India's Gross Domestic Product (GDP) growth rate rose for the first time in three quarters to 6.1 percent in January-March, the Ministry of Statistics and Programme Implementation said on May 31.

For 2022-23 as a whole, the statistics ministry's first provisional estimate has pegged the GDP growth at 7.2 percent, 20 basis points higher than the second advance estimate of 7 percent.

At 6.1 percent, the latest quarterly growth number is significantly higher than expectations of 5.1 percent. It is also well above the highest estimate of 5.5 percent in a poll conducted by Moneycontrol last week.

The blowout GDP data will be roundly cheered by India's policymakers, with Reserve Bank of India (RBI) Governor Shaktikanta Das sticking out his next last week and saying he wouldn't be surprised if GDP growth for 2022-23 is higher than 7 percent.

The numbers will also ease fears of the Indian economy slowing down, as has been predicted by several economists.

GDP fine print

The surge in growth in the last quarter of 2022-23 was led by the manufacturing sector, whose Gross Value Added (GVA) rose by 4.5 percent year-on-year after a dismal performance in the previous two quarters, when it contracted by 3.8 percent and 1.4 percent in July-September and October-December, respectively.

According to Aditi Nayar, chief economist at ICRA, the rebound in manufacturing sector growth was down to an pick-up in manufacturing volumes "as well as an improvement in margins during the quarter, partly on account of a sustained moderation in input costs."

| BREAKDOWN OF JAN-MAR GDP DATA (GROWTH IN %) | |||

| Q4 FY23 | Q3 FY23 | Q4 FY22 | |

| Real GDP | 6.1% | 4.5% | 4.0% |

| Nominal GDP | 10.4% | 11.4% | 13.0% |

| Real GVA | 6.5% | 4.7% | 3.9% |

| Agriculture, forestry, fishing | 5.5% | 4.7% | 4.1% |

| Mining, quarrying | 4.3% | 4.1% | 2.3% |

| Manufacturing | 4.5% | -1.4% | 0.6% |

| Electricity, gas, other utilities | 6.9% | 8.2% | 6.7% |

| Construction | 10.4% | 8.3% | 4.9% |

| Trade, hotels, transport, etc | 9.1% | 9.6% | 5.0% |

| Financial, real estate, professsional services | 7.1% | 5.7% | 4.6% |

| Public administration, defence, other services | 3.1% | 2.0% | 5.2% |

The agriculture sector also witnessed a sharp up-tick in January-March, as its GVA growth jumped to 5.5 percent from 4.7 percent the previous quarter and 4.1 percent in the first quarter of 2022.

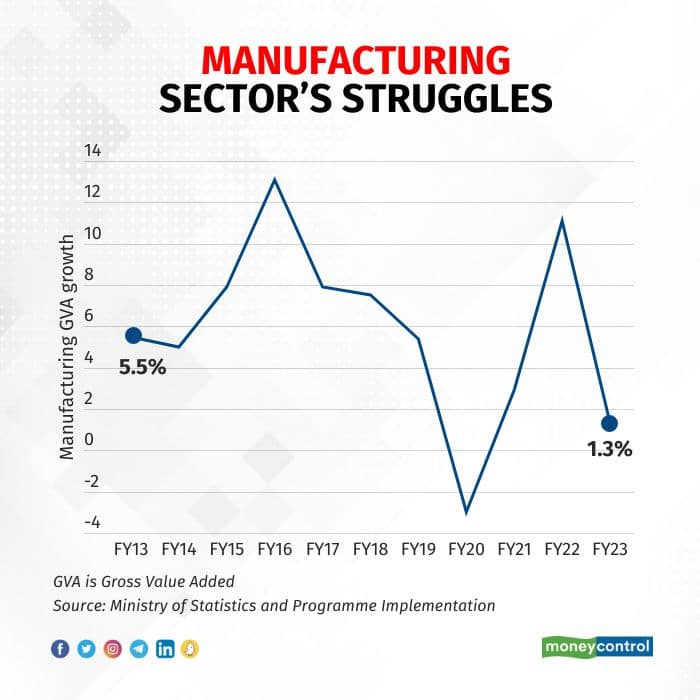

However, for the full-year, the manufacturing sector continues to struggle, with its GVA up a mere 1.3 percent. However, this is higher than the government's second advance estimate of 0.6 percent.

Meanwhile, farm growth was 4 percent in 2022-23.

The financial, real estate, and professional services segment grew by 7.1 percent in the March quarter compared to 5.7 percent in October-December.

In terms of spending, private consumption rose 2.8 percent in January-March, while gross fixed capital formation - a proxy for investments - was up 8.9 percent from last year.

In October-December, these two components had posted year-on-year increases of 2.2 percent and 8.0 percent, respectively.

For the whole year, private consumption is estimated to have risen by 7.5 percent, down from the favourable-base-effect-fuelled 11.2 percent in 2021-22. Growth in gross fixed capital formation also declined, as expected, but it remained in double-digit territory, coming in at 11.4 percent as compared to 14.6 percent in 2021-22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.