Despite today's selloff, Dalal Street has consistently surged to record highs in recent sessions, bringing smiles to investors who have been enjoying the benefits of a strong bull run. However, amidst this euphoria, there are still pockets of gloom.

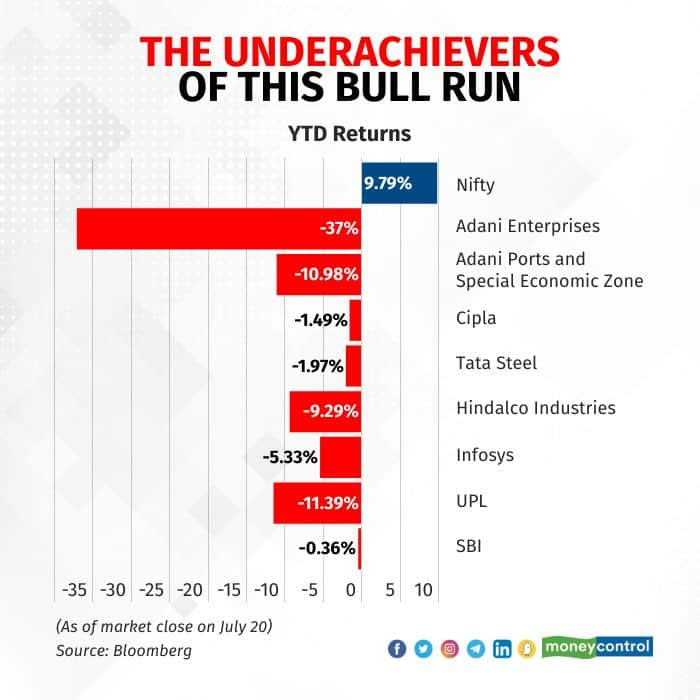

Only eight Nifty50 stocks are trading in the red on a year-to-date basis.

These include two Adani Group companies, India’s largest lender, India’s leading steel maker, India’s second-biggest IT firm, a pharma major, the metals flagship of the Aditya Birla Group, and an agri inputs giant.

Clearly corporate pedigree is no insurance against stock market pain.

Follow our live blog for all the market action

Analysts attribute this underperformance to a host of factors, ranging from a hit to profitability due to operational challenges to global headwinds and the most potent reason of them all – because the market so desires.

“If we leave the Adani stocks aside, the remaining are facing company-specific issues like challenging operative environment, price pressures etc. For SBI, there’s no particular problem on the company side, but we must remember the stock had a good run over the previous 2-year period, so it can be viewed as a time correction,” Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services, told Moneycontrol.

“All in all, the fact that we have just eight underperformers itself shows the health and breadth of this bull run,” he added.

The biggest laggards on the list are the Hindenburg-mauled Adani Group’s firms Adani Enterprises and Adani Ports and Special Economic Zone Ltd.

While most Adani firms have rebounded from the lows triggered by the damning report of US-based short-seller Hindenburg Research, they are still some distance away from their 52-week highs.

For example, Adani Enterprises is trading 70 percent below its 52-week high of Rs 4,189.55, while Adani Ports still needs to climb 35 percent to reach its 52-week peak of Rs 987.90.

In the case of agri solutions company UPL, the share prices nosedived after its fourth quarter numbers were pummelled by a rapid decline in post-patent product prices as China’s post-Covid reopening led to an oversupply of agri chemicals.

Most analysts anticipate the company’s operational performance to remain subdued at least in the first half of FY24.

Global macro headwinds have claimed three more prominent victims – Hindalco, Tata Steel and Infosys.

Metals and mining giant Hindalco, which soared to its 52-week high in January this year, has been trending downward since then, weighed by the muted performance of its US-based subsidiary Novelis, lacklustre global demand environment as well as shutdown of a copper plant for maintenance.

Tata Steel too suffered from weak demand across geographies and elevated input costs (mainly coking coal). However, robust steel demand in India and declining trend in raw material prices have kept the Street largely optimistic about the company’s prospects.

No such luck for Infosys, which is bearing the brunt of global tightening of IT budgets due to the slowdown in the EU and US – the bread-and-butter markets for India’s software service players.

A string of high-profile exits over the past few months has further stoked fears over the company’s leadership attrition and near-term roadmap.

Infosys has the most ‘sell’ ratings in this list as well as the steepest decline in the number of ‘buy’ calls compared to January 2023.

Infosys on July 20 posted an 11 percent increase in its net profit to Rs 5,945 crore, missing market expectations.

However, what came as a shocker was its revenue growth guidance for the current fiscal being slashed to 1-3.5 percent from 4-7 percent, triggering a rout in the company’s American Depository Receipts (ADRs) as well as domestic shares.

So severe has been the selling in Infosys this morning that the stock almost single-handedly prevented the Nifty from scaling the historic 20,000-mark which market participants were eagerly looking forward to.

Also Read: Infosys nosedives 10% on sharp guidance cut; fuels brokerage downgrades

Pharma company Cipla has the second highest number of ‘sell’ ratings, with the Street fretting over delays in potential launches in the key market of North America, regulatory risks and limited upside from current levels.

Cipla shares went into a tailspin in February after the United States Food and Drug Administration (USFDA) issued 8 observations for its Pithampur manufacturing facility. The company had said it would address the matter ‘within stipulated time.’

SBI is a bit of an anomaly in this list as the Street view is largely positive for the banking behemoth, despite the ‘government discount’ most PSU stocks suffer from.

Notably, the entire banking sector is thriving at this time, and public sector lenders collectively posted a record net profit of Rs 1.05 lakh crore in FY23, with SBI and others reporting their highest-ever earnings amid a steady decline in bad assets and healthy loan demand.

Of course, SBI is only marginally lower at this point and may well find itself out of this list by the time it announces its Q1 FY24 results amid expectations of another set of strong numbers.

Which means more wind beneath the wings of the current rally. And not to forget, wider smiles.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.