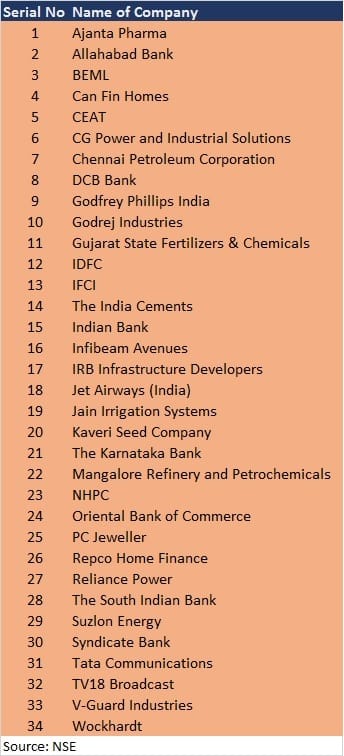

Most experts lauded the National Stock Exchange's decision to remove 34 securities from the futures & options (F&O) trading segment after the June expiry and advised investors to stay away from these stocks.

The move, a yearly practice by the exchange, is in the interest of retail investors. The removal, which is usually based on pre-defined criteria, helps in maintaining liquidity in the instrument.

“Exclusion from F&O can lead to short-term unwinding of arbitrage trades but once that effect wears off, price behaviour should be normal,” Rohit Srivastava, Fund Manager – PMS, Sharekhan told Moneycontrol.

“Investors should stay away from positional trades in the futures as you cannot roll over a position into the future anymore,” he said.

NSE said new contracts in these 34 securities will not be issued on expiry of contracts for existing months.

However, the existing unexpired contracts for April, May and June will continue to be available for trading until their respective expiry and new strikes would also be introduced in the existing contract months, it added.

These 34 stocks include Allahabad Bank, BEML, CG Power and Industrial Solutions, DCB Bank, Godfrey Phillips, Godrej Industries, IFCI, Indian Bank, IRB Infrastructure, Jet Airways, Karnataka Bank, NHPC, OBC, PC Jeweller, South Indian Bank, Suzlon Energy, Syndicate Bank, Wockhardt.

Most of the stocks that have seen significant double-digit corrections—PC Jewellers, Suzlon, Infibeam, etc.—have failed to meet a newly added criterion.

The exchange last year said stocks in which average delivery volume was less than Rs 10 crore in the last six months would not be included in the F&O segment.

In addition, the previously existing criteria quarter sigma order size and market wide position limit were also increased.

“These eligibility criteria’s were made more stringent to keep only the highly liquid stocks in F&O. There may be a further exclusion of some stocks on this basis. On the contrary, we are seeing certain better-performing stocks that are qualifying to enter in F&O segment,” Amit Gupta, head of derivatives at ICICIdirect told Moneycontrol.

“There are certain stocks that have seen a heavy short build up due to the underperformance of the underlying. As the contracts will be ended on June settlement, we can observe some short covering in these stocks towards May and June expiry,” he said.

Vivek Ranjan Misra, Head of Fundamental Research, Karvy Stock Broking is of the view that this exclusion shouldn’t have an impact on the long term trajectory of these stocks. However, in the short term, volatility in these stocks may increase, and liquidity may come down.

“We would advise investors to stay away from these stocks,” he said.

These stocks will be eligible to enter again in F&O only after a period of six months if they meet the eligibility criteria at that time.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!