LiveNow

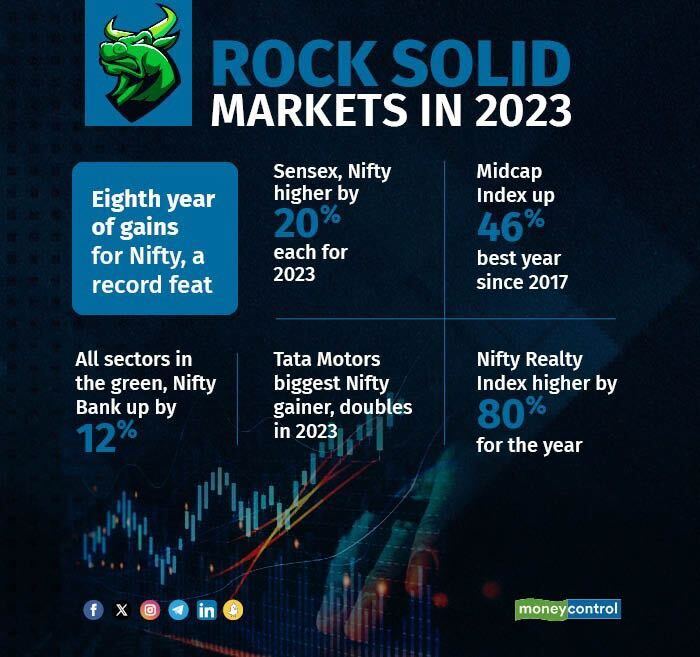

Closing Bell: Rock solid 2023 comes to an end; Nifty closes at 21,730, Sensex at 72,240

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21731.40 -0.22 | 20.03 1.79 | 8.13 19.46 |

| NIFTY BANK | 48292.25 -0.45 | 12.34 1.69 | 8.36 11.65 |

| NIFTY Midcap 100 | 46181.65 0.8 | 46.57 2.41 | 8.36 47.31 |

| NIFTY Smallcap 100 | 15143.65 0.61 | 55.62 2.00 | 8.08 56.78 |

| NIFTY NEXT 50 | 53344.80 0.72 | 26.45 2.70 | 12.33 26.25 |

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

The Indian Rupee appreciated slightly on Friday on weak US Dollar and a decline in crude oil prices. FII inflows also supported Rupee. However, weak domestic markets capped sharp gains. The US Dollar recovered slightly on short coverings but declined again today on rate cuts bets. Rising weekly jobless claims also signalled a slowdown in the labour market.

We expect the Rupee to trade with a slight positive bias on the weak tone of the US Dollar and declining crude oil prices. Fresh foreign inflows may also support the domestic currency. However, the weak tone in domestic markets caps a sharp upside. Month-end Dollar demand from OMCs and importers may weigh on the rupee at higher levels. Traders may take cues from India’s fiscal deficit and Chicago PMI data from the US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.50.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets took a breather on the final trading session of the calendar year and settled with a modest cut. After the initial downtick, the Nifty oscillated in a narrow range and finally closed at 21,731.40 levels. Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein auto and FMCG edged higher while energy, IT and banking witnessed some profit taking. Besides, the buoyancy on the broader front further eased the pressure.

We may see further consolidation in the index and it would be healthy after the recent surge. We expect Nifty to hold the 21,300-21,500 zone in case of a dip during consolidation and reiterate our positional target of 22,150 level. Participants should stay focused on the selection of stocks and prefer index majors.

Dhiraj Relli, MD & CEO at HDFC Securities

2023 has been a great year for our markets – for both the frontline indices and the broader markets. It once again showed the impact of Retail/HNI buying and when the FPIs also turned buyers there was no going back. In 2024, we are beginning on a high base and hence it may be difficult to expect a similar performance by the time 2024 ends. However, the resurgence of FPI buying and placement of India as an attractive market, despite the seeming high valuations, may help our markets register some more gains in the early part of the year. Later we may have bouts of volatility due to elections, timing and quantum of rate cuts, and valuation concerns. The retail Indian has truly woken up and will drive the markets whenever the macros are favourable.

