During the June quarter, India’s power producers delivered mixed earnings - weighed down by weak demand due to a shorter summer season - but the second quarter could see improvements across the board, barring merchant power companies, experts have said, pointing towards divergence in valuations.

An early onset of monsoon lowered cooling requirement, as nearly 60 percent of Q1FY26 days saw above-normal rainfall, and only 12 days recorded both high temperature and humidity, according to a note by SBI Capital Markets. As a result, the energy supplied fell 1.5% on-year - the first June quarter decline since FY16 (excluding the pandemic year) – as weather trends squeezed demand. SBI Caps said this volatility in demand could weigh on high-cost producers, forcing them to rely on merchant price spikes to seek returns.

Weak Demand Hurt Growth

Rupesh Sankhe, Senior VP - Research at Elara Capital said Q1 results were broadly in-line despite the quarter’s low demand. “That impacted merchant prices and volumes. Players like JSW Energy, Adani, and Torrent Power have shown slightly weaker numbers, but it was expected,” he said, adding that regulated players like NTPC, Tata Power and CESC too saw slower growth due to lower incentive income.

Pankaj Kumar, VP – Fundamental Research at Kotak Securities said that muted capacity growth and execution bottlenecks have added to the drag. “In Q1FY26, the Indian electric utilities sector delivered a mixed performance. Quarterly performance was largely driven by acquisitions (by JSW Energy), renewable project execution, etc., but execution bottlenecks, muted organic capacity additions impacted the overall performance.”

Renewables Hold the Key

Sankhe added that renewables outperformed merchant players, owing to a higher plant load factor (PLF), especially in wind generation, due to the early onset of monsoon. “Even for the renewables, the entire ecosystem like ETC, solar sales, model manufacturers, they have also shown very good improvement in their top line as well as profitability,” said Sankhe.

Margins in coal and regulated businesses slipped on lower incentives while renewable margins improved on better PLF and cost control.

