Ashwini Agarwal, founder and partner at Demeter Advisors, on June 7 shared his outlook on the stock market and analysed the impact of a possible US recession on the IT sector.

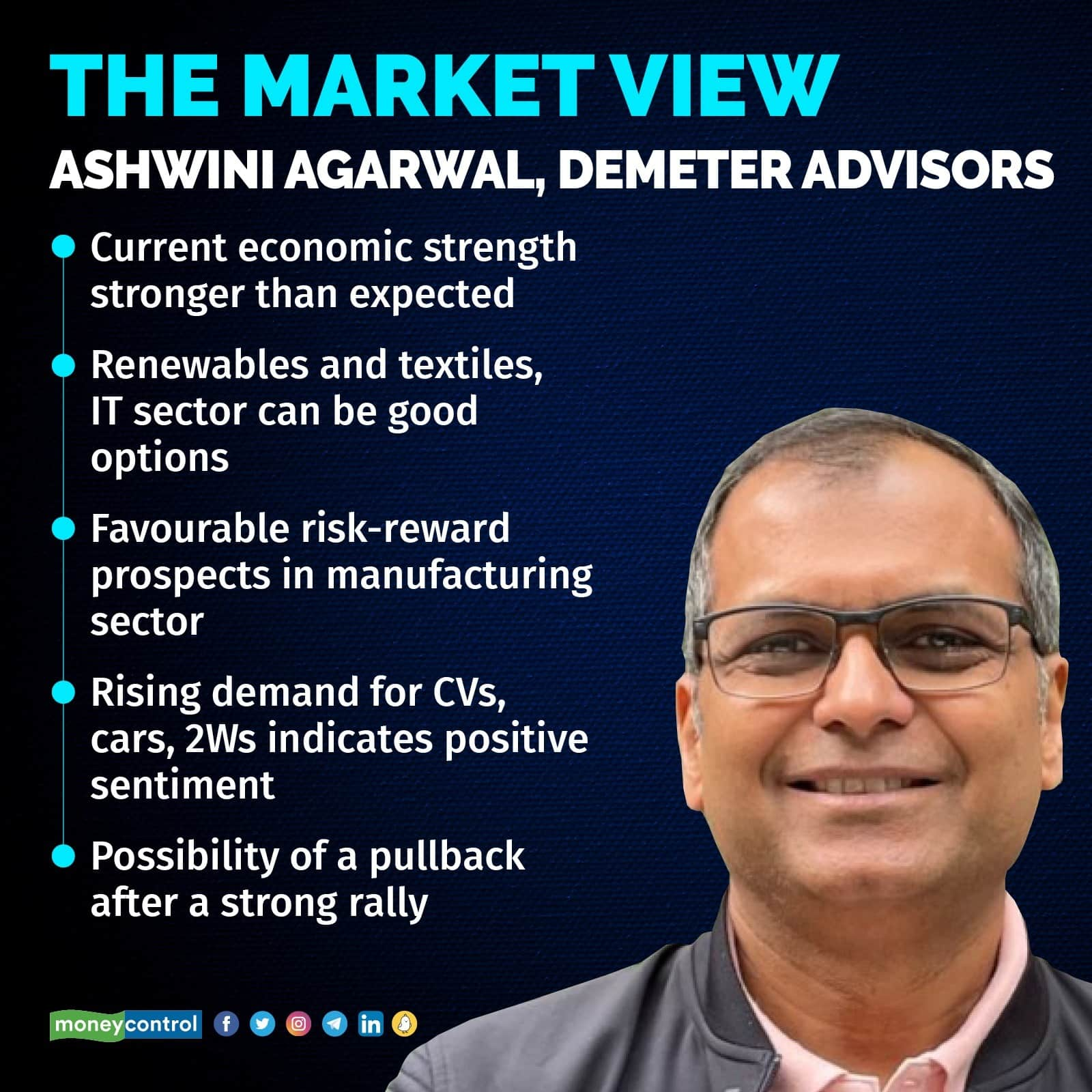

In an interview conducted by CNBC-TV18, Agarwal highlighted that the current economic strength in the face of rate increases is “a new territory we are in”, and there can be value found in smaller sectors such as renewables and textiles by observing cyclical trends.

When discussing the impact of a possible US recession on the IT sector, Agarwal acknowledged the long wait for a dip and recession. In Q4, most IT companies disappointed the Street with their results as uncertainty surrounding the US economic outlook had a noticeable impact on client spending.

However, Agarwal sounded optimistic of the free cash flow capabilities of IT companies, suggesting that the worst may already be priced in. “I believe that if one is willing to look through 2-3 quarters of underperformance in the worst case, the stocks may become a Buy,” he said.

Agarwal highlighted that the manufacturing sector, which has faced margin pressures due to high energy and transport costs, is expected to reverse its fortunes with normalizing costs and is currently showing favourable risk-reward prospects. As a result, related sectors, such as automobiles and pharmaceuticals, are viewed positively. “The Indian market is always happy to see the earnings growth and earnings revision,” he said.

Agarwal pointed to the rising demand for commercial vehicles, cars, and two-wheelers as indicators of positive market sentiment. He emphasised that the Indian market values earnings growth and revision, making these sectors attractive investment options.

Agarwal also identified two smaller sectors with potential opportunities. In the renewables sector, he highlighted the changes in wind projects and the global focus on renewable energy. "With India's commitments toward green energy, this sector presents a promising opportunity," he said.

Additionally, Agarwal mentioned the textiles sector, which has experienced margin compressions and rising energy and transport costs. However, he noted that no slowdown was seen in demand patterns during the Q4 results in the US.

"The sector may have experienced a slowdown ahead of time, corrected inventories, and is now witnessing restocking demand," he said, adding that as stock valuations become reasonable due to corrections, opportunities may arise in the sector.

Agarwal pointed out that while uncertainties and risks persist, opportunities can be found by considering long-term prospects, cyclical trends, and sector-specific dynamics.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.