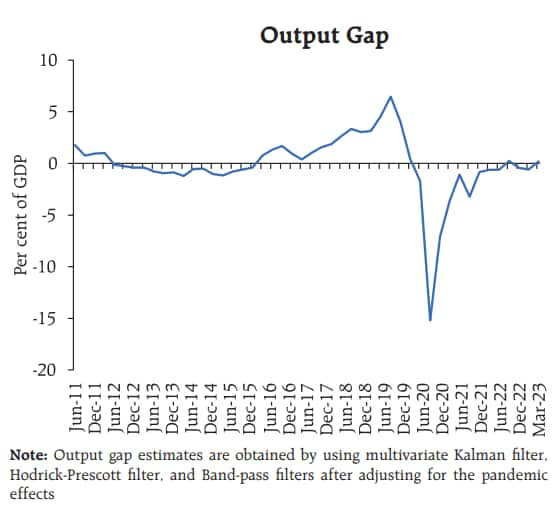

India's output gap finally became positive in the first quarter of 2023, an article in the Reserve Bank of India's (RBI) monthly bulletin has said. The article, titled State of the Economy, includes Deputy Governor Michael Patra as one of its co-authors and was published in the central bank's monthly bulletin on August 17.

"On balance, our assessment of the Indian economy in terms of its position in the business cycle is that the slack imposed by the pandemic has been pulled in,” the article said. "The output gap, which was mostly negative since the fourth quarter of 2019-20 has turned positive during January-March 2023."

The views expressed in the State of the Economy article do not reflect the central bank's official stance.

Source: Reserve Bank of India

Source: Reserve Bank of India

The output gap is the difference between an economy's actual output and what it can potentially produce. When the gap is positive, it can lead to demand-pull inflationary pressures.

Also Read: RBI's Michael Patra says threshold inflation of 6 percent must be re-estimated as output gap closes

In January-March - the period in which the RBI Bulletin article states the output gap turned positive - India's GDP growth came in at 6.1 percent, far higher than expectations of 5.1 percent. This forced the statistics ministry to upgrade its GDP growth estimate for 2022-23 to 7.2 percent - 20 basis points higher than its second advance estimate of 7 percent.

The government has been bullish on the back of the blowout GDP number for January-March, with Chief Economic Adviser V Anantha Nageswaran saying in June that the Indian economy can now grow rapidly for an extended period of time without heating up and encountering problems like it has done in the past.

Also Read: MPC's Jayanth Varma says one quarter of good data doesn't mean growth struggle over

GDP data for April-June will be released on August 31. According to the RBI's forecast, GDP growth may have risen further to 8 percent in the second quarter of 2023.

"Investors are ebullient about India's growth prospects at a time when the rest of the world is slowing down. They look at industrials, financials and consumer discretionary stocks as major beneficiaries of India's ongoing structural transformation," the State of the Economy article said.

Meanwhile, the RBI article also estimated that India only faced a 3 percent risk of stagflation, which refers to a phase of high inflation and low growth.

Source: Reserve Bank of India

Source: Reserve Bank of India

"Historical analysis shows that high stagflation risks were encountered during certain periods such as the Asian Crisis (1997-98), the Global Financial Crisis (2007-09), the taper tantrum (2013), and the COVID-19 pandemic," the article said.

"Currently, however, stagflation risk remains low for India with a probability of only 3 percent with easing of financial conditions, stability of the INR/USD exchange rate and steady domestic fuel prices," it added.

While India is the fastest-growing large economy in the world, growth is set to decline to 6.5 percent this financial year from 7.2 percent in 2022-23. However, economists think the government and the RBI's forecast is on the higher side. At the same time, inflation surged to a 15-month high of 7.44 percent in July on account of a spike in vegetable prices. While this rise is seen as being temporary, headline retail inflation has been above the RBI's medium-term target of 4 percent for nearly four years now.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!