Company Scorecard

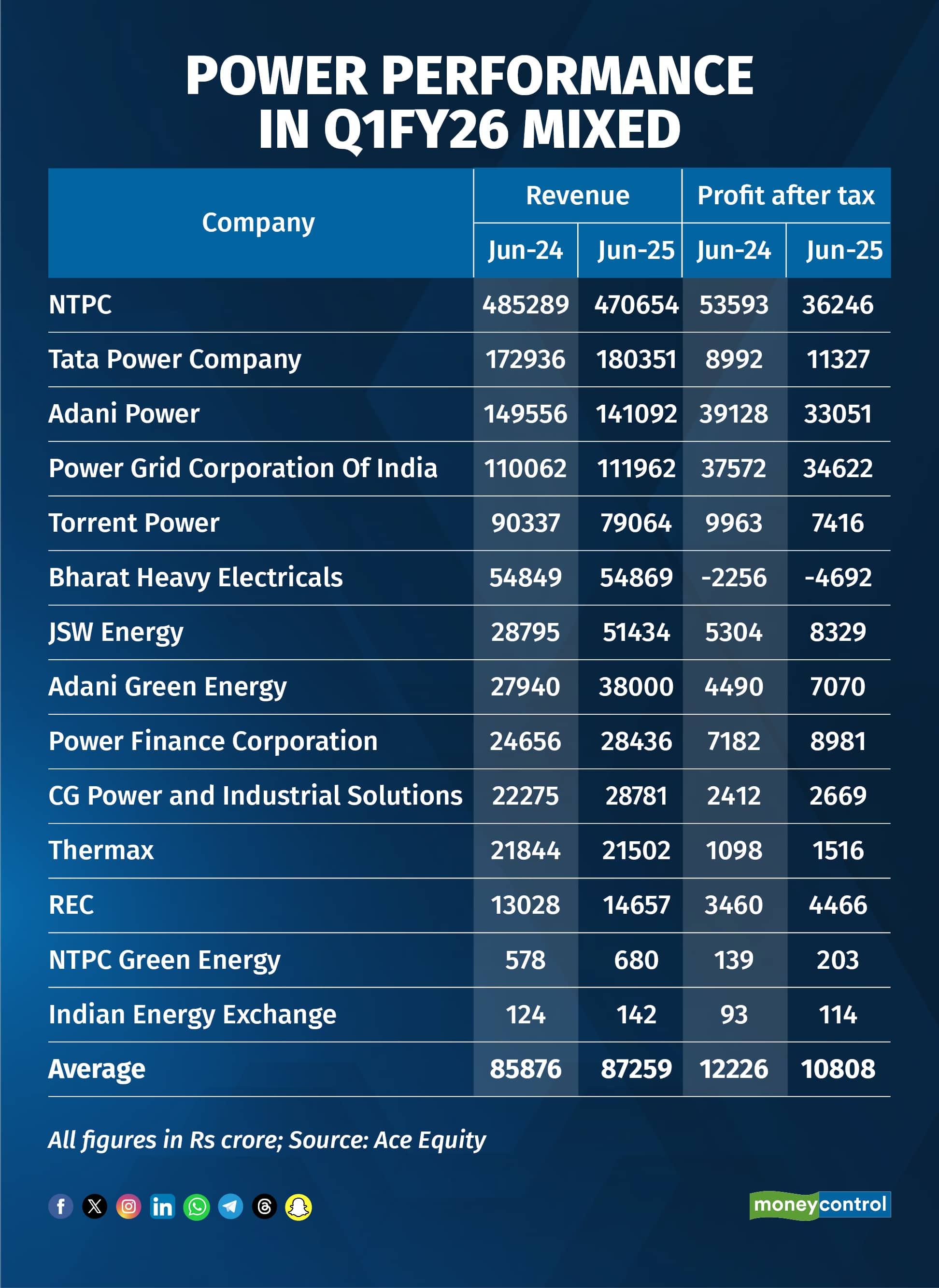

Renewable energy players like Adani Green and JSW Energy outpaced peers, but hybrid player Tata Power too managed to post solid growth. Among regulated utilities, NTPC and Power Grid saw a muted show as incentive income fell, while Torrent Power, reliant on merchant power, was hit by weaker spot prices.

Industrial suppliers CG Power, Thermax and market platform IEX delivered steady results, while BHEL lagged behind in the June quarter. Among financiers, PFC and REC maintained double-digit growth, and overall, the power sector revenue growth averaged around 1.6 percent YoY while PAT fell 11.6 percent.

The Valuation Scorecard

Based on the current price-to-book (P/B), regulated power majors like NTPC (1.79x vs peak 2.67x) and Power Grid (2.86x vs peak 3.90x) are currently trading well below their historic highs, which shows room for re-rating if earnings recover. Tata Power at 3.43x is also below its 4.79x peak P/B.

The price-to-book ratio of renewables and equipment makers remain expensive, with Adani Green at 12.15x (peak 33.35x), CG Power at 26.19x (43.44x), and Suzlon at 14.11 x (29.41 x). Industrial such as Thermax (7.96x vs 14.57x) and Hitachi Energy (21.88x vs 50.23x) are still richly valued compared with peers.

“The valuations remain rich across the sector, with most positives priced in, leaving ACME Solar as the only compelling risk-reward opportunity,” Pankaj Kumar, VP – Fundamental Research at Kotak Securities said.

Elara’s Rupesh Sankhe, on the other hand, is upbeat about the sector’s medium-to-long-term prospects even as valuations have diverged. “There’s nothing negative in the latest commentary, no signs of project delays, no slowdown in demand. Sentiment on the sector should stay positive for the next four or five years,” Sankhe said.

He pointed out that regulated utilities such as NTPC and CESC are trading at attractive price-to-book multiples of below 2x, a range considered as ‘decent’ for investors. Tata Power too falls into a reasonable bracket, he added. In contrast, valuations of merchant power companies like SJVN Power and JSW Energy are on the ‘higher side’ at above 3x price-to-book. “Anything more than 3x is on the expensive side; below 1.5–2x is low,” Sankhe explained.

Power Financiers

Shweta Daptardar, VP – Equity Research (NBFCs), Elara Capital said the growth for PFC and REC was ‘softer this quarter’ due to foreign exchange losses and slower government capex. “PFC’s YoY growth looked higher than REC’s because of a one-off; sequentially, it was barely one percent and is still weakish,” she said, adding that valuations remain subdued. “PFC trades below book after adjusting for its REC stake, and REC is around 1x, reflecting slow project execution.”

Outlook for Q2FY26

Elara’s Sankhe expects regulated players to maintain momentum, but merchant power businesses may remain under pressure. “From Q2 onwards, we will see better numbers for the other players as well, except for our merchants. Merchant business will continue to get impacted in Q2,” he said.

Most brokerages have been optimistic about the power sector, with UBS forecasting a 305 GW power capacity additions in FY25-30E - triple the FY20–25 pace - driven by strong OEM orderbooks. Thermal power should account for around 40 percent of incremental generation, said UBS, aiding grid stability and meeting the government’s ~80 GW target by FY32. Solar power commissioning may reach only 60 percent of the announced capacity for the year, which might ease over-capacity risks and enable consolidation among stronger incumbents.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.