If August was a busy month for companies coming out with initial public offerings and listing on the stock exchanges, it’s also been a month of disappointment for investors. The reason? The shares of companies that listed so far this month failed to generate enough returns for investors compared with the solid gains made in IPO stocks that debuted from January to July.

Experts said there were various factors for the comparatively poorer performance of IPO stocks in August, among them “valuation discomfort” in a majority of the share sales, a large offer-for-sale portion in the IPOs, a change of mood in the secondary markets after the sharp rally, and weakness in the broader markets.

Listing performance

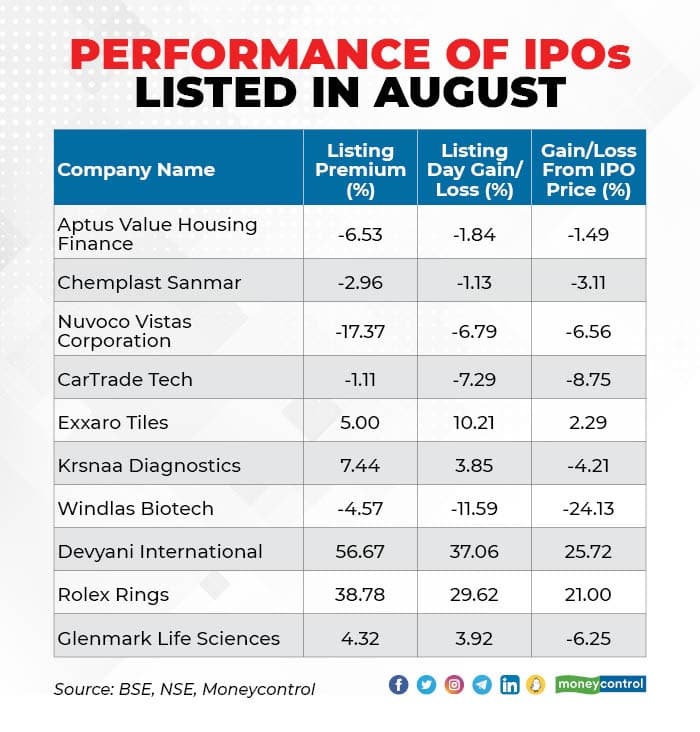

Ten companies had their shares listed so far this month – Glenmark Life Sciences on August 6, Rolex Rings on August 9, Windlas Biotech, Exxaro Tiles, Devyani International and Krsnaa Diagnostics on August 16, CarTrade Tech on August 20, Nuvoco Vistas Corporation on August 23, and Chemplast Sanmar and Aptus Value Housing Finance on August 24.

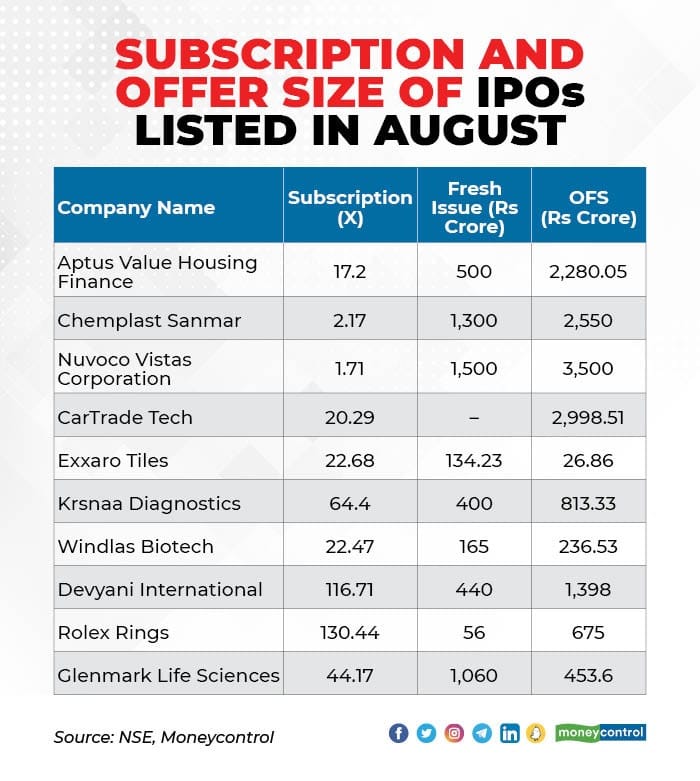

All these IPOs, except Exxaro Tiles and Windlas Biotech, were large in size – ranging from Rs 1,200 crore to Rs 5,000 crore.

Five of the 10 IPO stocks listed at a discount to their issue price and even closed below that level on their debut.

As of the August 25 close, seven of the 10 stocks appear to be in a bear trap. Only three have advanced above their issue price – Devyani International with a gain of 26 percent, Rolex Rings 21 percent and Exxaro Tiles 2.3 percent.

Valuations

“Most of the IPOs in the first half of 2021 did very well, where most of them were quality stocks and there were some valuation comfort as well. But many recent IPOs had a quality issue and valuation discomfort that are disturbing sentiment in the primary market,” said Santosh Meena, head of research at Swastika Investmart. “Promotors want to cash out opportunities in this bull run, where a major part of the recent IPOs was offer for sale, and that is another reason for the fragile sentiment in the primary market.”

Although some IPOs were subscribed heavily, high net worth individuals failed to recover their costs despite good listings, which is also weakening sentiment, Meena added.

The CarTrade Tech IPO attracted bids for over 20 times the shares on offer, Windlas Biotech was subscribed over 22 times and Aptus Value Housing over 17 times. However, comparatively, investor response was weaker for Chemplast Sanmar, which was subscribed 2.17 times and Nuvoco Vistas (1.71 times).

As seen in the table, the offer-for-sale size in eight of the 10 IPOs – including Aptus Value, Chemplast Sanmar, Nuvoco Vistas and CarTrade – was bigger than the issue of fresh shares. An offer for sale is usually made by existing investors and promoters.

According to Ajit Mishra, VP – research at Religare Broking, the valuations at which some companies offered shares appeared stretched and hence listing has been muted.

“Considering the sharp run-up, the market mood has shifted towards profit-taking, which has further impacted sentiment in the primary market. We believe the overall sentiments are still positive, but companies need to price it appropriately to gain investors’ traction,” Mishra said.

Broader market weakness

After hitting record highs last week, the benchmark indices were rangebound, while comparatively, the broader markets were weaker this month.

However, Gaurav Garg, head of research at CapitalVia Global Research, said valuations are not a problem.

“Overall, IPO fever is declining and along with that, weakness in the broader market indices is another setback that has spoiled the taste of IPOs, especially in August. I don’t see higher valuations as a problem, however. Market is trading at higher valuations,” Garg said.

Shrikant Chouhan, executive vice president for equity technical research at Kotak Securities, said market sentiment has been hit by global factors such as expectations of tapering in quantitative easing, growing geopolitical risks, a surge in Covid-19 cases in developed counties, uncertainty over new regulations in China, expensive valuations and tightening of liquidity. As a result, some stocks listed at a discount to their IPO prices, he said.

The good listing gains in some IPOs of the recent past have lifted the expectations of retail investors, who are looking for quick returns.

However, one needs to be selective in IPOs, Chouhan said, advising investors to evaluate each company on its merits and not to get carried away by the hype around IPOs.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!