Deveya Gaglani, Research Analyst - Commodities, Axis Securities

2023 has turned out to be a stellar year for Gold prices. COMEX prices gained more than 10 per cent, and in the domestic market, it is up by more than 12 per cent due to the weakness in the rupee. Gold prices have effectively navigated the challenges of solid dollar index and bond yields this year. Geopolitical tension between Israel and Hamas and expectation of a Fed Pivot and rate cut in 2024 supported Gold prices at the lower level. Overall, the outlook looks positive for prices as Central banks accumulate Gold at every dip. On the other hand, the ongoing geopolitical tension will continue next year, which will act as a cushion for Gold prices. Technically speaking, $2070 has been a vital supply zone for Gold for the past few years, which it tested this month but failed to sustain above it on account of profit booking. A monthly close above the mentioned level may push the door open for the target of $2250 and a target of Rs 70000 level in MCX for 2024.

Pranav Haridasan, MD & CEO, Axis Securities

2023 was intriguing for both the Indian and Global equity markets. While the year commenced with restrained expectations and notable volatility in the initial months, the Indian market witnessed a remarkable recovery in the second half from its Mar 2023 bottom. In 2024, the Indian economy will continue to stand out, especially against the challenging backdrop of other emerging economies. We firmly believe that India will continue its growth momentum in the year ahead and remain the land of stability against the backdrop of a volatile global economy. The bolstered balance sheet strength of corporate India and the significantly enhanced health of the Indian banking system are positive factors. These elements are poised to facilitate Indian equities in achieving double-digit returns over the next two to three years, supported by robust double-digit earnings growth.

Closing Bell | Sensex ends 170 pts lower, Nifty below 21,750; midcaps, smallcaps outperform

At close, the Sensex was down 170.12 points or 0.23 percent at 72,240.26, and the Nifty was down 47.30 points or 0.22 percent at 21,731.40. The market breadth favoured gainers over losers as about 1,758 shares advanced, 1,533 shares declined, and 54 shares unchanged.

Stock Market LIVE Update | Outlook 2024: Corporate chieftains highly bullish on India growth story

Ahead of the New Year 2024, India Inc bigwigs seem to be on the same page when it comes to India's growth trajectory, as Deepak Parekh, NR Narayana Murthy, Uday Kotak and Kiran Mazumdar Shaw shared their unwavering optimism about the country's economic prospects. READ MORE

Stock Market LIVE Update | Yogesh Kansal, Co-founder & CMO, Appreciate

The year 2023 had quite a few nerve-wracking rides in store, which kept equity market investors as well as corporates, banks and economists on the edge of their seats. Inflation remained the buzzword for the year, and the phrase ‘soft-landing’ elicited scoffs from all corners of the market. Chair Powell’s steadfast commitment to calming down inflationary waters has buoyed markets and led to an unanticipated bull run at the end of the year. By the middle of 2023, the US economy was being rattled to its core by the twin forces of an imminent recession and a severe, unsparing banking crisis.

As we make our way into the new year, institutional investors have already baked in higher valuations after the Federal Reserve’s rather benign projection that three rate cuts are in the offing in 2024. A deeper look at the S&P500 returns, tells us that the market gains are far from broad-based. For a truly robust bullish sentiment, investor optimism will have to seep into other sectors beyond technology, luxury and communication services stocks.

Looking at the larger picture, 2024 promises to be another rollercoaster ride for the markets. Like a tightrope walker, investors would have no choice but to be vigilant in the new year.

Stock Market LIVE Update | Gold in 2024: Rate cuts, central bank buying, geopolitics, polls to unleash a bigger bull run

Gold had a stellar run in the year drawing to a close, but the yellow metal is likely to shine brighter in the year about to unfold. Reversal in monetary policy, buying by the central bank, safe haven sentiment amid geopolitical uncertainties, are among the factors that will cushion the prices for the bullion. READ MORE

