The market remained under pressure for three consecutive days, falling more than half a percent on December 18, with breadth favouring bears. About 1,801 shares declined compared to 719 advancing shares on the NSE. Given the weak sentiment, the benchmark indices may extend their southward journey in the upcoming session. Below are some trading ideas for the near term:

Shitij Gandhi, Senior Technical Research Analyst at SMC Global Securities

Chalet Hotels | CMP: Rs 1,001

Chalet Hotels has been maintaining its bullish trend and is trading well above its 200-day exponential moving average (EMA) on the daily time frame. Last week, a fresh breakout above the key resistance of the Rs 950 level was observed on the charts, as the stock witnessed an upside after a prolonged consolidation phase. The rising volume, along with positive price action, suggests further upside potential for the stock. Therefore, one can accumulate the stock in the range of Rs 990-1,000 for the expected upside to Rs 1,160, with a stop-loss below Rs 900.

Strategy: Buy

Target: Rs 1,150, 1,160

Stop-Loss: Rs 900

Bharti Hexacom | CMP: Rs 1,545.85

Bharti Hexacom has been consolidating in a broader range of Rs 1,300-1,500 for the last few months, with prices sustaining well above its 100-day EMA on daily charts. Technically, the stock has formed an Inverted Head & Shoulder pattern on daily charts, with a breakout seen above the neckline of the pattern formation, accompanied by larger volumes. Therefore, one can accumulate the stock in the range of Rs 1,540-1,550 for the expected upside to Rs 1,775, with a stop-loss below Rs 1,400.

Strategy: Buy

Target: Rs 1,770, 1,775

Stop-Loss: Rs 1,400

Royal Orchid Hotels | CMP: Rs 356.85

Royal Orchid Hotels picked up fresh bullish momentum once again above its 200-day EMA on daily charts. However, since then, the stock has entered a consolidation phase. On broader charts, the stock has given a fresh breakout above the W pattern after forming a Double Bottom pattern around the Rs 300 level. Therefore, one can accumulate the stock in the range of Rs 350-355 for the expected upside to Rs 400, with a stop-loss below Rs 320.

Strategy: Buy

Target: Rs 395, Rs 400

Stop-Loss: Rs 320

Vidnyan Sawant, Head of Research at GEPL Capital

Radico Khaitan | CMP: Rs 2,553.2

Radico Khaitan has exhibited a robust price structure, forming higher tops and bottoms, indicating a bullish trend. The stock has experienced a volatility contraction breakout on the daily scale, accompanied by high volumes exceeding the 20-day average. The MACD (Moving Average Convergence Divergence) momentum indicator is trending upward, reinforcing the positive trend and confirming strong bullish momentum.

Strategy: Buy

Target: Rs 3,070

Stop-Loss: Rs 2,350

Wipro | CMP: Rs 312.6

On the weekly chart, Wipro has displayed a strong base formation after finding support at the 61.8% Fibonacci retracement level. The formation of higher bottoms highlights a robust bullish chart structure. The stock is currently trading at its 52-week high, reflecting strong momentum.

Strategy: Buy

Target: Rs 358

Stop-Loss: Rs 290

KFIN Technologies | CMP: Rs 1,328.7

KFIN Technologies continues its upward trajectory, forming higher tops and higher bottoms, and consistently trading above the 12-week and 26-week EMAs, reinforcing bullish momentum. The weekly MACD is in buy mode, indicating strong bullish sentiment.

