Krishna KarwaMoneycontrol Research

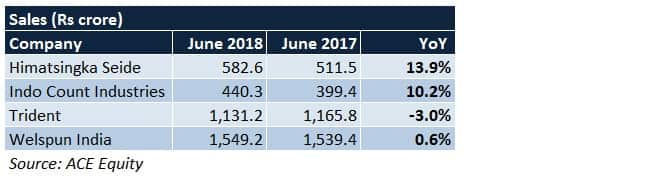

India's export-oriented home textile companies have been caught amid a myriad of challenges of late. This fact was clearly visible in their weak financial performance in the quarter gone by, as seen in the tables below:

While the rupee’s depreciation against the dollar in the recent past could offer some respite to these companies, the near-term outlook for the sector as a whole is far from promising. Here’s why:

Competition

Stiff competition from other home textile exporting nations such as China, Vietnam, Pakistan and Turkey is expected to continue. Barring the yuan, currencies of other countries currently trade at a steep discount to the dollar.

The rupee, despite its current weakness vis-a-vis the dollar, is on a much stronger footing versus currencies of most developing nations.

Consequently, it can be hard for India's home textile players to compete against foreign counterparts in terms of gaining market share in the US. What adds to Indian companies' woes is the relatively low electricity, labour and fixed overhead costs in competing countries.

Cost inflation

Raw material (cotton) prices have been on an uptrend in India since quite some time, and no price respite may be visible in the foreseeable future. According to the Cotton Association of India, cotton production is likely to decline by 3-4 percent this year to 350 lakh bales.

The reduction is attributable to low rainfall in key cotton growing states such as Gujarat (which affects sowing patterns), a decline in acreage, outbreak of pink ballworm infestation on crops, and focus on other cash crops by farmers (especially in Andhra Pradesh, Maharashtra, Karnataka and Punjab).

For home textile majors, passing on such cost hikes to importers is difficult because products, more often than not, are commoditised in nature.

Weak offtake

In the US, which is the biggest market for home textile exports from India, financial position of some offline retailers hasn’t been too encouraging. This is predominantly because of heightened threat from e-commerce players out there, which has forced many brick-and-mortar outlets to shut shop and file for bankruptcy.

As a result, demand for home textile products from their end may remain sluggish for quite some time. Contract renegotiations may get trickier for India's home textile majors in view of the ongoing tough market conditions.

Established US-based retailers are realigning and restructuring business models by cutting down inventory. Instead of following the erstwhile policy of receiving monthly consignments, they are moving to the weekly orders system, which eventually increases working capital costs of suppliers (ie. India's home textile companies).

Outlook

Leading home textile markets for Indian exporters (primarily North America and Europe) witness strong demand traction in H2 of a fiscal due to the onset of the festive/wedding/holiday season. Hopefully, this will help Indian textile companies offset existing subdued scenario.

From a company-specific perspective, a lot would depend on the pace at which utilisation levels at manufacturing centres scale up. This factor, besides being a key indicator of the order book strength and probable demand trajectory, is extremely crucial in terms of aiding margin expansion.

An equally important aspect to look at is how quickly funds invested in capex start translating into cash inflows. Home textile majors, historically, have been investing heavily in building capital assets for a wide variety of purposes.

These include achieving the benefits of backward integration (manufacturing yarn/fabric), increasing existing product manufacturing capacities, adding capacities to manufacture new products, saving power costs, facilitating technological upgradation, undertaking equipment maintenance or a combination of these.

Regional diversification is also the need of the hour given the high degree of dependence of Indian home textile companies on the US market.

Any stock that merits attention?

The undemanding valuations and inability to deliver significant price returns over an extended period of time is indicative of the bearish sentiment harboured by D-street towards home textile majors.

Notwithstanding the challenges mentioned above, in our view, Himatsingka Seide appears better placed to tackle industry headwinds compared to its peers and has good fundamentals to back its plans.

Himatsingka manufactures bed sheets, pillow covers, fabric (drapery and upholstery variants) and ultra-fine count yarn (constitutes a very nominal percentage of the annual turnover). The company’s retail and distribution arm caters to private labels of major retailers across North America, Europe and Asia.

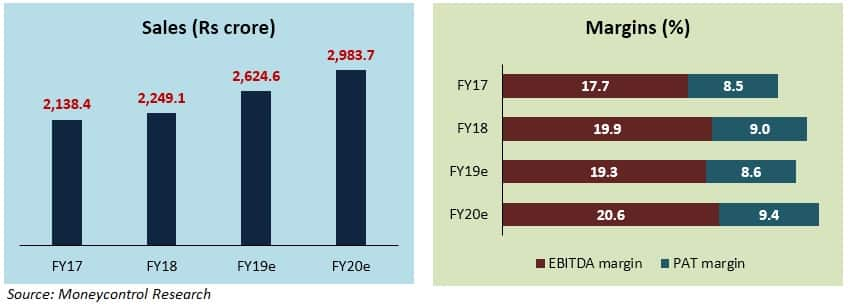

To explore the bath linen space, Himatsingka will commence operations at its 25,000 metric tons per annum terry towel manufacturing factory from Q4 FY19. A gradual increase in efficiency at its expanded 23 million metres per annum (mmpa) bed sheet manufacturing unit, which was commissioned back in H2 FY17, should provide an added impetus to the company’s top-line.

An uptick in utilisation rate at Himatsingka’s ultra fine count yarn spinning facility (set up in H2 FY18), coupled with higher contribution of private label and premium brands to overall revenue, will be critical in boosting margins. The company is also involved in talks with new European retailers for export orders.

However, interest and depreciation costs are anticipated to be higher in FY19 because of investments directed towards establishing the terry towel unit. GST-induced blockage of funds is another bottleneck that ought to be addressed. Realistically, a noticeable increase in earnings will be seen only starting FY20.

The stock, after witnessing a sharp correction of 37.3 percent from its 52-week high, trades at 9.8 times its 2-year forward earnings. Investors may, therefore, consider keeping this on their radar.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!