The quality of the government expenditure is a long-running debate. While the importance of increasing capital expenditure is recognised, large revenue expenditure commitments such as interest payments and the inherent nature of capital expenditure delivering results in the medium-to-long term have seen successive regimes making meagre allocations.

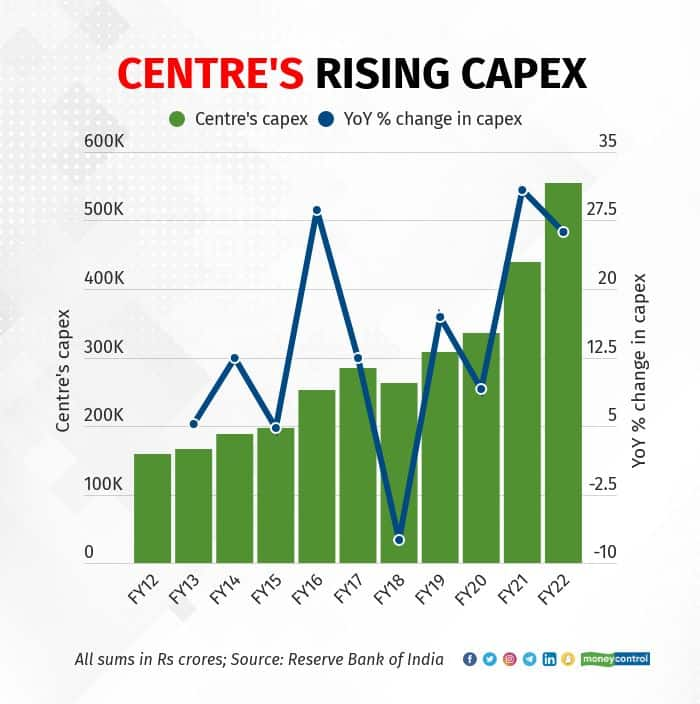

The COVID-19 pandemic and the resultant hit to economic growth, however, has forced a visible shift to more long-term thinking. The Centre's capital expenditure target in FY22 was Rs 5.54 lakh crore, more than twice of what was spent as recently as FY18.

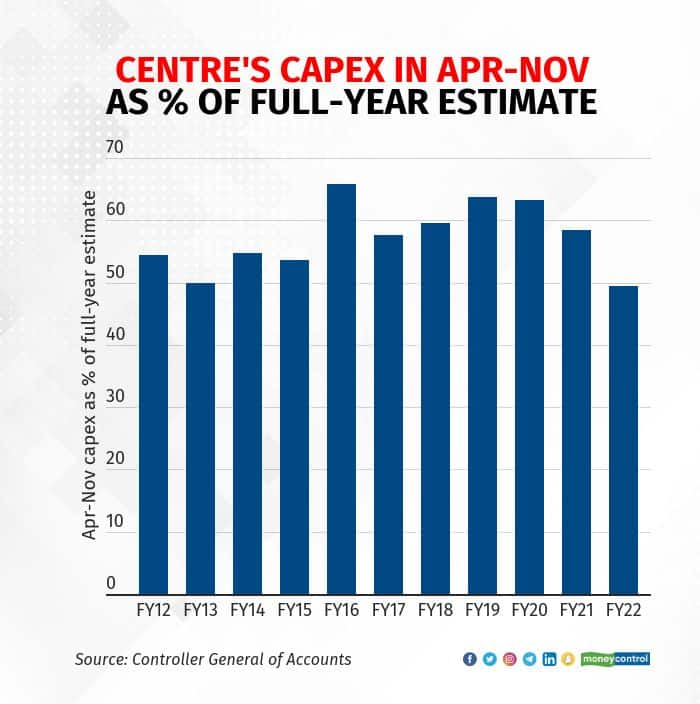

But the sharp increase in the capital expenditure target is not so easily met. In the first eight months of the current financial year, the central government has managed to spend only 49.4 percent of the full-year allocation. The last time the utilisation rate was similarly low was in FY13, when only 50 percent of the full-year target was achieved in the first eight months of the financial year.

