For the calendar year, foreign investors have sharply trimmed fund allocations to India, however, the pullback has had a far more severe impact on active offshore funds than for ETFs.

India-focused active offshore funds have seen $3.7 billion in outflows year-to-date, while ETFs have recorded $271 million in withdrawals, according to Morningstar’s Offshore Fund Spy for September 2025.

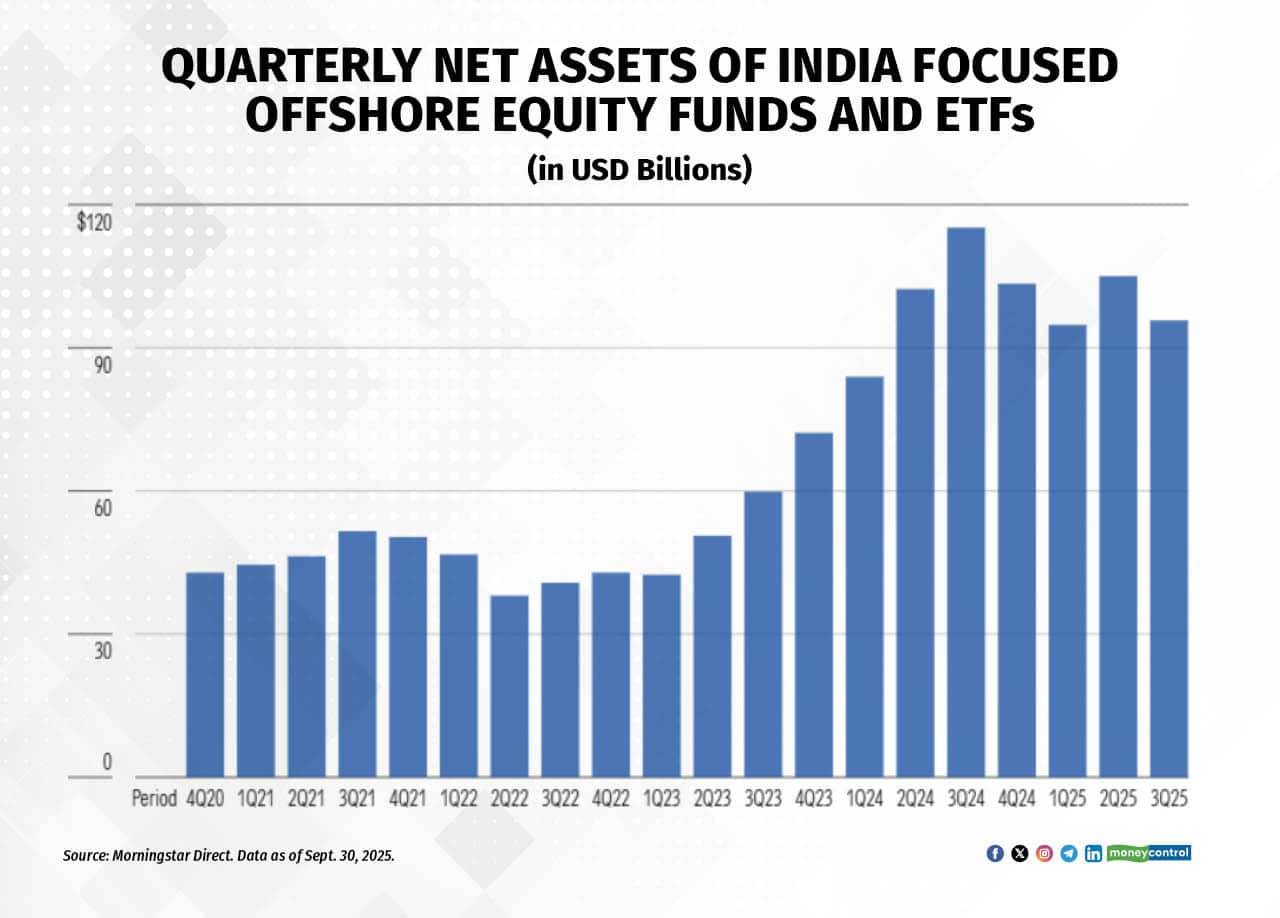

This marks a reversal from 2024 when offshore India funds and ETFs together attracted $23.4 billion, the strongest annual inflow on record. In 2025 so far, the category has seen $3.65 billion in net outflows, reflecting a sharp sentiment shift of nearly $27 billion in just one year.

The September quarter saw the heaviest selling, with offshore India funds recording $2.5 billion in net outflows after Trump's tariffs on Indian exports and a weaknening of global risk appetite. Earlier this year, the March quarter had clocked $3.1 billion in net outflows while the June quarter saw $2 billion worth of inflows before higher US yields and a firmer dollar turned sentiment sour.

