India’s gold exchange-traded funds (ETFs) recorded their highest-ever monthly inflows in September, leading Asia and underscoring investors’ growing appetite for the yellow metal.

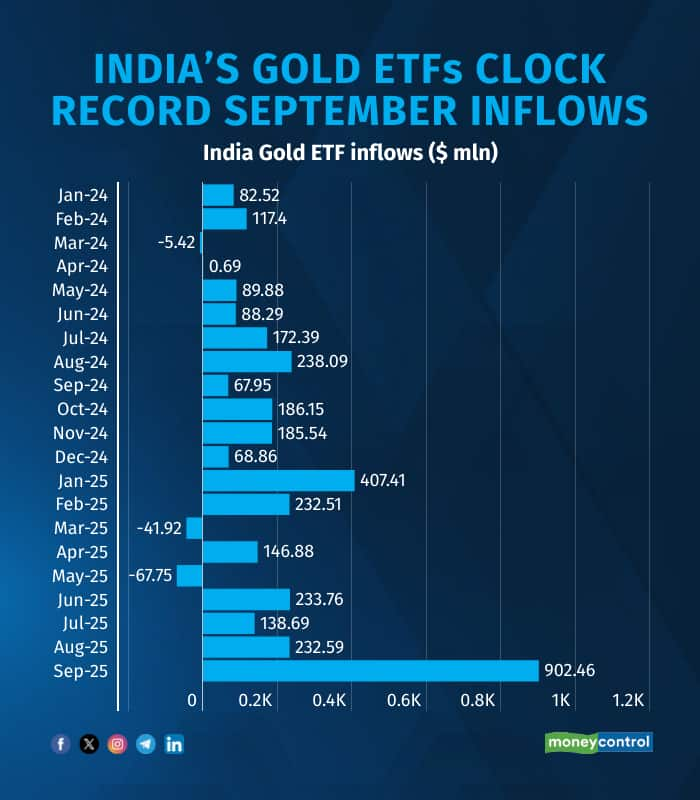

Data from the World Gold Council shows that Indian gold ETFs attracted $902 million in net inflows during September 2025 — a 285 percent surge from $232 million in August. This marked the fourth straight month of inflows, with every month of 2025, except March and May, seeing positive traction.

India ranked fourth globally in ETF inflows for the month. The US led with $10.3 billion, followed by the UK ($2.23 billion) and Switzerland ($1.09 billion). Overall, global ETF inflows stood at $17.3 billion in September.

Year-to-date, inflows into Indian gold ETFs have reached $2.18 billion, the highest on record for any single year. This compares with $1.29 billion in 2024, $310 million in 2023, and just $33 million in 2022.

Analysts attribute the surge to favourable currency movements and a rising preference for safe-haven assets, as investors look for stability amid weaker domestic equities and persistent geopolitical and trade risks.

Across Asia, gold ETFs recorded $2.1 billion in inflows during September, helping the region end the quarter on a positive note. China ($622 million) and Japan ($415 million) accounted for the bulk of these regional gains.

Other major contributors globally included Germany ($811 million), Canada ($301 million), Italy ($234 million), Australia ($182 million), and South Korea ($165 million).

Experts said demand remained strong through the month and quarter, supported by lingering trade and policy uncertainties, a weaker dollar, and expectations of lower yields following the US Federal Reserve’s 25-basis-point rate cut in September.

Markets are now pricing in one to two additional cuts by year-end.

With gold prices repeatedly touching record highs, investor interest has surged. Even as global equities hover near historic peaks, many investors appear to be positioning defensively, adding gold as a trusted hedge against potential market volatility.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.