The Nifty has rallied from 11,000 levels in January to 11,600 in August, a gain of 5.4 percent. In course of this rally, there was plenty of stock-specific action that might have got unnoticed.

Buying from foreign institutional investors, stability in the dollar-rupee, positive global cues, as well as in-line earnings from India Inc are some of the factors that are fuelling a rally in the domestic market.

The sharp rally in the market since July may have caught many investors by surprise, but analysts feel long-term investors should opt for largecaps as compared to midcaps.

“Markets are interestingly poised and hitting fresh highs despite global volatility as well as currency depreciation. Clearly, the earnings cycle seems to be turning around. While valuations are not offering any room for error, it alone can’t pull the market down in our view given the turnaround in earnings,” Gautam Duggad, Head of Research, Motilal Oswal Institutional Equities, said.

He sees the Nifty remaining rangebound in the near term till earnings catch up with valuations. "We continue to prefer largecaps versus midcaps. We would suggest systematic and staggered buying to partake in the earnings rebound."

We looked at various stocks among NSE indices that have contributed the most to the rally and have seen selling pressure.

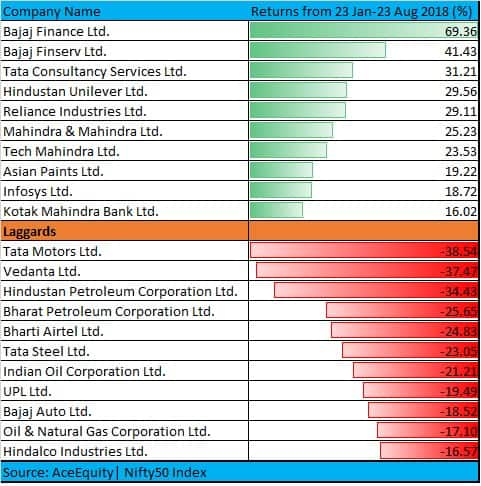

Among Nifty constituents, both largecaps and midcaps led the rally. These include: Bajaj Finance, which rallied 70 percent from January, followed by Bajaj Finserv (41 percent) and Tata Consultancy Services (31 percent).

Tata Motors (down 38 percent), followed by Vedanta (37 percent) and Hindustan Petroleum Corporation (34 percent) were the major laggards in the same period.

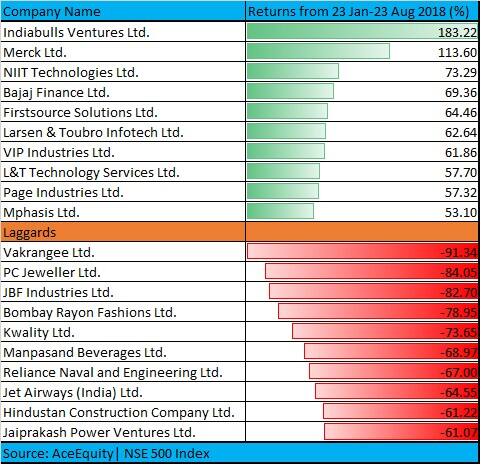

NSE 500 index

Among NSE500 constituents, Indiabulls Ventures and Merck more than doubled investors wealth since January. NIIT Technologies, Bajaj Finance, Firstsource Solutions, L&T Infotech and VIP Industries rose 60-100 percent in the same period. Vakrangee lost a little over 90 percent, followed by PC Jeweller (84 percent) and JBF Industries (82 percent) in the same period.

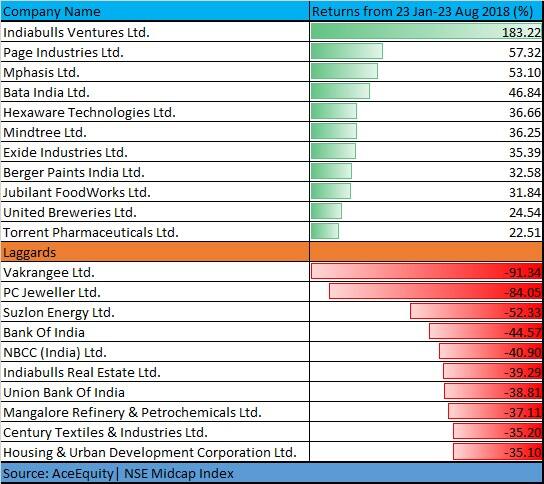

NSE Midcap index

Among NSE Midcap index constituents, Page Industries, Mphasis, Bata India, Hexaware Technologies, MindTree, Exide Industries, Berger Paints and Jubilant FoodWorks rose 30-50 percent since January.

Among the laggards, Suzlon lost 52 percent, Bank of India (44 percent), Indiabulls Real Estate (39 percent), Union Bank of India (38 percent) and Century Textiles (35 percent)

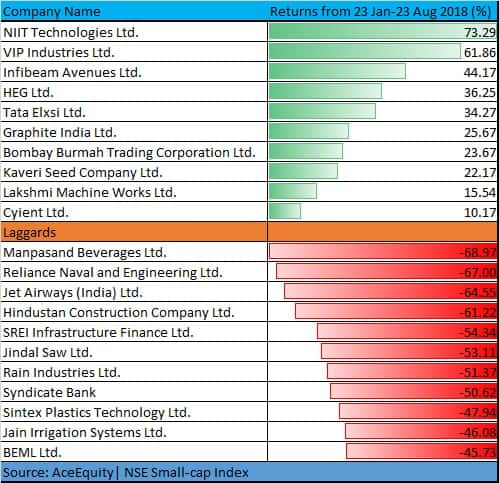

NSE Smallcap indexFrom NSE Smallcap index pack, NIIT Technologies surged 73 percent, followed by VIP Industries (61 percent), Infibeam Avenues (44 percent) and HEG (36 percent) since January.

From the losers pack, Manpasand Beverages fell 68 percent since January, followed by Reliance Naval (67 percent), Jet Airways (64 percent) and HCC (61 percent).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.