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18587.55 0.97 | 47.38 4.55 | 6.32 47.12 |

| NIFTY IT | 35468.85 -0.62 | 23.92 -0.47 | 8.77 23.64 |

| NIFTY PHARMA | 16802.35 -0.35 | 33.38 2.49 | 5.08 32.99 |

| NIFTY FMCG | 56887.55 0.68 | 28.79 3.24 | 7.89 27.81 |

| NIFTY PSU BANK | 5704.95 -0.79 | 32.10 2.15 | 11.93 34.09 |

| NIFTY METAL | 7955.60 0.37 | 18.33 3.96 | 13.39 18.97 |

| NIFTY REALTY | 777.80 0.05 | 80.13 1.93 | 10.57 81.84 |

| NIFTY ENERGY | 33430.65 -0.86 | 29.23 1.89 | 14.05 29.26 |

| NIFTY INFRA | 7295.30 -0.25 | 38.90 2.25 | 11.50 38.50 |

| NIFTY MEDIA | 2390.40 0.45 | 20.00 0.00 | 4.57 20.66 |

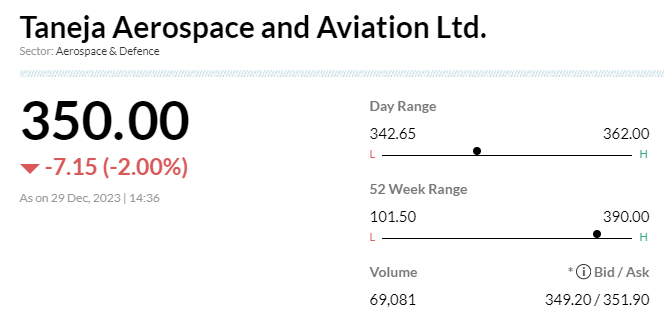

Stock Market LIVE Updates | Taneja Aerospace signs accord with Altair Infrasec

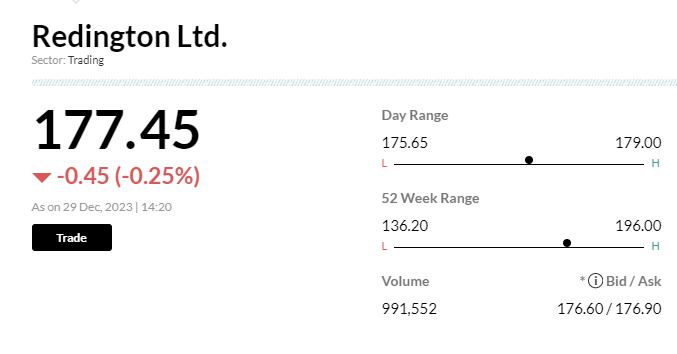

Stock Market LIVE Updates | Redington gets Rs 136 crore income tax demand for 2021-22 AY

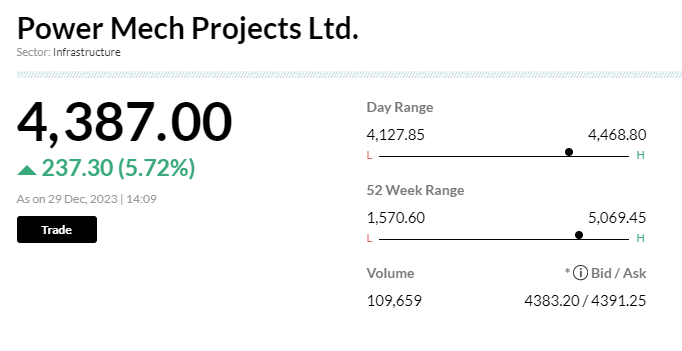

Stock Market LIVE Updates | Power Mech jumps 5% after it won two orders worth Rs 2190 crore

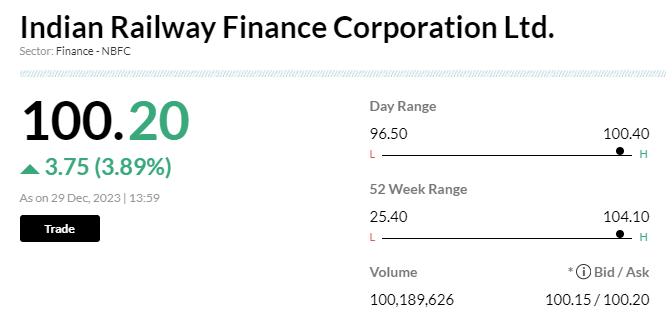

Stock Market LIVE Updates | IRFC gains 3% after huge block deal

Shares of Indian Railway Finance Corp surged 3 percent after huge block deal. Around 1.65 million shares changed hands in single block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

