India remains a bright spot in an otherwise gloomy global economic landscape. But that does not prove that the Indian economy has been plain-sailing domestically, with the authorities facing multiple short-term and medium-term challenges.

Given the various forces at play and indicators that must be tracked, the Reserve Bank of India (RBI) in November 2020 revived a practice that had been discontinued 25 years back – the publication of a monthly review of the state of the economy. While the State of the Economy (SotE) article does not reflect the RBI's official stance, it has become a key monitorable, throwing up interesting tidbits every now and then and providing insight into the thoughts of of the central bank.

Moneycontrol takes a look through five key charts from its latest edition, released on August 17.

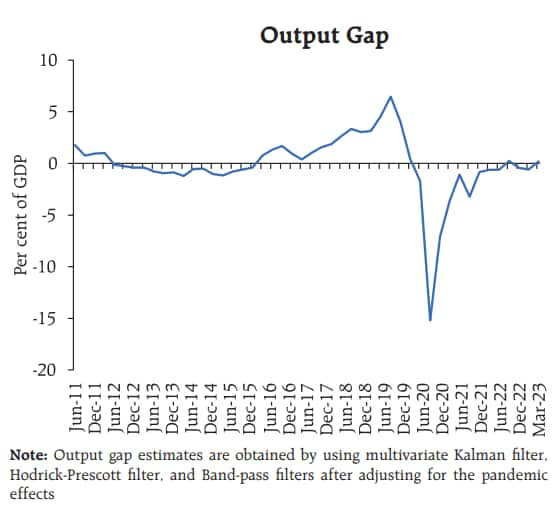

It is perhaps appropriate to begin with output, given India's status as the world's fastest-growing large economy. And, according to the SotE article, India's output gap not only closed but turned positive in the first quarter of 2023.

Source: Reserve Bank of India

Source: Reserve Bank of India

The output gap is the difference between an economy's actual output and what it can potentially produce. So, while it's good news that it has turned positive, reflecting that there is no slack in the economy, it also indicates that the demand-pull pressure could lead to higher inflation unless there is capacity addition.

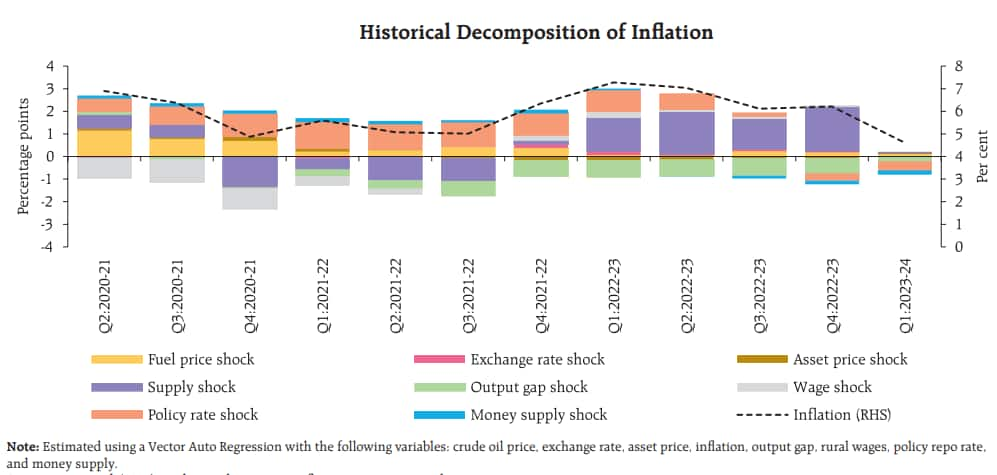

High inflation, of course, would not be a new problem for India, with the headline retail inflation staying above the RBI's medium-term target of 4 percent for nearly four years now. There is, however, only so much that the RBI can do to bring down inflation. And it can't do much when the reasons are supply-related.

Source: Reserve Bank of India

Source: Reserve Bank of India

According to the above chart, supply shocks have been the biggest determinants of inflation in the last four quarters. The 250 basis points of repo rate hikes from 2022-23 are having an effect, with the SotE noting that they account for around 130 basis points of the decline in inflation.

While inflation did really decline from 7.79 percent in April 2022 to 4.31 percent in May, a huge increase in vegetable prices pushed it back to 7.44 percent in July.

Source: Reserve Bank of India

Source: Reserve Bank of India

It can be difficult to truly understand how absurd the recent rise in tomato prices has been. In the above graph, it is clear that while most sub-groups of the Consumer Price Index (CPI) are crowded in the bottom left quadrant, vegetable is nearly outside the graph in the top-right corner, indicating very high year-on-year inflation and month-on-month price momentum in July.

Also Read: 'Major reforms' needed in supply chains to control food price shocks, says RBI Bulletin

With high inflation having been a feature of the Indian economy for a long time, any instance of a drop in growth brings up an uncomfortable word: stagflation.

Source: Reserve Bank of India

Source: Reserve Bank of India

According to the SotE, India faced high stagflation risks during the Asian and global financial crises, the taper tantrums, and the coronavirus pandemic.

"Currently, however, stagflation risk remains low for India with a probability of only 3 percent with easing of financial conditions, stability of the INR/USD exchange rate, and steady domestic fuel prices," the article said.

Key to any economy's fundamentals is the government's finances. After the pandemic-induced jump in the fiscal deficit and total debt, India has made a conscious effort to increase its capital expenditure to revive growth.

Source: Reserve Bank of India

Source: Reserve Bank of India

As per the SotE, there has been a "marked improvement" in the quality of government expenditure, with a sharp decline in the revenue deficit-to-gross fiscal deficit and revenue expenditure-to-capital outlay ratios in the first quarter of 2023-24, compared to even pre-pandemic years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.