Strategy: Buy

Target: Rs 1,535

Stop-Loss: Rs 1,220

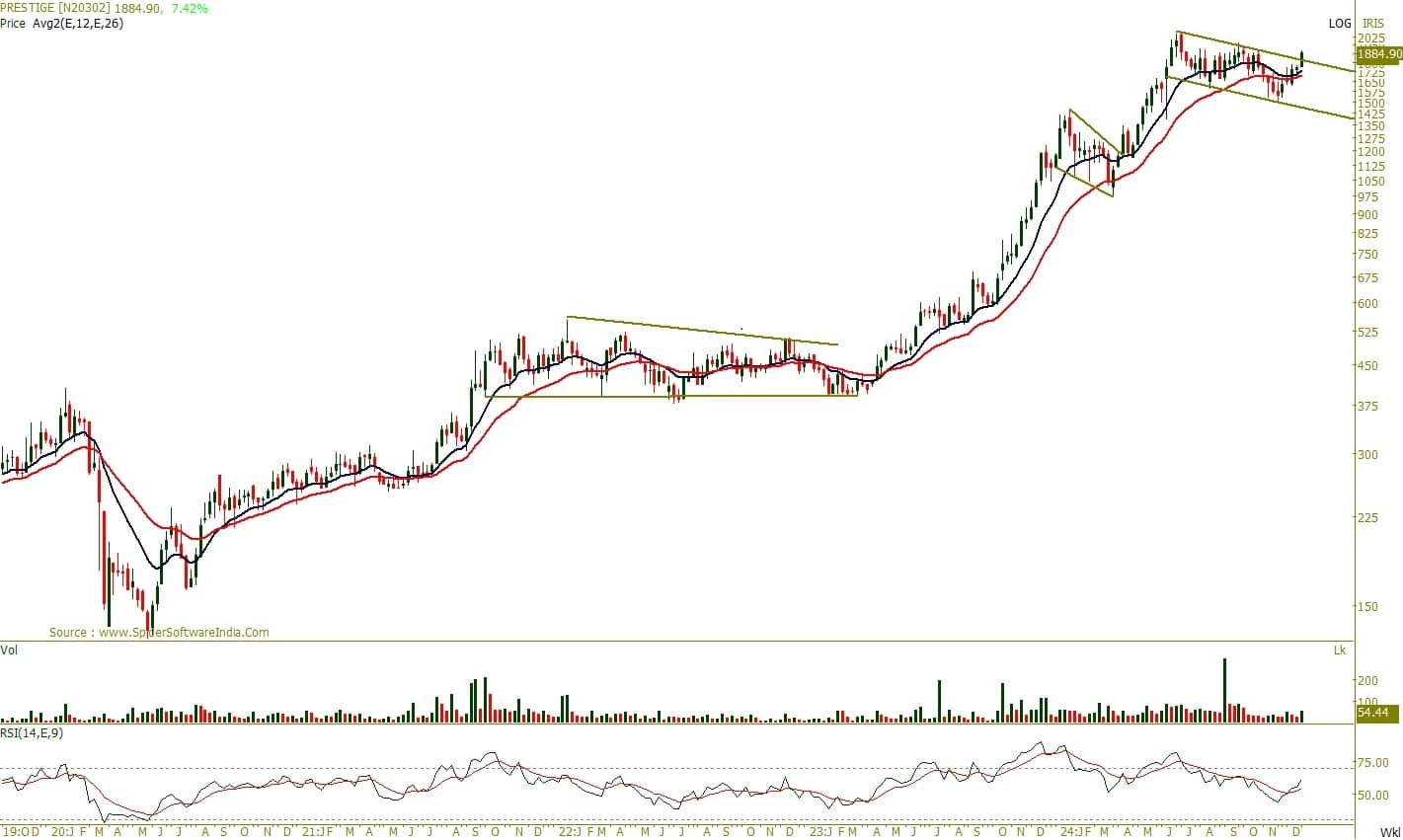

Prestige Estates Projects | CMP: Rs 1888

Since 2020, Prestige Estates Projects has maintained a classical bullish chart structure, forming consistent higher tops and bottoms. Recently, the stock broke out of a channel pattern on the weekly scale, signaling a likely continuation of its upward trajectory. The RSI (Relative Strength Index) has confirmed a bullish crossover, further reinforcing the positive momentum.

Strategy: Buy

Target: Rs 2,205

Stop-Loss: Rs 1,750

Anshul Jain, Head of Research at Lakshmishree Investments & Securities

KCP | CMP: Rs 256.15

KCP is forming a classic 131-day Cup-and-Handle pattern on the daily chart, a bullish signal that has caught the attention of savvy investors. Over the last 30 trading sessions, volumes have exceeded the 50-day average, with 8 days seeing spikes of over 3x the average—a clear indicator of institutional interest. With a breakout above Rs 260, KCP is primed for a surge, potentially targeting Rs 310 in the near term. The strong volume activity and technical formation suggest significant momentum ahead, making it a stock to watch closely. As market confidence builds, the next move could deliver robust gains. Keep an eye on KCP as it approaches a pivotal moment on the charts.

Strategy: Buy

Target: Rs 310

Stop-Loss: Rs 240

Chambal Fertilisers | CMP: Rs 524

Chambal Fertilizers is making another attempt to breach the Rs 520-525 resistance zone after six failed attempts. This time, the stock is supported by a bullish Cup-and-Handle pattern on the daily chart. Rising volumes and pre-budget rally expectations add strength to the setup. A decisive breakout above Rs 525 could lead to a quick move toward Rs 545, and if the stock surpasses Rs 545, it is poised for an explosive rally toward Rs 625. The combination of strong technicals and market optimism makes Chambal Fertilizers a stock to watch closely in the coming sessions, as it inches closer to this critical zone, signaling significant upside potential for investors.