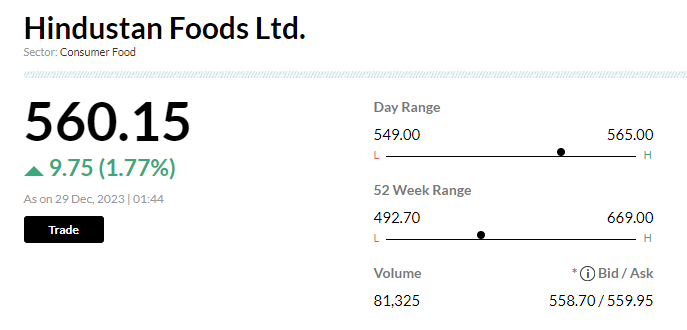

Stock Market LIVE Updates | Hindustan Foods to buy sports she plant in Haryana for Rs 30.72 crore

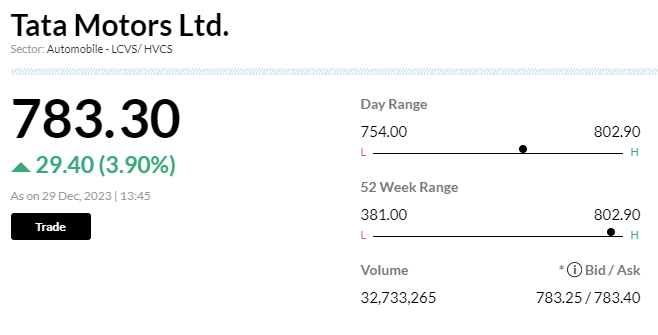

Stock Market LIVE Updates | Tata Motors and allies ride high on ET reports of India's 800,000 electric bus initiative

Tata Motors leads the surge among electric bus manufacturers following reports by the Economic Times on India's plan to replace 800,000 diesel buses with electric ones by 2030. Tata Motors stock soared by as much as 6.5%, hitting a record high. Other beneficiaries include Olectra Greentech (+11%), JBM Auto (+5.1%), Ashok Leyland (+4.4%), and auto component manufacturers like Samvardhana Motherson (+5.4%), Exide Industries (+5.4%), NRB Bearings (+20%), and Amara Raja Energy (+1.3%).

Stock Market LIVE Updates | DAM Capital View On Ratnamani Metals

-Initiate buy with target Rs 3,950 per share

-A premium player (as defined by its steady margins) in a commoditised space

-Leadership position in steel tubes

-Product mix (both stainless/carbon) has kept margins stable

-Has a stellar capital allocation track record (20% median RoCE)

-Has strong net cash balance sheet despite capex plans

Sensex Today | Oil prices to end year 10% down, traders expect a better 2024

Oil prices are set to end 2023 about 10% lower, the first annual decline in two years, after geopolitical concerns, production cuts and global measures to rein in inflation triggered wild fluctuations in prices.

Brent crude futures were up 48 cents, or 0.6%, at $77.63 a barrel at 0523 GMT on Friday, the last trading day of 2023, while the U.S. West Texas Intermediate (WTI) crude futures were trading 37 cents, or 0.5% higher, at $72.14.

On Friday, oil prices stabilised after falling 3% the previous day as more shipping firms prepared to transit the Red Sea route. Major firms had stopped using Red Sea routes after Yemen's Houthi militant group began targeting vessels.

The expected interest rate cuts, which could reduce consumer borrowing costs in major consuming regions, and a weaker dollar, which makes oil less expensive for foreign purchasers, could boost demand in 2024, industry officials say.

Sensex Today | Gold set for best year in three on hopes for Fed rate cuts

Gold prices were set on Friday for their best year in three, as expectations grew for U.S. interest rate cuts early next year and the war in Ukraine and tensions in the Middle East lifted safe-haven demand.

Spot gold was up 0.4% at $2,072.90 per ounce, as of 0722 GMT. It has risen about 14% so far this year, heading for its biggest annual gain since 2020.

