Even as the Adani Group stocks recorded a sharp rally over the past few weeks, the state-run Life Insurance Corp of India's Adani portfolio continued to languish 30 percent below its valuation at the start of 2023.

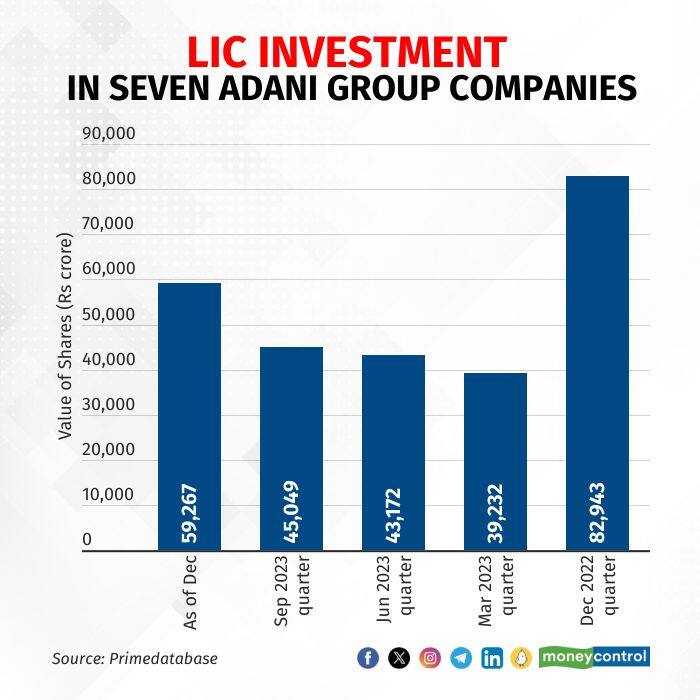

At Rs 58,577 crore, the valuation of the Adani Group portfolio in the LIC kitty in December 2023 is down around 29 percent from Rs 82,943 crore in December 2022.

In comparison, Rajiv Jain-led GQG Partners, which threw its hat in the ring after the Hindenburg fiasco broke out and the stocks went into a tailspin early this year, almost doubled its investments in Adani shares over the last one year. To be sure, GQG invested in phases in Adani Group in March, June and August.

LIC holds stake in seven Adani Group companies as of September 2023 quarter—ACC Ltd (6.41 percent stake), Adani Energy Solutions (3.68 percent stake), Adani Enterprises (4.23 percent stake), Adani Green Energy (1.36 percent stake), Adani Port & SEZ (9.07 percent), Adani Total Gas (6.02 percent) and Ambuja Cements (6.3 percent).

LIC's investments in Adani Ports and SEZ and ACC Ltd have surged 25 percent and 314 percent from the December 2022 quarter, reaching Rs 20,208 crore and Rs 2,613 crore. Conversely, its investments in five other firms have yielded negative returns: Adani Energy Solutions Ltd down 56 percent, Adani Enterprises down 26 percent, Adani Green Energy down 16.3 percent, Adani Total Gas down 68 percent, and Ambuja Cements Ltd down 4.3 percent.

The Adani Group stocks have not notably influenced LIC’s investment portfolio in 2023. LIC invested in a total of 274 listed firms, totaling Rs 12.6 lakh crore, marking a 15.5 percent increase from its December 2022 quarter portfolio value of Rs 10.90 lakh crore.

Read: Infosys's chief financial officer Nilanjan Roy resigns

Excluding the Adani Group's seven stocks, LIC’s portfolio stands at Rs 12 lakh crore, showing a 20 percent increase from its December 2022 quarter portfolio value of Rs 10.07 lakh crore.

GQG investments

According to Prime Database data, GQG's Adani Group portfolio soared to Rs 39,331 crore from its Rs 21,660 crore initial investment, marking an 82 percent total return from investments made in three phases starting March 2023.

Its investment of Rs 3,403 crore in Adani Enterprises, now valued at Rs 9,024 crore. Adani Green Energy's initial investment of Rs 4,743 crore increased to Rs 8,800 crore. For Adani Ports, GQG's investment of Rs 4,472 crore surged to Rs 7,766 crore, while Adani Power's investment by GQG rose from Rs 4,245 crore to Rs 8,718 crore.

Adani Group stocks surged since November 24, boosting its market cap by almost Rs 4.5 lakh crore to hit Rs 14.8 lakh crore. Factors like a sustained market bull run, the Supreme Court's decision not to probe the group based on allegations by a US short-seller, BJP's election win in the Hindi heartland, and a US agency dismissing Hindenburg's claims of fraud contributed to this rally, rebuilding investor confidence in the group.

Read: Sterling & Wilson Renewable Energy launches QIP; floor price at Rs 365.02 per share

LIC’s top holding

LIC's top-performing stocks in its portfolio include ITC Ltd, reaching Rs 86,895 crore, up by Rs 24,000 crore from December 2022. Additionally, LIC's investments in L&T and Tata Consultancy Services Ltd rose to Rs 51,714 crore and Rs 63,653 crore respectively, up from Rs 36,157 crore and Rs 52,584 crore in December 2022.

LIC's investments in Coal India and Infosys Ltd reached Rs 23,863 crore and Rs 50,973 crore respectively, up from Rs 15,259 crore and Rs 42,439 crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.