There was absolutely no place to hide in the markets on Monday as Indian stocks mirrored the global meltdown and lost heavy ground with mid-cap and small-cap stocks bearing the maximum brunt.

The big question now is: Will this end the rally in the mid-cap and small-cap space that began last year and has been touching new highs even amidst concerns related to valuations among other things.

The BSE Midcap index lost 3.6 percent on Monday while the BSE SmallCap barometer fell 4.21 percent even as the Sensex lost 2.74 percent. For both the broader indices, it was the biggest single-day decline since June 4.

More importantly, both indices are trading at expensive valuations compared to their long-term averages. The BSE Midcap index's current one-year forward P/E is 30.11x, above its 10-year average of 25.83x. Similarly, the BSE SmallCap index's one-year forward P/E is 25.92x, compared to its 10-year average of 19.65x.

Both the broader indices have gained over 45 percent each in 2023 and 25 percent so far in 2024.

After today’s fall, Rajesh Palvia of Axis Securities believes that buying will resume only after midcap and smallcap indices will need to stabilize for buying to resume. Monday marks the first day of significant pressure, with broad-based selling, a surge in India VIX, and negative global cues and it is better for investors wait for 2-3 days for the market to absorb this supply pressure, he says.

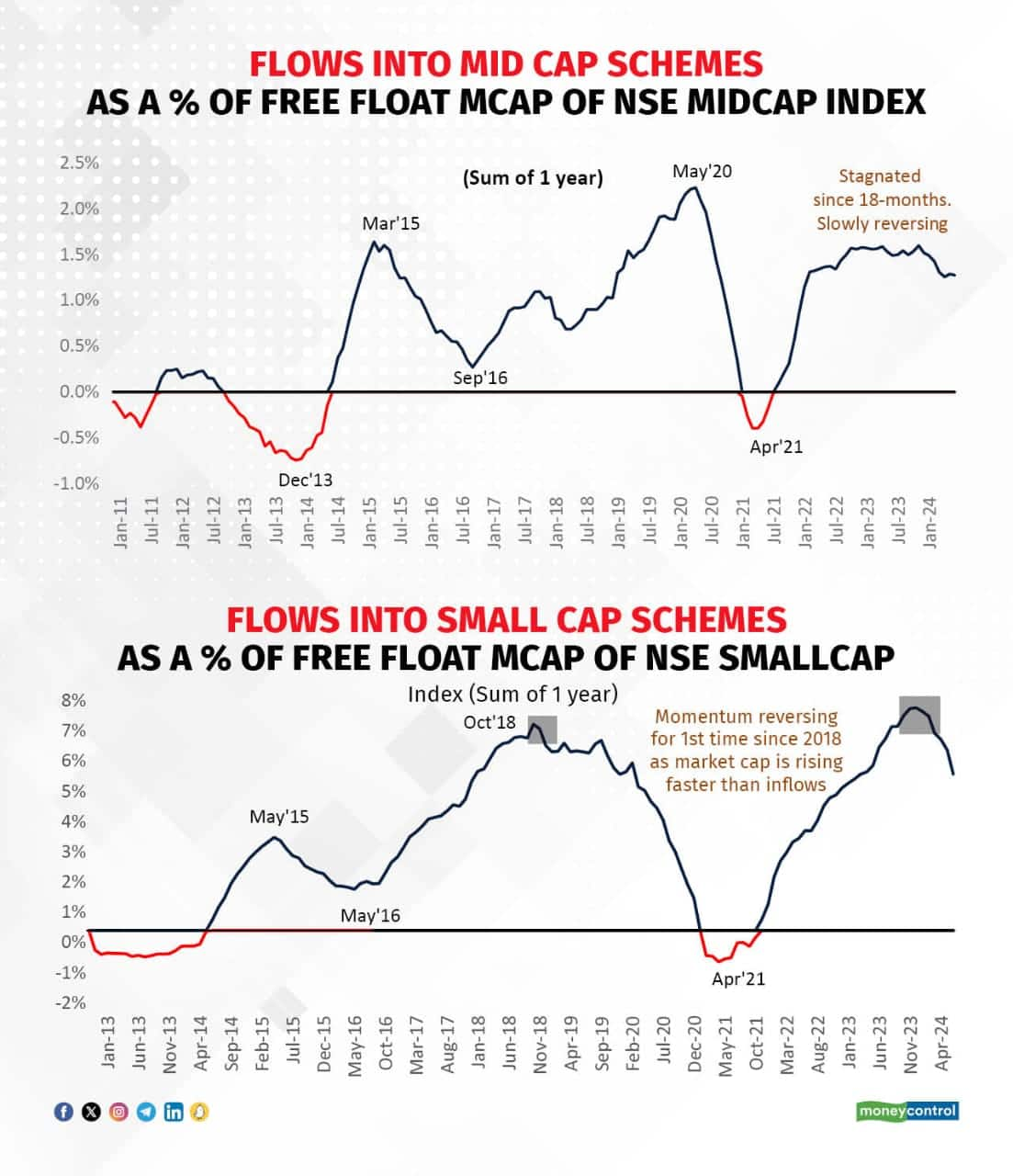

Even otherwise, there were signs of potential reversal in small caps. Firstly, an earlier report by Elara Capital highlighted a reversal in small-cap flows as percentage of free float market capitalisation.

The report indicated that the small-cap flows ( into small cap funds) were on a strong uptrend since 2021 and for the first time since 2018, they were seeing a significant reversal in small-cap flows as a percentage of free float market cap.

Source: Elara Capital

The report further stated that momentum is reversing as market cap is rising faster than inflows. Despite the strong absolute flows, their percentage of free float market cap is weakening.

Mid-cap flow momentum, as a percentage of free float market cap, has been flat for the past 18 months, with early signs of softening, stated the Elara report.

Secondly, a recent study by Capitalmind Financial Services found that the P/E multiple of the BSE SmallCap 250 index increased by 63 percent, while EPS remained flat. This suggests the P/E rise is mainly due to higher prices and with stagnant earnings, a price correction in the small-cap index is increasingly likely, it said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.