April 19, 2023 / 16:30 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets settled marginally lower in a dull trading session, in continuation to the prevailing consolidation phase. After the flat start, Nifty hovered in a narrow range and finally closed at 17,618.75 levels. Most sectors traded in sync with the move wherein pressure in the IT majors was weighing on sentiment. The broader indices also took a breather and ended almost unchanged.

We are seeing a healthy consolidation in the index and expect the same to end soon. However, prevailing underperformance of select sectors like IT and energy might cap the momentum in the following sessions. Meanwhile, participants should continue with a stock-specific approach and prefer sectors like banking, financials, auto and FMCG for the long trades.

April 19, 2023 / 16:26 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

The Nifty has been falling for the past three days as a result of deteriorating risk sentiment globally and growing investor anxiety about a probable recession. The downward trend has also been influenced by Infosys and TCS dismal Q4 reports.

The Pharma, Metal, and Realty Indices all saw some buying despite the general decrease, with the Nifty Metal Index outperforming and the Nifty IT Index underperforming.

With support at 17573 and resistance at 17863, the Nifty is likely to stay choppy and volatile. Strength will only be confirmed above the 17863 level. The 21 DMA, 50 DMA, and 200 DMA are being attentively examined by professional analysts for any indications of trends, which are now neutral. The overall range for the Nifty is expected to be between 17500-17750.

April 19, 2023 / 16:25 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

While the markets have seen FIIs paring equity exposure in last few sessions, the recent dismal earnings show from select frontline IT companies have been a sour point which has led to broad-based selling, especially in IT counters.

Currently the Nifty is trading near the 200-day SMA (Simple Moving Average) level and the texture is suggesting a strong possibility of a fresh rally from the current levels only after dismissal of 17675. Above which, the index could retest the level of 17800-17825.

On the flip side, as long as the index is trading below 17675, the correction wave is likely to continue and could slip till 17500-17475.

April 19, 2023 / 16:24 IST

Vinod Nair, Head of Research at Geojit Financial Services.

The dark clouds of weak Q4 numbers are haunting the domestic market leading to a consecutive third fall in the week. IT stocks continued their selling spree ahead of the release of earnings from other tech majors. Tepid cues from the global peers are also creating havoc as the market prices in the possibility of another rate hike by the Fed. The biggest risk for the market today is a downgrade in the corporate earnings forecast.

April 19, 2023 / 15:57 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Nifty opened flat and continued to remain in negative territory throughout the session to close with a loss of 41 points at 17,619 levels. Sectorally,it was a mixed bag with IT continuing to remain under pressure. However, traction is seen in specialty chemicals on account of attractive valuation and the expectation of improved export demand. Rice-producing companies rallied today after a report by research agency Fitch Solutions said that the global market was to log its biggest shortfall in two decades this year in rice.

Nifty after gaining nine consecutive trading sessions, has now been consolidating below the 17,800 zones for the last 3 days. Even FIIs have turned net sellers and have added to the overall weakness. For now, the market is stuck in a narrow range due to a lack of major triggers. There is some action seen in the broader market with niche sector-specific momentum. We expect further momentum in pharma, specialty chemicals, sugar, rice and realty to continue over the next few days.

April 19, 2023 / 15:53 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The dark clouds of weak Q4 numbers are haunting the domestic market leading to a consecutive third fall in the week. IT stocks continued their selling spree ahead of the release of earnings from other tech majors. Tepid cues from the global peers are also creating havoc as the market prices in the possibility of another rate hike by the Fed. The biggest risk for the market today is a downgrade in the corporate earnings forecast.

April 19, 2023 / 15:53 IST

Dilip Parmar, Research Analyst, HDFC Securities

The Indian rupee headed lower for the third day in trot following the rebound in the US Treasury Yields and foreign fund outflows. Tracking the weak regional currencies, the rupee today fell to its weakest level after April 4.