U.S. gold futures fell 0.1% to $2,082.50 per ounce.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Tata Motors | 786.80 4.36 | 31.06m | 2,443.38 |

| Vodafone Idea | 15.10 13.96 | 840.71m | 1,219.03 |

| HDFC Bank | 1,710.95 0.33 | 6.73m | 1,148.49 |

| IEX | 168.80 4.52 | 67.67m | 1,143.54 |

| Olectra Greente | 1,366.70 9.63 | 6.82m | 911.89 |

| BHEL | 193.25 0.34 | 45.98m | 899.78 |

| Hind Copper | 275.50 1.94 | 29.95m | 806.83 |

| NALCO | 133.75 4 | 58.97m | 763.99 |

| GAIL | 163.90 4.33 | 44.67m | 722.40 |

| Reliance | 2,592.45 -0.5 | 2.80m | 725.16 |

Stock Market LIVE Updates | DAM Capital View On Venus Pipes

-Initiate buy call, target Rs 1,810 per share

-An emerging contender in the stainless steel pipe sector with hunger for growth

-Venus pipes is building a niche for itself in high-margin stainless steel pipes space

-Large capacity expansion behind, asset-sweating to commence

-Going up the value chain & healthy balance sheet to drive strong 60% earnings CAGR

Stock Market LIVE Updates | Morgan STanley View On Banks

-RBI shifts SBI & HDFC Bank to higher buckets in 2023 domestic systemically imporatant banks list

-This entails a higher additional CET-1 requirement of 20 bps

-CET-1 ratio for SBI is one of lowest

-Additional CET-1 ratio requirement for SBI is incrementally negative but manageable

-HDFC Bank’s CET-1 ratio remains healthy, at 16.4% & therefore impact is immaterial

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HDFC Bank | 1,710.60 | 0.32 | 194.63k |

| Federal Bank | 155.55 | 0.06 | 246.82k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SBI | 641.70 | -1.44 | 344.57k |

| Kotak Mahindra | 1,894.55 | -1.32 | 34.56k |

| AU Small Financ | 780.50 | -1.08 | 22.88k |

| IndusInd Bank | 1,594.95 | -0.95 | 15.91k |

| Bank of Baroda | 230.85 | -0.92 | 556.68k |

| IDFC First Bank | 88.00 | -0.85 | 1.93m |

| Axis Bank | 1,099.75 | -0.74 | 77.21k |

| ICICI Bank | 998.05 | -0.73 | 172.89k |

Stock Market LIVE Updates | Nodwin Gaming makes further investment in to Nodwin Gaming International

Nodwin Gaming Private Limited, a material subsidiary of the Nazara Technologies has made further investments on December 29, 2023 in Nodwin Gaming International Pte. Ltd., a wholly owned subsidiary of Nodwin and a step down subsidiary of Nazara Technologies, by subscription of 26,267 shares for an aggregate consideration of USD 4,999,923.45, in cash.

Sensex Today | Market at 1 PM

The Sensex was down 189.17 points or 0.26 percent at 72,221.21, and the Nifty was down 60.30 points or 0.28 percent at 21,718.40. About 1687 shares advanced, 1529 shares declined, and 83 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 788.55 | 4.6 | 29.69m |

| TATA Cons. Prod | 1,076.60 | 3.42 | 3.36m |

| Tata Steel | 139.90 | 1.27 | 23.42m |

| HUL | 2,657.30 | 0.89 | 743.93k |

| Adani Ports | 1,025.60 | 0.85 | 1.51m |

| Adani Enterpris | 2,833.55 | 0.84 | 1.07m |

| Britannia | 5,315.00 | 0.62 | 375.00k |

| Maruti Suzuki | 10,331.45 | 0.58 | 443.73k |

| Eicher Motors | 4,113.95 | 0.54 | 395.54k |

| Bajaj Finance | 7,293.70 | 0.48 | 510.48k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BPCL | 452.35 | -2.89 | 6.01m |

