The Reserve Bank of India pegs Indian crude oil basket price at an average of $100 per barrel for its inflation projection of 6.7 percent in 2022-23, signaling that it expects limited upside to crude oil prices for the rest of the fiscal year.

This week, international oil benchmark Brent crude slipped below $80 a barrel following a slew of bearish news. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, commonly known as OPEC+, decided on December 4 to keep its oil production unchanged, just two days after the Group of Seven (G7) nations agreed on a price cap on Russian oil. European economies are slowing due to soaring energy costs and rising interest rates, Chinese service-sector activity hitting a six-month low, and equity markets tumbling have weighed on the sentiment.

“Average crude at $100 a barrel is a realistic assumption by the RBI. While India would like crude to fall towards $60 for overall macroeconomic stability, given the geopolitical uncertainties it is unlikely to sustainably remain low. OPEC is watching the prices closely and if it trends below $80, it may come in to cut supplies to protect prices and call it market balancing,” said Debasish Mishra, partner and leader (energy) at Deloitte India, told Moneycontrol.

On December 7, the Reserve Bank of India’s monetary policy committee (MPC) raised policy repo rate by 35 basis points to 6.25 percent with immediate effect. The MPC said that the inflation trajectory going ahead would be shaped by both global and domestic factors. Taking into account all these factors and assuming an average crude oil price (Indian basket) of $100 per barrel, inflation is projected at 6.7 percent in 2022-23, with the third quarter at 6.6 per cent and Q4 at 5.9 per cent, and risks evenly balanced, MPC said.

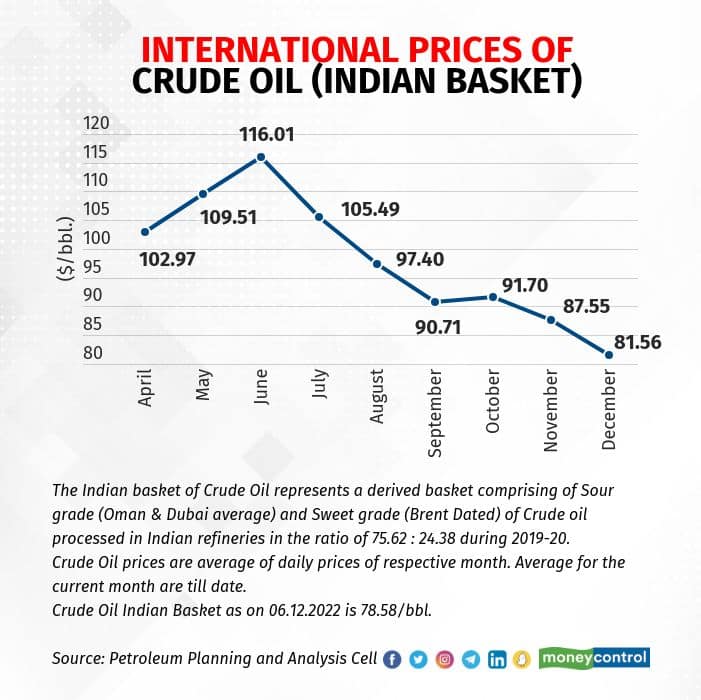

Crude oil prices have remained volatile, touching lows of $69.28/barrel in December 2021 and highs of $139.13/barrel in the last 52 weeks. The Indian basket of crude oil, which represents a derived basket comprising sour grade (Oman and Dubai average) and sweet grade (Brent dated) of crude oil processed in Indian refineries, was at $116.01/barrel in June and has declined to 78.58/barrel as on December 6, according to Petroleum Planning and Analysis Cell.

While price correction in crude oil is positive for India in the long term, experts expect a mixed impact in the short-to-medium term on Oil Marketing Companies (OMCs) like Bharat Petroleum Corporation Ltd, Indian Oil Corporation Ltd, and Hindustan Petroleum Corporation Ltd.

“The correction in prices would have a dual impact on OMCs (although overall positive impact). Firstly, OMCs would incur one-time inventory loss (on GRMs front) due to the impact of falling oil prices on existing inventory. Secondly, and more significantly, we expect the performance of the marketing segment to improve owing to lower losses on the diesel front,” ICICI Direct said in a report on December 7.

India has been buying discounted oil from Russia to keep its oil basket under check and the government has repeatedly said that it would continue to do so as it prioritises domestic energy security. Union Minister for Petroleum and Natural Gas Hardeep Singh Puri has repeatedly said that India will examine the impact of the price cap on Russian oil but will respond with national interest in mind.

“India is already buying around 800,000- 900,000 barrels per day, which is already 20 percent of total imports. It is unlikely India will increase the volume of Russian imports as it may not work given the configuration of Indian refineries. It is also unlikely that the G7 price cap on Russian crude will have any significant impact on India’s imports from the country. The discounted price at which Russia is selling to India, translates into a realisation for the country which is close to the $60 cap,” Mishra said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!