After making a low of 18,834 on October 26, a reversal was seen and thereafter, the Nifty50 has been trading in an Ascending Channel with a higher-top higher-bottom formation.

The index is at the mid-range of the channel and any correction towards 19,330 will offer a good opportunity to go long as it converges with the 21 DMA of 19,348 as well as a bullish gap support area, while the nearest resistance is seen at 19,550.

The 12-pack Bank Nifty more or less replicated Nifty50 and formed the same pattern of a rising channel but it virtually touched the lower range of the channel by forming a long-legged doji candlestick pattern on November 13, which indicates a reversal of the trend.

The immediate strong hurdle comes at 44,600 on the higher side, while the downside seems to be protected at the 43,700-43,560 zone.

Here are three buy calls for the short term:

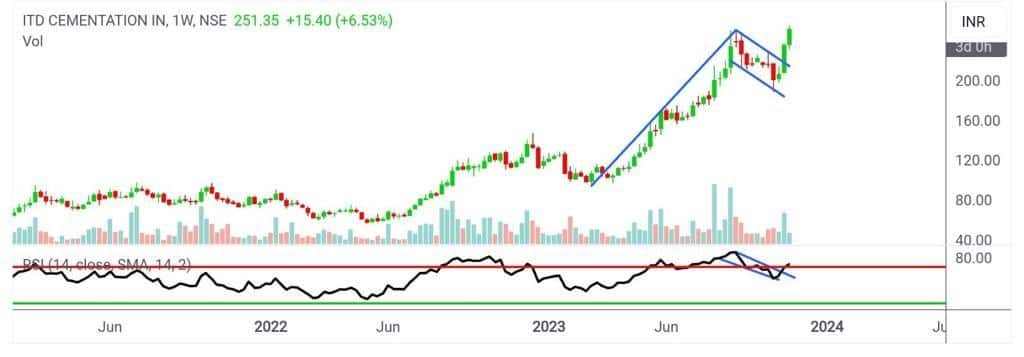

ITD Cementation India: Buy | LTP: Rs 251 | Stop-Loss: Rs 185 | Target: Rs 291-344 | Return: 16 percent

The stock is in the primary uptrend and recently, it has given a breakout from a continuation pattern known as a Bullish Flag and Pole formation. The leading momentum indicator RSI (relative strength index) replicates price activity by giving a breakout from the Flag pattern.

Another reading of a strong ADX (averge directional index) suggests the presence of a powerful trend and an upsurge in volumes confirms price activity.

We recommend a buy on the company for a target of Rs 291-344 with a closing stop-loss of Rs 185, with a horizon of 6–9 months.

Bharat Heavy Electricals: Buy | LTP: Rs 136 | Stop-Loss: Rs 124 | Target: 151 | Return: 11 percent

The stock has given a breakout from an Inverted Head and Shoulder formation which was confirmed with an above-average volumes. Momentum indicator RSI (relative strength index) has also breached its trendline resistance in the form of an Inverted Head and Shoulder pattern.

MACD (moving average convergence divergence) has already generated a positive crossover which also signifies an extension of the current uptrend. We recommend a buy on the company for a target of Rs 151, with a closing stop-loss of Rs 124 with a horizon of 1–2 weeks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!