| SBI | 641.15 | -1.57 | 8.48m |

| Kotak Mahindra | 1,891.50 | -1.55 | 1.24m |

| Infosys | 1,543.20 | -1.24 | 2.02m |

| Dr Reddys Labs | 5,785.70 | -1.24 | 187.45k |

| ONGC | 205.75 | -1.22 | 6.84m |

| Apollo Hospital | 5,690.45 | -1.22 | 204.15k |

| Titan Company | 3,671.20 | -1.18 | 384.40k |

| Coal India | 376.45 | -1.18 | 6.04m |

| Cipla | 1,246.95 | -1.1 | 1.17m |

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| ABM Inter | 59.00 | 54.90 | -4.10 528 |

| Poddar Housing | 135.15 | 130.25 | -4.90 19 |

| Mangalam Worldw | 122.75 | 118.50 | -4.25 2.21k |

| Baheti Recyclin | 180.00 | 174.00 | -6.00 5.24k |

| Srivari Spices | 194.00 | 188.00 | -6.00 1000 |

| Pramara Promoti | 94.75 | 91.95 | -2.80 - |

| Bedmutha Ind | 172.95 | 168.00 | -4.95 148 |

| Arabian Petrole | 99.95 | 97.10 | -2.85 - |

| Saakshi Medtech | 216.00 | 210.10 | -5.90 2.86k |

| Micropro Soft | 57.90 | 56.50 | -1.40 - |

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Madhav Copper | 36.70 | 39.20 | 2.50 15.84k |

| Reliance Infra | 193.95 | 205.25 | 11.30 195.09k |

| Inox Wind | 478.95 | 500.50 | 21.55 203.21k |

| Medicamen Bio | 579.80 | 604.80 | 25.00 2.59k |

| Rockingdeals | 329.00 | 342.35 | 13.35 5.43k |

| Sadbhav Engg | 20.10 | 20.90 | 0.80 34.25k |

| JTEKT India | 151.25 | 157.15 | 5.90 30.19k |

| Exide Ind | 309.40 | 321.30 | 11.90 224.81k |

| Magson Retail | 118.55 | 123.00 | 4.45 1.75k |

| AMJ Land | 38.55 | 39.95 | 1.40 3.08k |

Stock Market LIVE Updates | Antique View On Shree Cements:

-Buy call, target Rs 31,200 per share

-Increased focus on improving brand positioning

-Minimised price differential with larger peers

-Targeting historical >1.5x Industry growth rates

-Industry growth rates supported by aggressive 15% CAGR

-Costs unlikely to be a major headwind going ahead given current lower fuel costs

-To remain low-cost producer aided by increasing share of green energy

-To remain low-cost producer aided by higher share of rail coefficient in freight mix

-Believe company is likely back on track to post industry leading growth

-Believe company is back on track for profitability over FY24-26 justifying its premium valuation

Stock Market LIVE Updates | Threpsi Care LLP offloads Rs 127.3 crore shares in Zydus Wellness:

Threpsi Care LLP, the alternate investment fund, sold 7.8 lakh equity shares or 1.22% stake in Zydus Wellness at an average price of Rs 1,632 per share, which were valued at Rs 127.3 crore. Threpsi Care held 11.35% stake in the company as of September 2023.

However, SBI Mutual Fund picked 3.9 lakh shares and promoter entity Zydus Family Trust bought 3.9 lakh shares, at same price.

Stock Market LIVE Updates | Motilal Oswal View On GAIL India:

-Buy call, target Rs 195 per share

-Re-rating on cards driven by a sharp improvement in RoE & FCF

-Core earnings strong

-Earnings visibility higher as transmission contribution improves

-Improving demand, lower capacity additions to drive petchem turnaround

-Expect RoE to improve to 15% in FY26 from 9.5% In FY23

-Expect healthy FCF generation of Rs 4,560 crore in FY26 versus Rs 4,530 crore in FY23

