Cipla is scheduled to announce its Q1FY26 earnings on July 25. While revenue growth is likely to be driven by strong domestic and emerging market performance, analysts expect profitability to remain under pressure due to muted US sales, price erosion, and normalising base margins.

As per analysts polled by Moneycontrol, Cipla’s consolidated revenue for Q1FY26 is expected to grow 6 to 8 percent year-on-year to Rs 70,000 to 72,600 crore. Net profit may grow in a narrower 1 to 6 percent range, impacted by a dip in US sales and weak performance in respiratory segments.

Sequentially, profit may remain flattish or even decline marginally due to a strong base in Q4FY25.

Note: Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock.

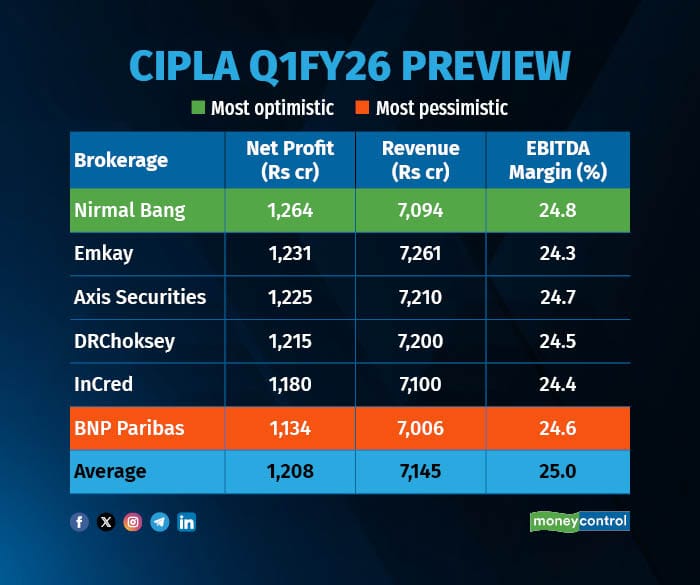

Note: Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock.Analyst estimates for Cipla’s Q1FY26 suggest a modest improvement over the previous quarter, with revenue expected to grow 5 to 6 percent sequentially from Rs 6,725 crore in Q4FY25 to an average of Rs 7,145 crore this quarter.

Net profit, however, is likely to remain flat to marginally lower, with the average estimate at Rs 1,208 crore compared to Rs 1,210 crore in the March quarter.

While EBITDA margins are seen expanding sequentially — from 22.8 percent in Q4FY25 to around 25 percent in Q1FY26 — analysts expect pressure from the US business and a strong year-ago base to cap overall profitability gains.

Growth driversAccording to BNP Paribas, Cipla’s India business is expected to post double-digit growth, aided by favourable seasonality and sustained strength in respiratory and chronic therapies. Prescription tracker data indicates steady gains in key segments, while analysts at Emkay expect branded prescription sales to grow around 8% on a low base.

However, the US market — which typically accounts for over 20% of Cipla’s top line — is expected to remain flat sequentially at $220 to 230 million, as higher contributions from Lanreotide and gRevlimid may be offset by price erosion in Albuterol and other inhalers.

“Cipla may face challenges in maintaining stable market share in Albuterol and Advair,” noted Axis Securities. They expect around $35 million in gRevlimid sales to contribute to Q1, alongside gradual gains in Lanreotide.

Despite topline growth, EBITDA margins are likely to contract by 90–130 basis points year-on-year, as per estimates from BNPP, Axis, and Emkay. This is due to lower gross margin contributions from the US business and some normalisation after a strong margin base last year.

Geographical distribution IndiaCipla’s India business is expected to grow 10.5% YoY, backed by seasonality, favourable demand in chronic segments, and strong price realisation. BNPP and DRChoksey both highlight that cardiac and respiratory therapies outperformed in Q1, with overall IPM growth estimated at 7.2–8.6% YoY.

USBNPP expects US sales at $230 million, while Axis and Emkay peg it closer to $220 to 221 million, citing weak volumes in Albuterol and flattish demand in respiratory drugs. Lanreotide’s gradual ramp-up and a $35 million boost from gRevlimid may partly cushion the impact.

South Africa & Emerging MarketsAxis and Emkay highlight strong 15 percent YoY growth in Cipla’s South Africa operations, along with stable performance in emerging markets like the Philippines and Brazil. Analysts see these regions contributing positively to the revenue mix in Q1.

Margin CompressionBNPP expects Cipla’s Q1FY26 EBITDA margin to decline by ~100bps YoY to 24.6 percent, though sequentially it should improve from Q4’s 22.8 percent. Emkay and Axis estimate margins at 24.3 to 24.7 percent, citing pressure from weak US pricing, lower Albuterol volumes, and the normalising benefit base from FY25.

Factors to watch for1. Cipla’s US respiratory portfolio trajectory, particularly Albuterol and Advair

2. Sustainability of gRevlimid and Lanreotide market share

3. Commentary on domestic growth outlook in IPM given the fading base benefit from FY25

4. The margin outlook, guidance for US new launches, and visibility on South Africa growth will be important triggers.

As Nirmal Bang noted, investors should also track input cost commentary and guidance on niche product ramp-ups in the complex generics pipeline.

The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.