Strategy: Buy

Target: Rs 625

Stop-Loss: Rs 510

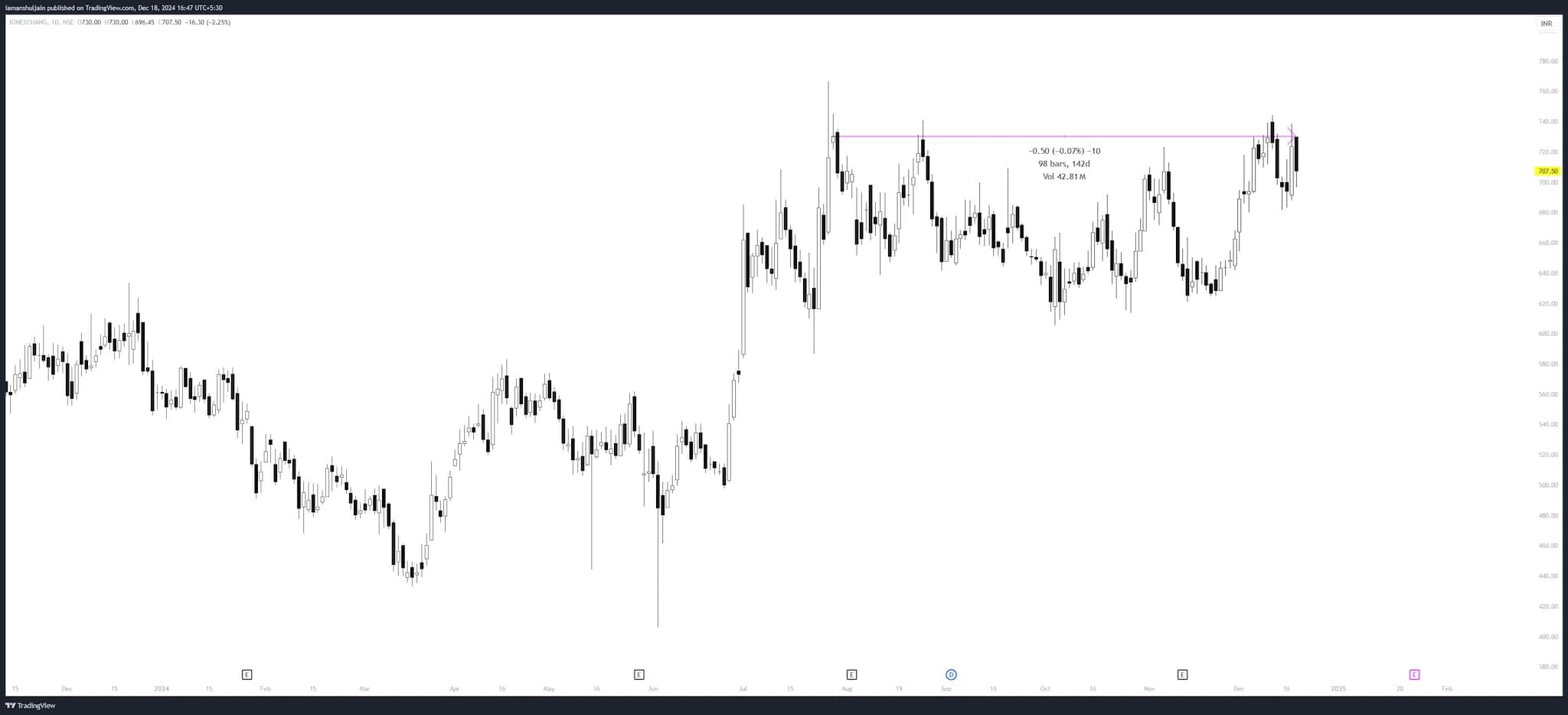

Ion Exchange | CMP: Rs 707.5

Ion Exchange is forming a 98-day flat base on the daily chart, patiently consolidating as its weekly moving averages catch up, a process that is nearly complete. Recent volume surges signal increasing institutional activity, adding strength to the technical setup. A breakout above Rs 730 could trigger significant momentum, paving the way for an immediate upside to Rs 850. This textbook consolidation pattern, coupled with rising investor interest, positions Ion Exchange as a potential outperformer in the near term. As the stock inches closer to this key resistance, it becomes a prime candidate for traders and investors seeking opportunities in strong, technically sound plays. Keep an eye on Ion Exchange for a decisive breakout in the coming sessions.

Strategy: Buy

Target: Rs 850

Stop-Loss: Rs 670

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.