Textile stocks are set for a joyride, with some of the already having scaled 52-week highs.

After a tough FY23 because of low demand, excess inventory with retailers, limited supplies, and snowballing cotton prices, textile companies are hoping that a demand revival is around the corner.

The companies expect demand to pick up again by the third quarter of FY24 as global retailers slash inventories. Trade volumes are likely to improve in the second half of FY24 as global retailers order their summer and spring 2024 collections, some analysts said.

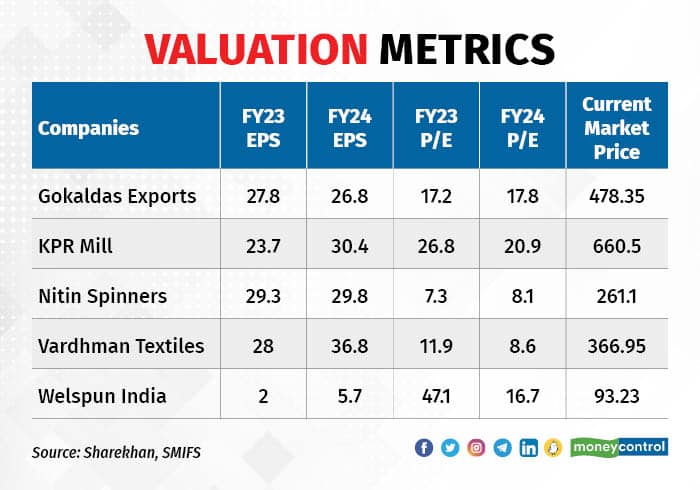

“Textile stocks are certainly factoring in the hope of recovery in the second half of the current fiscal, which has triggered a joyride in these stocks,” Awanish Chandra, executive director and head of institutional equities at SMIFS.

Some are playing catch-up because they are still noticeably away from their all-time highs, he added.

Textile stocks rolling towards a new high

Textile stocks rolling towards a new highAshwini Agarwal, founder of Demeter Advisors, told CNBC-TV18 that value can be found in smaller sectors such as renewables and textiles by tracking cyclical trends.

"The sector may have experienced a slowdown ahead of time, corrected inventories, and is now witnessing restocking demand," Agarwal said, adding that as stock valuations become reasonable due to corrections, opportunities may arise.

“There is still some steam left in textile stocks, provided a recovery happens,” Chandra pointed out.

With a UK-India free trade agreement on the horizon, which represents a $1 billion additional opportunity for India, and the possibility of a China-plus-one push picking up pace, there is a possibility of recalibrating earnings and multiples for the sector, JM Financial Institutional Securities said. Further, the government’s focus on the textile ecosystem with production-linked incentives and stable duties is the cherry on the cake, it added.

Read more | Infra.Market buys majority stake in textilemaker Strata Geosystems

Declining inventoryHarmit Singh, chief financial and growth officer of Levi Strauss & Co., said recently the company made significant progress in reducing inventory levels. Gap Inc. too said it moved quickly and effectively at clearing excess inventory.

“We ended the first quarter with nearly 40 percent more cash than last year, almost 30 percent less inventory than last year,” the US clothing and accessories retailer said in its latest conference call with analysts.

Demand recoveryAny normalisation of demand in 2024 amid an improvement in the inventory position of global retailers leaves headroom for a recovery in Indian exports, which implies a pick-up in orders from the second half of FY24, JM Financial said.

With its global clients making significant progress in optimising inventory, Himatsingka Seide expects demand to improve. Even Indo Count Industries experienced improvement in demand due to the normalised inventory levels and witnessed a spike in order bookings.

Indo Count Industries, a home linen supplier to the world’s top brands, is optimistic about the growth phase returning.

Gokaldas Exports anticipates an improvement in the demand situation in the second half of the year and Welspun India said an uptick in consumer demand is likely for the home textile sector.

Read more | India actively considering CEPAs, FTAs to boost textile exports: Piyush Goyal

According to brokerage firm Sharekhan by BNP Paribas, the China-plus-one strategy, supply chain front challenges, and potential free trade agreements with the UK and Europe are expected to drive strong earnings growth for garment and home textile companies.

