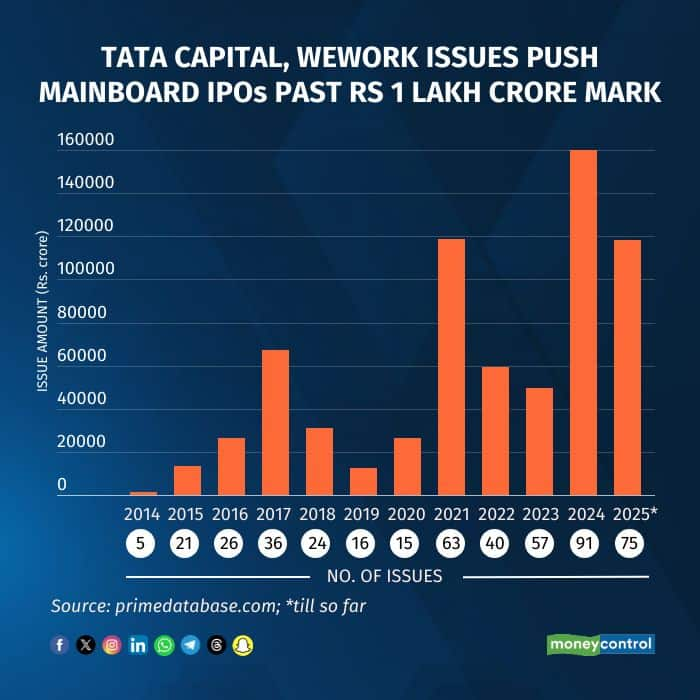

India’s primary market is on track for a record-breaking year as mainboard initial public offerings (IPOs) have already crossed the Rs 1 lakh crore fundraising milestone in 2025 so far, with three months still remaining. This is only the third time in history that the threshold has been breached.

As of September, 74 IPOs have mobilised around Rs 85,000 crore. The upcoming launches of Tata Capital (Rs 16,000 crore) and WeWork India Management (Rs 3,000 crore) will push the tally past Rs 1 lakh crore. Tata Capital’s issue will open on October 6 and close on October 8, while WeWork India’s IPO is scheduled between October 3 and October 7.

The landmark was last achieved in 2024 and 2021, when 91 and 63 IPOs raised Rs 1.6 lakh crore and Rs 1.19 lakh crore, respectively. LG India is also expected to launch its IPO in the first half of October, raising an estimated Rs 15,000 crore. With this, total fundraising is set to cross Rs 1.3 lakh crore, which will make 2025 the second-largest year for IPO collections .

With marquee names such as ICICI Prudential, Groww, Pine Labs, Canara HSBC Life, Credila Financial and PhysicsWallah also lining up, analysts say 2025 could well set a new fundraising record.

“The primary market pipeline looks robust. A wave of heavyweight IPOs is expected in the coming quarters, many dominated by large offer-for-sale components as institutional investors seek exits,” experts noted.

The surge comes despite muted listing gains, driven largely by foreign portfolio investors, retail participation, high-net-worth individuals and mutual funds at a time when secondary markets remain subdued. Analysts caution that while the IPO frenzy may persist in the short term, risks such as market corrections and tariff headwinds could temper momentum. They advise investors to stay focused on fundamentals.

Meanwhile, the SME segment is scripting its own record. In September alone, 53 SME IPOs raised Rs 2,309 crore — the highest ever in a single month by both volume and value. With 207 SME listings so far in 2025, the platform has already mobilised Rs 9,129 crore, surpassing all previous annual records with a full quarter still left.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.