Anchor investor allocation in initial public offers (IPOs) of small and medium enterprises (SMEs) this year was cornered by a clutch of select few, as data showed that the same set of investors featured repeatedly in several public issues, statistics from Prime Database has revealed.

The year has seen over 100 SME IPOs with an anchor book portion, and top five investors featured in more than 20 percent of the public issues, with the top three names cornering nearly 30 percent of the anchor allocation, showed Prime Database.

Institutional investors such as Vikasa Capital, Rajasthan Global Securities, Saint Capital Fund, Aarth AIF Growth Fund, and NAV Capital VCC-NAV Capital Emerging Star Fund have been placing big bets on SME IPOs, having had share in anchor allocation in around 20 percent of the issues launched in 2025.

Both Vikasa Capital and Rajasthan Global Securities cornered more than 30 percent each of the total anchor allotment by SME IPOs so far this year till August 31. Saint Capital Fund too was in the same league, with the quantum of allotment at a little over 28 percent.

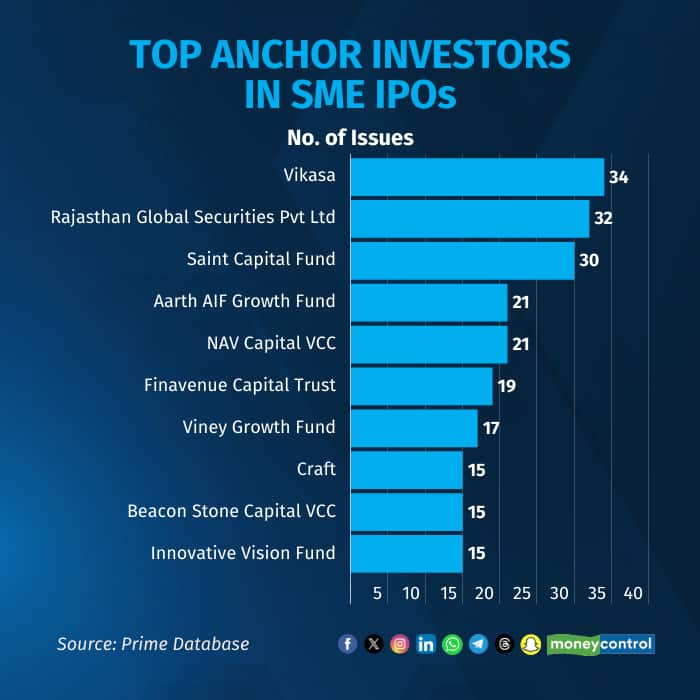

The cumulative size of anchor allotment in 106 SME IPOs so far this year was pegged at nearly Rs 1,522 crore. Meanwhile, in terms of the number of issues where these investors managed allotment, Vikasa leads the list with 34 SME IPOs, followed by Rajasthan Global Securities at 32, and Saint Capital Fund at 30. These three investors featured in the anchor book of nearly 30 percent of the SME IPOs that hit the market this calendar year.

A bunch of 15-20 SME IPOs this year saw participation from several institutional investors such as Viney Growth Fund, Craft, Beacon Stone Capital, Innovative Vision Fund, Ashika Global Securities and Steptrade Revolution Fund, among others, as per data from Prime Database.

The SME IPO arena has been attracting a lot of attention – from the regulator too - due to factors such as abnormally high subscription and huge listing gains followed by a significant price correction.

In recent past, regulatory officials have highlighted that only a select set of investors were typically allotted shares in the anchor book of SME IPOs. Capital market regulator Sebi along with BSE and NSE have tightened the norms for SME IPOs in recent months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.