Dear Reader,

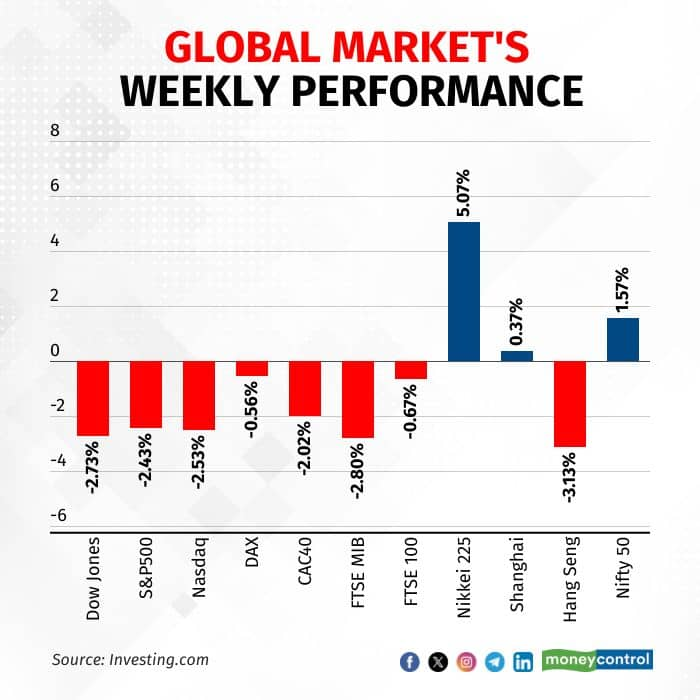

India's financial markets closed the week on an encouraging note, posting a solid gain of 1.57 percent. However, this momentum is likely to be hit after US President Donald Trump announced his intention to impose a punitive 100 percent tariff on China, sending shockwaves through global markets.

The announcement triggered an immediate selloff in American equities, with the S&P 500 plummeting 2.7 percent on Friday alone—marking its worst performance since April. The reverberations extended beyond the US borders, impacting international markets where gold, silver, and cryptocurrencies all experienced significant downward pressure.

Trump's aggressive move was in retaliation to China's restrictions on the export of rare earth elements, materials that form the backbone of modern manufacturing, from smartphones and consumer electronics to sophisticated jet engines and defence systems.

Despite the global turbulence, India's market showed signs of resilience and selectivity. While small-cap indices remained essentially flat over the week, mid-cap and large-cap stocks demonstrated relative strength, gaining approximately 1.5 percent. The Capital Markets and IT sectors emerged as clear winners, each posting impressive five percent gains, while the Healthcare sector climbed three percent. The Real Estate sector also rebounded nicely, capturing a two percent rise.

Adding to the tentative optimism, FIIs turned net buyers for the first time in twelve weeks, suggesting a potential shift in market sentiment. However, the real impact of Trump's tariff will be felt on Monday, the first day of market action since the announcement. Post that markets will realign itself and focus on corporate earnings reports.

Compounding the uncertainty, US corporate earnings themselves loom as a source of volatility, with the recent government shutdown having obscured corporate guidance and visibility. Market analysts will be closely scrutinizing earnings announcements and management commentary for clues about the economic trajectory ahead.

Source: Investing.com

FIIs hold the second highest short position

Nifty has demonstrated renewed momentum, extending its gains into a second consecutive week and finally breaking above its 20-week moving average—a technical milestone that signals a potential shift in longer-term sentiment. Yet, previous attempts to climb above this key technical level in recent months have not been successful, with the index surrendering all accumulated gains and reverting to lower levels.

Nifty has established a pattern of reversing course after advancing 500 to 800 points in either direction, suggesting that the index is approaching a decisive turning point. The overnight price action hinted at potential weakness ahead, with markets showing signs they could experience a modest pullback in coming sessions.

However, sentiment indicators have not reached overbought extremes. The daily swing indicator, which had cooled off during the previous week, began climbing again to close at 62. Should markets decline from current levels, this rising indicator would create a negative divergence—a warning sign that often precedes price weakness.

Source: web.strike.money

At 197,578 contracts net short, FIIs built the second-highest short position on record this week. After that, we did see some short covering, and the week closed at 181,339 contracts short. The short position in index futures is still very large and is probably the reason why markets are not falling too far. Any dip is resulting in buying support from short sellers covering their positions.

Source: web.strike.money

The Call-Put histogram measures the value of open interest in calls versus puts. Red bars indicate more puts than calls due to short covering by call writers. This usually happens at the end of a move, but during the most recent move, we have been seeing more puts than calls right from the start. It was indicating a strong push against shorts in the market.

