Taking stock: Sensex, Nifty make a smart recovery as investor confidence returns

The market was influenced by credit rating agencies reposing faith in Adani group companies, overnight rally in US stock markets and low-level buying... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,562.78 | 84.11 | +0.10% |

| Nifty 50 | 25,910.05 | 30.90 | +0.12% |

| Nifty Bank | 58,517.55 | 135.60 | +0.23% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Eternal | 303.75 | 6.00 | +2.02% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Infosys | 1,502.80 | -39.00 | -2.53% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8399.90 | 96.85 | +1.17% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36301.30 | -378.10 | -1.03% |

USDINR spot closed 35 paise lower at 81.82, as sentiment improved in local and heavy intervention was suspected.

Over the next week, we could see USDINR trade within a broad range of 81.50 and 82.20 levels. Key event will be the RBI monetary policy, where RBI is expected to raise rates by 25 bps.

On the daily chart, the index has continued its range within the falling channel. However, on the daily chart, we find that the index has found support at the lower band of the falling channel before moving higher.

In the near term, the index may continue recovering towards 17,950–18,000. On the lower end, support is visible at 17,450.

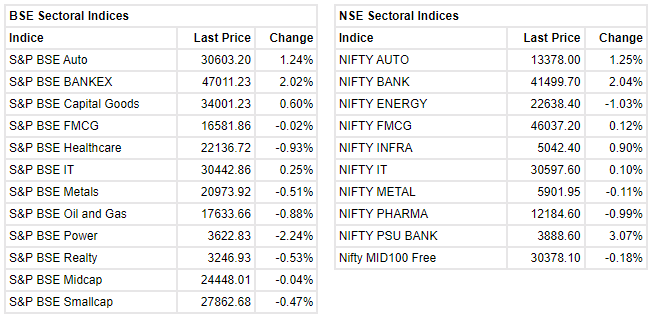

Domestic equities are rising as a result of dovish comments from global central banks. The European Central Bank (ECB) and the Bank of England (BoE) followed suit a day later after the United States Federal Reserve acknowledged in its monetary policy meeting on Wednesday that the disinflationary process may have begun.

The volume profile suggests that the Index may find support around 17500-17400. In terms of OI data, the highest OI was observed on the call side at 18000, followed by 18100 strike prices, while the highest OI was observed on the put side at 17600 strike price. Bank Nifty, on the other hand, has support at 40500-41000 and resistance at 42000-42400.

The Nifty, in the week gone by, had breached its 40 WEMA on an intraweek basis; however received support near the lower end of the downward sloping channel & the 200 DMA & recovered thereon.

The recovery picked up momentum on February 03 as the index surpassed the hurdle zone of 17,650-17,700. Consequently, the Nifty is approaching to climb above the 20 DMA & can test the level of 18,000 on the higher side. On the other hand, the near term support is placed at 17,700 with the major support near 17,350.

During the week, the Nifty traded below the 20 day SMA (Simple Moving Average) mark and also breached the important support level of 17800 and also formed a long bearish candle on weekly charts. Technically, a minor pullback rally is possible if the index trades above 17650. On the flip side, selling pressure is likely to accelerate only after the dismissal of 17550 and below the same the index could slip till 17400. Extended correction could drag the index till the 200 day SMA or 17300.

We expect Rupee to trade with a slight positive bias as rebound in domestic equities, may led to fresh foreign inflows. Decline in crude oil prices and weak Dollar amid dovish Fed may support Rupee at lower levels. Markets participants may remain cautious ahead of non-farm payrolls and ISM services PMI data from US. While the payrolls data is expected to show slowdown in pace of job additions, services PMI is expected to show the sector move to the expansion territory.USDINR spot price is expected to trade in a range of Rs 81.20 to Rs 82.80.

Sensex gained 909.64 points or 1.52 percentto close at 60,841.88. Nifty gained 243.60 points or 1.38 percent at 17,854. About 1304 shares advanced, 2128 shares declined, and 127 shares were unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 163.65 | 6.23 | 70824310 |

| Canara Bank | 296.2 | 3.89 | 16154346 |

| SBI | 545.2 | 3.24 | 31642093 |

| Bank of India | 79.75 | 2.57 | 16943504 |

| PNB | 52.1 | 2.56 | 111300040 |

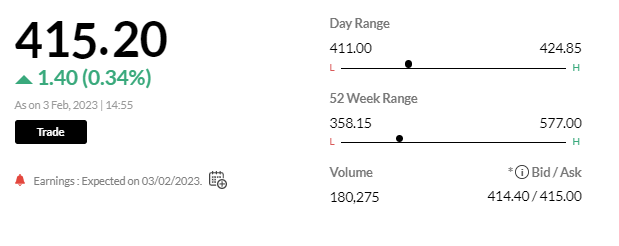

-Net profit down 14.2 percentat Rs 109.9 crore

-Revenue up 1 percentat Rs 1,827 crore

-EBITDA down 7.8 percentat Rs 195.5 crore

-Margin at 10.7 percent vs 11.7 percent