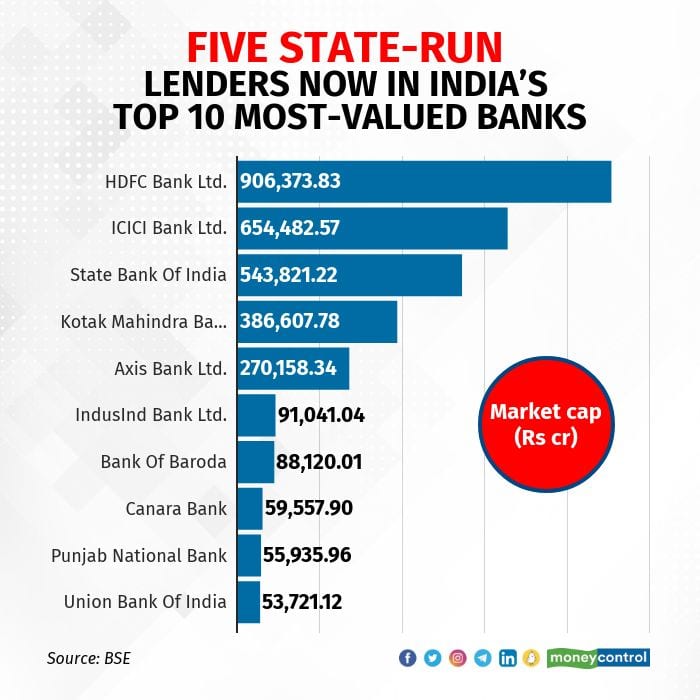

A rally in public-sector bank stocks has led five of them to the top 10 most-valued Indian lenders this year, compared to three in 2021.

State Bank of India, Bank of Baroda, Canara Bank, Punjab National Bank and Union Bank of India are in the top 10.

SBI is India's third most-valued lender with a market capitalisation of Rs 5.44 lakh crore, BoB ranks seventh with Rs 88,120 crore, Canara Bank (Rs 59,557 crore) ranks eighth, PNB (Rs 55,935 crore) ranks ninth and Union Bank of India (Rs 53,721 crore) ranks 10th.

At the end of 2021, SBI, BoB and PNB were in the top 10.

HDFC Bank remains India’s most valued bank with a m-cap of Rs 9.06 lakh crore, followed by ICICI Bank (Rs 6.54 lakh crore).

The Nifty PSU Bank index has outperformed the Nifty Bank index by a wide margin so far this year. The Nifty PSU Bank jumped 60 percent while the Nifty Bank index advanced 21 percent.

All PSU banks are trading at 52-week highs, while SBI hit a record high on November 7. Bank of India was the top mover year to date, with gains of over 106 percent, followed by Indian Bank, which rose 98 percent.

Union Bank of India and Canara Bank gained 75 percent and 65 percent, respectively. Bank of India, Uco Bank and Bank of Maharashtra each climbed about 50 percent.

Credit, deposit growth

Analysts attributed the rally in PSU bank stocks to robust earnings along with higher credit growth and improvement in asset quality in the September quarter. Analysts also expected the strong performances to continue.

“PSU banks have benefitted from rising credit demand, given their lower loan-to-deposit ratio, large low-cost CASA (current and savings account) deposits, stable/improving asset quality, stable cost-to-income ratios and improving NIMs (net interest margins),” said Deepak Jasani, head of retail research at HDFC Securities. “Most of these benefits were already being enjoyed by private banks in the past. Lower valuation of PSU banks helped a faster rerating of their stocks.”

Collectively, the 12 PSU banks posted a 50 percent increase in profit to Rs 25,685 crore. On a quarter-on-quarter basis, earnings increased 68 percent.

Barring Bank of India and PNB, all public-sector banks reported a rise in profit year-on-year and quarter-on-quarter. Bank of India’s net profit fell 8.7 percent from a year earlier, while PNB reported a 63 percent drop in profit.

The gross and net non-performing assets (NPAs) of all listed PSU banks declined YoY and QoQ. Aggregate gross NPAs fell 16 percent and 8.3 percent QoQ to Rs 4.87 lakh crore in the September quarter, while net NPAs dropped 30 percent YoY and 13 percent QoQ to Rs 1.29 lakh crore.

Loan growth for most PSU banks was healthy and in double digits, except for Punjab & Sind Bank, which reported a 9 percent YoY increase in lending.

Bank of Baroda, Canara Bank, SBI and Union Bank of India reported deposit growth in double digits.

Bank of Maharashtra had credit growth of 30 percent YoY while its deposit growth was just 8 percent.

Union Bank of India’s credit growth was 25 percent, followed by Bank of India at 22 percent. Canara Bank and SBI had a 21 percent increase in credit growth.

“Performance of PSU banks during the last 10 years has been very poor. This led to under-ownership in PSU banks. FIIs, DIIs and HNIs avoided them. This led to poor valuations of PSU banks, with most of them quoting below their book values. Now, the situation has changed. Improving asset quality, impressive credit growth and rising interest rates have improved the profitability and prospects of PSU banks. Consequently, the price differential between private and PSU banks has narrowed, leading to their outperformance,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.