Source: web.strike.money

Sector Rotation

Nifty 50 – The Benchmark Index ended higher by +1.57% this week and closed at 25,285.35.

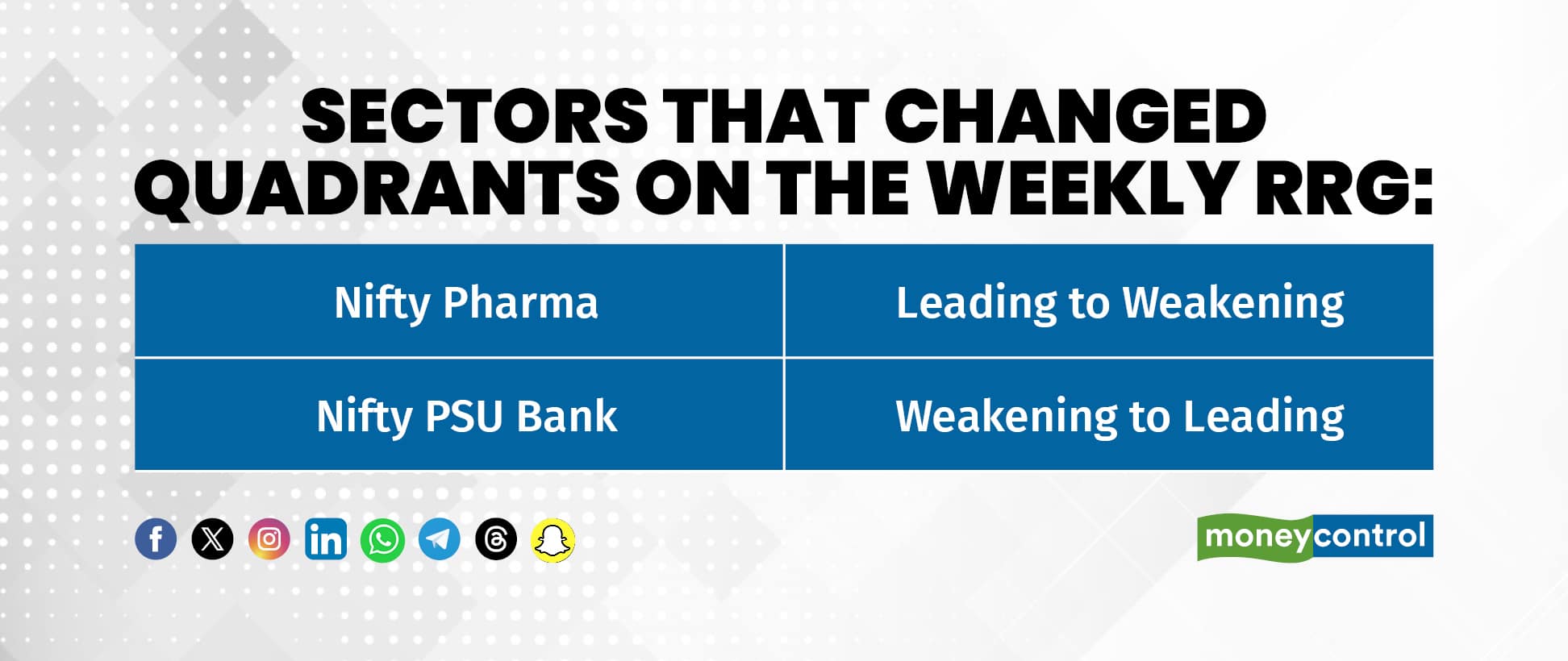

Weekly RRG:

Weakening Quadrant: The Nifty Pharma index has entered the weakening quadrant this week due to deteriorating momentum and relative strength. The Nifty Infrastructure index has seen a minor uptick in momentum this week, but relative strength continues to deteriorate.

Lagging Quadrant: The Nifty Media index is the only index in the lagging quadrant that is witnessing both deteriorating momentum and relative strength. Other indices, such as Nifty Realty and Nifty Private Bank, have seen good improvement in momentum, but their relative strength has deteriorated this week as well. The Nifty Energy, Nifty Bank, and Nifty Financial Services indices are seeing marginal improvement in momentum, but relative strength continues to deteriorate in these indices as well. Significant improvement in momentum is seen in the Nifty Oil & Gas and Nifty PSU indices. If this trend continues, we may see improvement in relative strength as well in the coming weeks.

Improving Quadrant: The Nifty IT index has shown significant improvement in both momentum and relative strength this week. However, the Nifty FMCG index has seen meaningful deterioration in both momentum and relative strength.