Spot USDINR has reclaimed the 100-day simple moving average after broadly trading in the range of 82.20 to 81.77 for the last couple of weeks. The pair has the next crucial resistance at 82.40, the 50-day simple moving average and support shifted upward to 81.85.

April 19, 2023 / 15:40 IST

Prestige Estates Q4 Update

Prestige Estates registers quarterly sales of Rs 3888.8 crore up by 19 percent on year and quarterly collections of Rs 2763.3 crore which grew 12 percent on year during Q4. For FY23, the company posted its highest ever sales of Rs 12,930.9 crore, up by 25 percent YoY while collections also jumped 31 percent to Rs 9805.5 crore.

April 19, 2023 / 15:35 IST

Rupee Close:

Indian rupee closed 19 paise lower at 82.23 per dollar versus previous close of 82.04.

April 19, 2023 / 15:30 IST

Market Close

: Benchmark indices ended lower in the volatile session on April 19.

At close, the Sensex was down 159.21 points or 0.27 percent at 59,567.80, and the Nifty was down 41.40 points or 0.23 percent at 17,618.80. About 1,768 shares advanced, 1,650 shares declined, and 117 shares were unchanged.

HCL Technologies, Infosys, IndusInd Bank, SBI Life Insurance and Wipro were among the top losers on the Nifty, while gainers included BPCL, Divis Laboratories, Bajaj Auto, Axis Bank and M&M.

On the sectoral front, information technology and power indices lost 1 percent each. However, buying was seen in the metal, oil & gas and pharma names.

The BSE midcap and smallcap indices ended flat.

April 19, 2023 / 15:25 IST

NIFTY 50 Recovery from Day's Low

| Company | CMP | High Low | Gain from Day's Low |

|---|

| Divis Labs | 3,343.70 | 3,364.50

3,248.05 | 2.94% |

| BPCL | 343.00 | 343.30

333.70 | 2.79% |

| Apollo Hospital | 4,318.55 | 4,355.00

4,221.55 | 2.3% |

| Bajaj Auto | 4,265.00 | 4,296.90

4,180.05 | 2.03% |

| ONGC | 160.10 | 160.45

158.05 | 1.3% |

| Axis Bank | 873.60 | 874.50

862.55 | 1.28% |

| Bharti Airtel | 764.70 | 765.25

756.00 | 1.15% |

| Bajaj Finance | 5,947.05 | 5,960.00

5,880.00 | 1.14% |

| Nestle | 20,617.10 | 20,663.65

20,388.00 | 1.12% |

| M&M | 1,216.50 | 1,217.75

1,203.40 | 1.09% |

April 19, 2023 / 15:22 IST

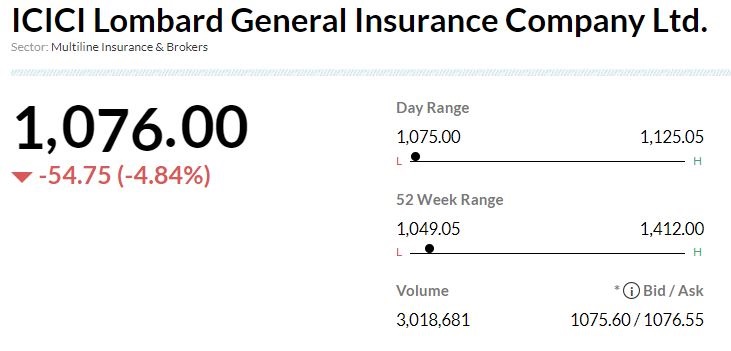

Jefferies View On ICICI Lombard

-Buy rating, target cut to Rs 1,560 per share

-For Q4FY23, company’s profit was ahead of estimate aided by higher investment income

-Premium growth was softer partly due to sell-down & higher base

-Combined ratio was up 100 bps YoY to 104 percent

-Watch for impact of rise in reinsurance cost & Industry discipline under EOM regime in FY24

-Trim estimates by 3-5 percentto factor such risks

-Stake sale & CEO succession may limit re-rating