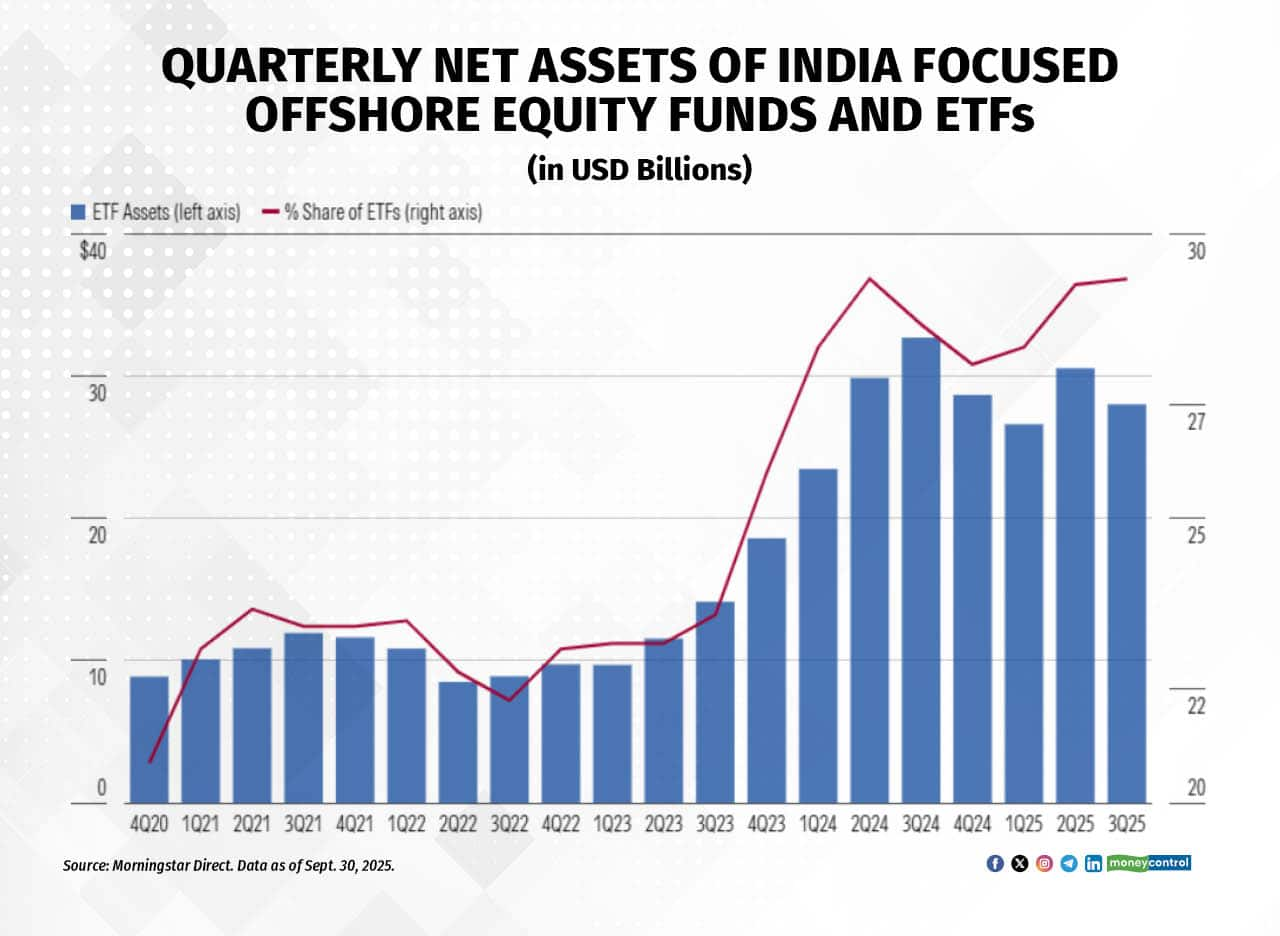

Active funds reported assets falling from $75 billion in December 2024 to $68 billion in September 2025, a 9.3% decline, whereas ETF assets dipped only from $29 billion to $28 billion, a modest 3.4% decrease. Morningstar attributed the resilience of ETFs to their lower fees, lack of exit loads, and intraday liquidity features that foreign investors relied on to adjust India exposure quickly during bouts of global volatility. ETFs attracted $1.6 billion in net inflows during the June quarter.