Leading Quadrant: The Nifty Consumer Durable index has been experiencing declining momentum and relative strength over the last few weeks, which is not a positive sign. The Nifty MNC index has also seen a meaningful decline in momentum this week. The Nifty Auto index continues to gain relative strength, but it has experienced a dip in momentum this week. The Nifty PSU Bank index has entered the leading quadrant this week. The Nifty Metal and Nifty PSU Bank indices have seen sharp improvement in both momentum and relative strength.

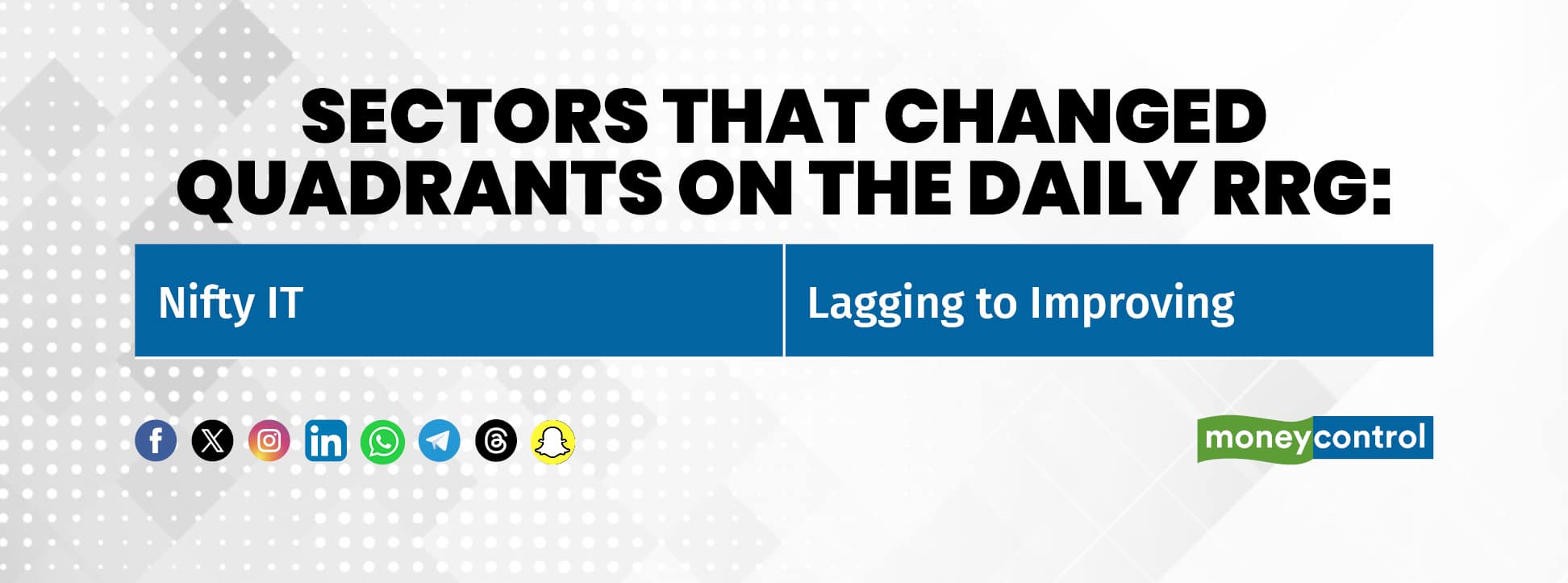

Daily RRG:

Weakening Quadrant: The Nifty Infrastructure, Nifty Energy, Nifty PSU, Nifty Metal, and Nifty Auto indices are in the weakening quadrant this week. All these indices are losing both momentum and relative strength.

Lagging Quadrant: The Nifty MNC and Nifty Media indices continue to see deteriorating momentum and relative strength. The Nifty FMCG index has seen some improvement in momentum over the past few trading sessions, but relative strength continues to deteriorate. The Nifty Consumer Durable index is seeing improvement in momentum, but no improvement has been seen in relative strength yet. The Nifty Pharma and Nifty Realty indices have seen a sharp turnaround in momentum.

Improving Quadrant: The Nifty IT index has seen sharp improvement in momentum, and its relative strength is improving gradually. This could be an interesting index to watch in the near term.

Leading Quadrant: The Nifty Bank, Nifty Financial Services, Nifty Private Bank, and Nifty Oil & Gas indices are seeing improvement in relative strength, but momentum has been declining over the past few trading sessions. If this trend persists, relative strength is likely to deteriorate in the coming days. Watch out for these sectors.

Stocks to watch

Among the stocks expected to perform better during the week are PNB, SBI, Indian Bank, Polycab, ONGC, Vedl and JSW Steel.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.