The month of March was a nightmare for Indian markets, with the benchmarks Nifty and Sensex dropping 23 percent each, dragged down by the coronavirus pandemic and FII sellout.

Foreign institutional investors (FIIs) pulled out more than Rs 60,000 crore from the cash segment of the equity market, shaving off Rs 30 lakh crore of investors' wealth in March alone.

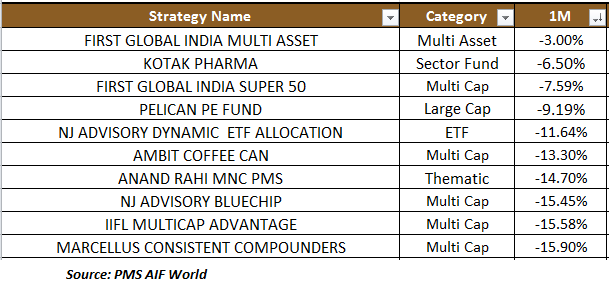

The Portfolio Management Services (PMSes) suffered a similar fate, falling 3-41 percent during the month.

Of the 147 PMSes that reported their returns, 62 outperformed the Nifty.

First Global India Multi Asset Fund was the best performer in the club, falling the least -- 3 percent-- month-on-month, data collated by PMS AIF World, a research-backed financial services firm, shows.

Five of the 10 best performing PMSes in March were multi-cap focused.

Kotak Pharma was the second-best performing fund, falling 6.5 percent during the month. It is managed by Anshul Saigal and focuses on the pharma and healthcare companies, which constitute 95.7 percent of its 17-stock portfolio. The rest 4.3 percent is allocated to cash and cash equivalents.

As on February 28, Sun Pharmaceutical Industries was its top holding at 16.1 percent of the portfolio. Dr Reddy's Laboratories (9 percent), Aurobindo Pharma ( 8.3 percent) and Lupin (5.61percent) were some other major stocks in its portfolio.

Despite the impressive returns, given the current market scenario, the fund underperformed its strategic benchmark the Nifty Pharma which fell 5.28 percent during the month.

"One may get enticed to invest in sectoral /thematic portfolios–like consumption, financials, pharma for example, but we do not suggest such approach," said Kamal Manocha, CEO and Chief Strategist at PMS AIF World, in a newsletter.

"Remember, equity builds wealth in long term but the sectoral play is seasonal and when a particular sector goes out of favour, one runs out of patience and hence, the long-term perspective goes for a toss. We suggest multi-cap, concentrated, focused, largecap biased portfolios," he said.

Portfolio Management Services cater to wealthy investors and the professional fee charged by them is slightly higher than regular mutual funds (MFs).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.