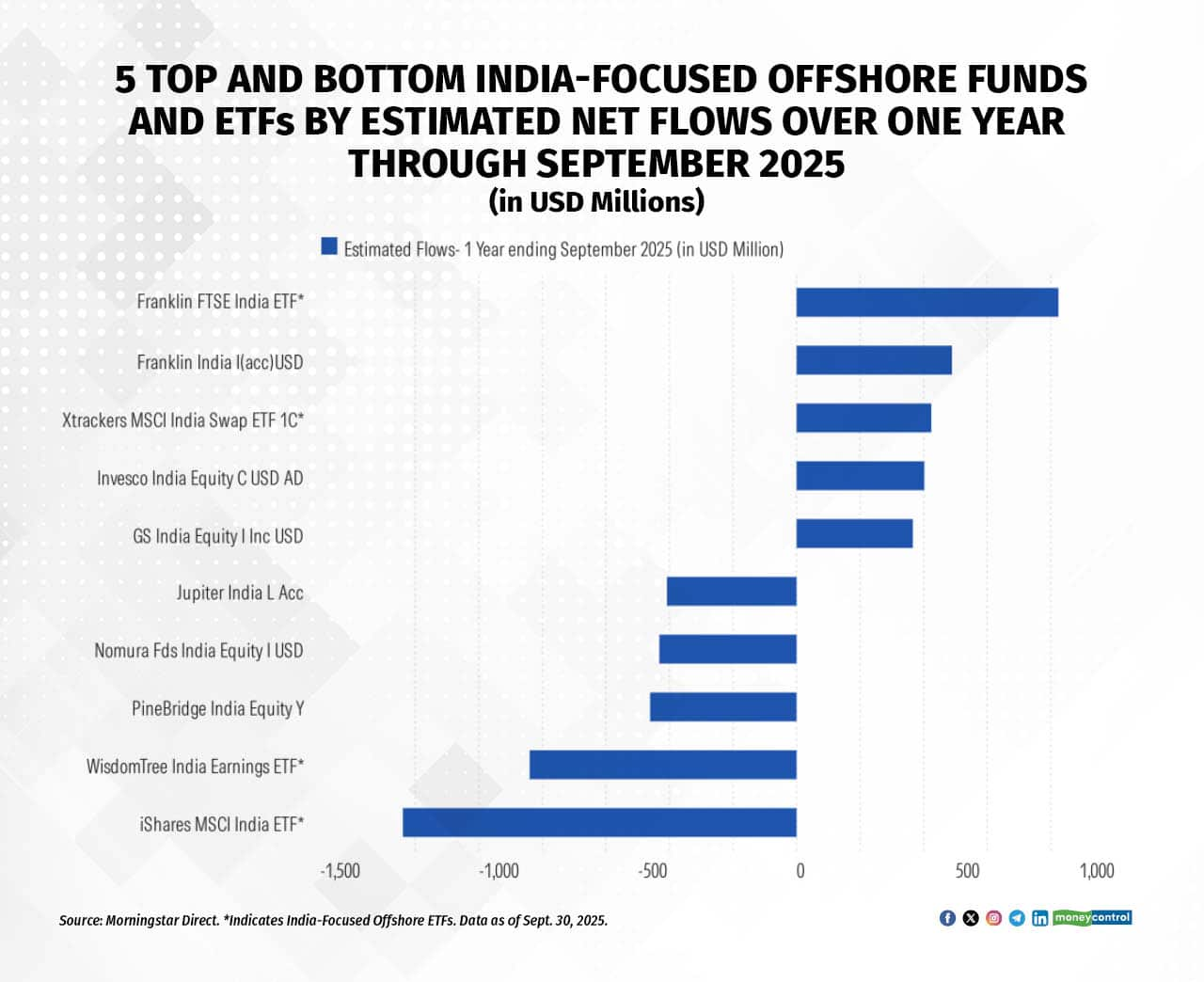

Among specific funds, The Franklin FTSE India ETF topped six-month inflows with $633 million, ahead of the Xtrackers MSCI India Swap ETF 1C at $305 million, and the Amundi MSCI India II ETF EUR Acc at $241 million.

On outflows, the WisdomTree India Earnings ETF recorded the steepest six-month withdrawals at $301 million, while the active Abrdn-Indian Equity A Acc GBP fund saw $277 million in exits. Over a one-year period, the iShares MSCI India ETF saw redemptions of $1.2 billion, with the WisdomTree India Earnings ETF posting $840 million in one-year outflows, both ranking among the weakest offshore India products.

Among active funds, the Franklin India I (acc) USD strategy stood out as a major gainer with $489 million in one-year inflows. The Aryabhata India F Institutional USD Acc fund also maintained a strong position across Morningstar’s performance lists, supported by consistent long-term returns.

The largest offshore India funds collectively manage $38.9 billion as of September 2025, up 3% from March. The iShares MSCI India ETF leads the pack with $9.1 billion in assets, followed by iShares MSCI India ETF USD Acc at $5.3 billion, and GS India Equity I Inc USD at $4.7 billion. Together, the top ten funds account for 41% of the offshore India category.

The selling by foreign institutional investors mirrored the risk-off trend in listed equities. FIIs sold $16.51 billion of Indian shares in 2025 so far, cutting the value of their holdings by 4% from $831 billion in December 2024 to $797 billion in September 2025. Their share of India’s market capitalisation dropped from 16.11% to 15.67%, a multi-year low.

Global and regional funds with partial India exposure showed mixed positioning, with their combined India holdings up from $360.7 billion in December 2024 to $365.5 billion in September 2025, a modest rise of 1.3% but allocations declined 5% from the June peak of $384.6 billion. Asia/Asia-Pacific funds cut India exposure the most, reducing holdings by 8.6% from $32.6 billion to $29.8 billion, while global funds increased their India weights by around 5%.

Between April and October 2025, the Sensex managed to gain 14.9%, while mid and smallcaps rose 23.8% and 28.1% respectively, supported by strong domestic institutional buying and sustained retail participation.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.