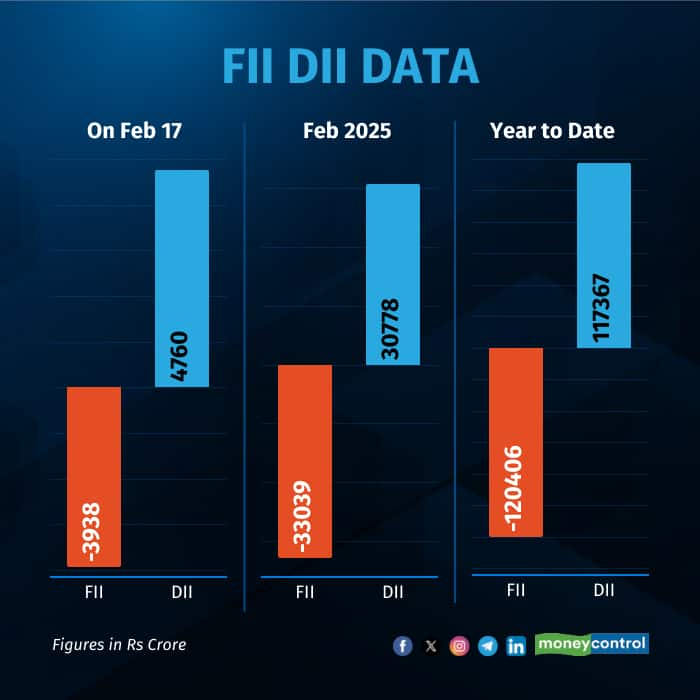

Foreign institutional investors (FII/FPI) were net sellers on February 17, offloading shares worth Rs 3,937.83 crore while domestic institutional investors (DII) were net buyers of shares worth Rs 4,759.77 crore, provisional data showed.

During the trading session of February 17, DIIs net bought shares worth Rs 12,504.11 crore and sold shares worth Rs 7,744.34 crore. FIIs purchased shares worth Rs 6,826.98 crore and sold shares worth Rs 10,764.81 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.20 lakh crore, while DIIs have net bought Rs 1.17 lakh crore worth of shares.

Also Read: Taking Stock: Nifty, Sensex snap 8-day fall; financial, metal, pharma stocks shine

Market Performance

For the benchmark indices, it was a day of rebound with Nifty 50 and Sensex closing higher after initial weakness.

Sensex ended at 75,996.86, higher by 57.65 points while Nifty 50 recovered early losses as buying emerged at lower levels, ending 30 points higher at 22,960 level. The gains have come after eight consecutive sessions of fall.

Broader market indices too closed in the green, with Nifty Midcap 100 up 0.4% and Smallcap 100 index up marginally.

Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services, said, "Amongst sectoral indices, Pharma and Healthcare were the top gainers, rising over 1% each. Also, investor interest was seen in the consumer durables, metals, oil & gas and PSU Banking space. The overall market sentiment remains cautious amidst persistent FII selling, US trade tariff concerns and weak quarterly earnings."

The Q3FY25 earning has seen more downgrades than upgrades. “Weakness in consumption coupled with a drag from commodities has put pressure on earnings even though BFSI, Healthcare, Capital Goods and Technology have posted a healthy print. The main factor leading to current market volatility is Trump’s announcement of reciprocal tariffs on US trading partners," Siddhartha Khemka added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!