Sensex Today | BSE Midcap index up 0.5 percent supported by Vodafone Idea, 3M India, Godrej Industries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Vodafone Idea | 14.68 | 10.88 | 110.48m |

| 3M India | 37,332.55 | 6.37 | 1.20k |

| Godrej Ind | 743.85 | 5.53 | 82.28k |

| Emami | 557.05 | 4.75 | 60.70k |

| GlaxoSmithKline | 1,936.00 | 4.73 | 12.26k |

| Exide Ind | 320.55 | 4.07 | 403.61k |

| CG Consumer | 309.55 | 4.07 | 112.58k |

| Ashok Leyland | 181.60 | 3.65 | 963.25k |

| MOTHERSON | 100.91 | 3.39 | 2.18m |

| AB Capital | 165.80 | 2.54 | 638.59k |

Stock Market LIVE Updates | Nine Rivers Capital sells 0.6% stake in GPT Infraprojects

Foreign company Nine Rivers Capital sold 3,41,410 equity shares or 0.58% of paid-up equity in GPT Infraprojects at an average price of Rs 164.5 per share. Nine Rivers held 44.02 lakh shares or 7.57% stake in the company as of September 2023.

Sensex Today | BSE Smallcap index up 0.5 percnet led by NRB Bearings, 3i Infotech, Surya Roshni:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NRB Bearings | 342.75 | 19.99 | 195.21k |

| Surya Roshni | 758.60 | 16.52 | 260.09k |

| 3i Infotech | 51.15 | 12.71 | 739.80k |

| Transformers | 239.15 | 11.34 | 290.65k |

| Seamec | 1,053.50 | 10.88 | 63.21k |

| KPIGREEN | 1,468.05 | 10 | 220.70k |

| Guj Themis | 245.00 | 9.35 | 917.07k |

| Olectra Greente | 1,361.85 | 9.32 | 242.13k |

| KPIL | 718.50 | 9.08 | 183.40k |

| Wendt | 15,198.25 | 8.71 | 746 |

Stock Market LIVE Updates | ICICI Prudential AMC, ICICI Prudential Life Insurance get RBI approval to acquire up to 9.95% stake in IDFC FIRST Bank

ICICI Prudential Asset Management Company and ICICI Prudential Life Insurance Company have received approval from the Reserve Bank of India, to acquire up to 9.95% of the paid-up share capital or voting rights of IDFC FIRST Bank.

Stock Market LIVE Updates | RailTel Corporation of India bags work order worth Rs 120.45 crore

RailTel Corporation of India has received the work order amounting to Rs 120.45 crore from South Central Railway for comprehensive signalling and telecommunication works for provision of automatic block signalling system in Yermaras-Nalwar section of Guntakal division in South Central Railway.

Sensex Today | BSE Auto index up 1 percent supported by Tata Motors, Ashok Leyland, Samvardhana Motherson International:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 791.30 | 4.92 | 1.92m |

| MOTHERSON | 101.29 | 3.78 | 2.13m |

| Ashok Leyland | 181.30 | 3.48 | 922.50k |

| Apollo Tyres | 450.00 | 2.45 | 162.56k |

| MRF | 128,546.90 | 2.2 | 339 |

| Balkrishna Ind | 2,563.75 | 1.68 | 1.55k |

| Cummins | 1,965.20 | 1.01 | 7.03k |

| Eicher Motors | 4,119.10 | 0.69 | 8.85k |

| TVS Motor | 2,015.00 | 0.52 | 8.65k |

| Maruti Suzuki | 10,321.05 | 0.47 | 166.75k |

Stock Market LIVE Updates | Waaree Renewable Technologies collaborates with Australian company

Waaree Renewable Technologies has signed a collaboration agreement with Australian company 5B Maverick Services Pty Ltd, to accelerate the deployment of utility-grade solar power locally in India as well as in international.

Stock Market LIVE Updates | Aditya Birla Fashion picks additional 4.81% stake in subsidiary Finesse International Design

Aditya Birla Fashion's subsidiary Finesse International Design (FIDPL) has allotted 1,93,964 equity shares for Rs 20 crore to Aditya Birla Fashion and Retail. Pursuant to this, the holding of the company in FIDPL has increased from 58.69% to 63.50% of equity share capital of FIDPL.

Sensex Today | Market at 12 PM

The Sensex was down 94.12 points or 0.13 percent at 72,316.26, and the Nifty was down 31.60 points or 0.15 percent at 21,747.10. About 1740 shares advanced, 1435 shares declined, and 96 shares unchanged.