Moreover, now that the capital expenditure phase has ended, textile companies are set to leverage their expanded capacities and the focus will shift to strengthening the balance sheet and improving return ratios, the brokerage said.

“Better capacity utilisation, enhanced product mix, lower cotton/yarn prices and a fall in supply costs will boost industry margins in the coming years,” the brokerage said.

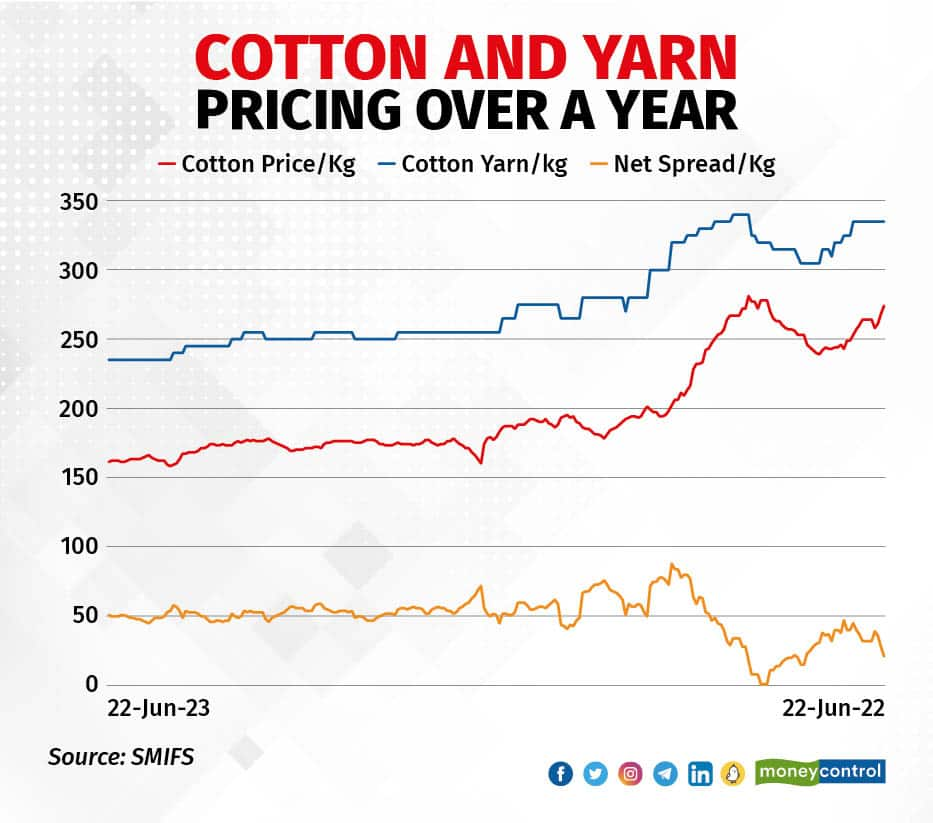

Lower cotton pricesCotton prices have stagnated at lower levels during the past one month. A recent hike in the minimum selling price has set a base, which means a further correction from current levels does not seem to be a possibility now, according to a research note by SMIFS.

Yarn prices also stagnated compared with cotton prices and the spread has been more or less in the same zone during the past month, the note said.

Chandra pointed out that cotton prices have moderated to about Rs 60,000 per candy (1 candy = 356 kg cotton) currently from a high of Rs 1,02,000 per candy in August 2022. Even though cotton prices snowballed in the past two years to over Rs 1,00,000, the current price of Rs 60,000 is still above the historical Rs 40,000 figure, he explained.

Chandra pointed out that cotton prices have moderated to about Rs 60,000 per candy (1 candy = 356 kg cotton) currently from a high of Rs 1,02,000 per candy in August 2022. Even though cotton prices snowballed in the past two years to over Rs 1,00,000, the current price of Rs 60,000 is still above the historical Rs 40,000 figure, he explained.

Following this trend, prices of cotton textile products have also corrected and stabilised at higher levels as compared to historical levels.

Chandra said profitability in the first quarter of FY24 is not expected to be great compared with margins in the fourth quarter of FY23. Yet he agreed the margin trend will start moving upwards from the second half of this financial year.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.