Brokerages are envisioning a massive bump in profit for ICICI Bank in the fourth quarter of FY19.

The private lender is scheduled to post with its March quarter earnings on May 6, 2019.

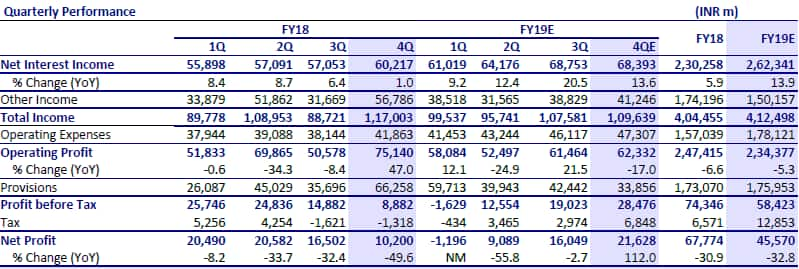

Research firm Motilal Oswal expects the bank to report net profit at Rs 2,162.8 crore up 112 percent year-on-year (up 34.8 percent quarter-on-quarter). Net Interest Income (NII) is expected to increase 13.6 percent YoY (down 0.5 percent QoQ) to Rs 6,839.3 crore.

Table: Motilal Oswal's expectations for Q4

Pre Provision Profit (PPP) is likely to fall by 17 percent Y-o-Y (up 1.4 percent Q-o-Q) to Rs 6,233.2 crore, the report said.

NIMs are expected to be under slight pressure due to an increase in funding cost which is expected to grow 16 percent YoY, according to Motilal Oswal. Total other income may spike 25 percent on account of improved treasury performance, the brokerage added.

Centrum Broking expects the bank to report strong 21.3 percent YoY growth in NII, helped by healthy 15 percent YoY growth in domestic loans and 27bps YoY expansion in NIM.

Fee income/treasury income could remain high. With stable cost, the firm expects the operating profit of Rs 6,550 crore and sees slippages to remain lower in Q4. Overall provisions are also expected to remain lower QoQ.

Centrum expects ICICI Bank to report net profit of Rs 1,840 crore and is one of the top picks in the largecap banking space.

Kotak Institutional Equities expects core earnings trajectory to

remain strong led by a recovery in loan growth (~15 percent YoY) and better NII growth (20 percent YoY) and a decline in credit costs.

Slippages will be sharply lower at less than 2 percent of loans and

NIM will be stable QoQ at 3.4 percent, it said.

Kotak expects a reduction in gross NPLs on the back of resolution as well as write-offs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.