, it has formed a strong base and the uptrend is intact, starting a new rally towards the Rs 650+ level. The overall structure is very lucrative as it trades above all important moving averages. On the upside, Rs 620 is an immediate resistance area; above this, we can expect a run-up towards Rs 680+ levels in the near term. On the downside, Rs 550 is a major support level for any correction. The momentum indicator RSI is also positively poised whereas MACD (Moving Average Convergence Divergence) is supporting the current strength.

Strategy: Buy

Target: Rs 684

Stop-Loss: Rs 550

Vishnu Prakash R Punglia | CMP: Rs 265

Vishnu Prakash R Punglia has given a multi-month breakout above Rs 242 on the daily chart with strong volume. The structure of the counter is very lucrative, as it is trading above all its moving averages. MACD supports the current strength, and the momentum indicator RSI is also positively poised. On the higher side, Rs 280 acts as a susceptible level; above this, we can expect a move towards Rs 300+ in the shorter to longer timeframe. On the lower side, Rs 245 serves as an important support during any correction.

Strategy: Buy

Target: Rs 300

Stop-Loss: Rs 245

Coromandel International | CMP: Rs 1,680

Coromandel International is in a strong uptrend, with a breakout of a triangle formation with strong volume. The overall structure is very lucrative, as it is trading above all its important moving averages. On the higher timeframe, there is a breakout of a bullish Flag formation, suggesting much more potential upside. It has retested its previous breakout level of Rs 1,500 after hitting a fresh all-time high. The momentum indicator RSI is positively poised, and MACD is witnessing a centerline crossover on the upside. On the higher side, Rs 1,700 is an important psychological level; above this, we can expect a level of Rs 1,850+ in the near-short term. On the lower side, Rs 1,550 will act as major support during any correction.

Strategy: Buy

Target: Rs 1,870

Stop-Loss: Rs 1,550

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI SecuritiesPiramal Enterprises | CMP: Rs 1,029.75

Piramal Enterprises has provided a breakout from the falling channel with a bullish crossover on its short-term as well as medium-term time frames. It has also surpassed its multiple swing resistances, leaving no major hurdles technically until the Rs 1,110 to Rs 1,160 levels. The crucial support is pegged at Rs 953 levels. The stock has recently seen some good long build-up as well, hence the short-term bias is positive.

Strategy: Buy

Target: Rs 1,110, Rs 1,160

Stop-Loss: Rs 953

Balkrishna Industries | CMP: Rs 3,305

Technically, Balkrishna Industries has provided a breakout from the sideways consolidation on the daily charts after having provided a breakout from an ascending triangular pattern. The short-term and medium-term momentum indicators are well in buy mode. From the derivatives point of view, the stock has seen decent short covering, and it has good build-up at the Rs 3,200 strike Put, which is its next support, so the short-term bias remains positive.

Strategy: Buy

Target: Rs 3,450, 3,525

Stop-Loss: Rs 3,200

Adani Ports and Special Economic Zone | CMP: Rs 1,548.7

Technically, Adani Ports has provided a breakout from the sideways consolidation with a bullish crossover on its daily momentum indicators. From the derivatives point of view, it has strong Put writing at the Rs 1,500 strike Put levels, whereas it has the highest Call open interest at the Rs 1,600 strike levels. Once this level is surpassed, the stock is expected to rise to the Rs 1,620 to Rs 1,660 levels. The stock is trading well above its maximum pain and modified maximum pain levels, which are at Rs 1,500 and Rs 1,482, respectively, hence the short-term trend is positive.

Strategy: Buy

Target: Rs 1,620, Rs 1,660

Stop-Loss: Rs 1,510

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.