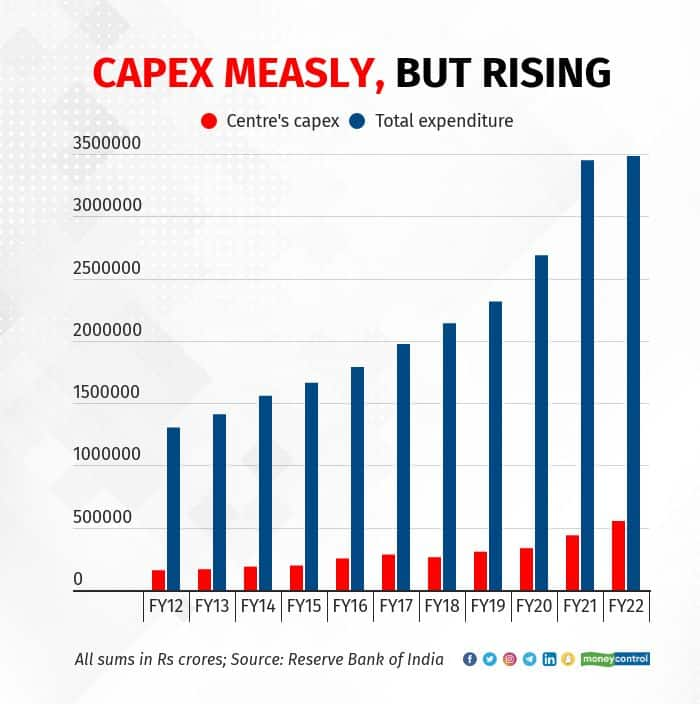

But even as the Centre's capital expenditure allocations have received a boost in recent years – and is seen rising further to Rs 6.5 lakh crore in FY23, according to a Moneycontrol survey – the fact remains that the budgeted sums constitute a fraction of total expenditure.

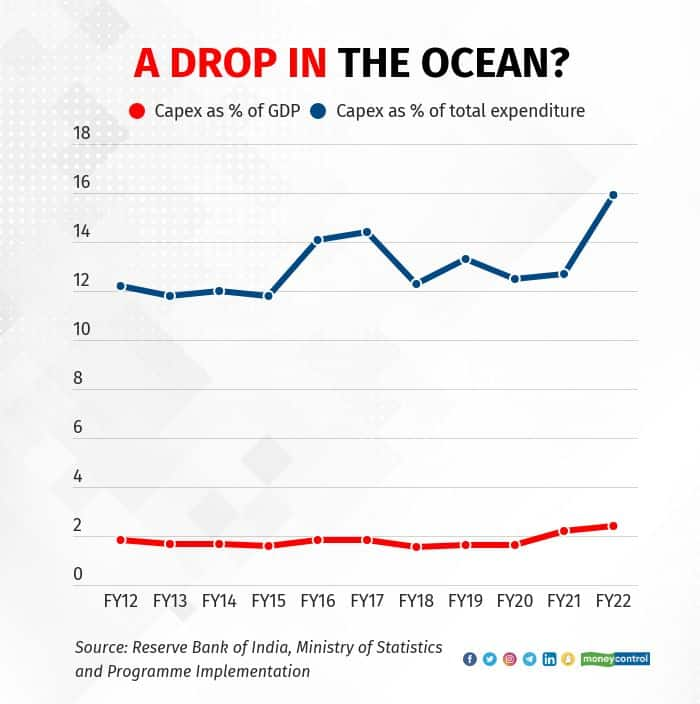

In terms of percentage, the FY22 capital expenditure allocation made up 15.9 percent of total expenditure. While this is sharply higher than the 12.7 percent in FY21, the share of capital expenditure in total expenditure has increased extremely slowly, standing at 12.2 percent in FY12.

When compared to the Gross Domestic Product (GDP), the numbers are obviously smaller. But more importantly, they have only risen, thanks to the pandemic. From 1.82 percent in FY12, capital expenditure as a percentage of the GDP fell to 1.65 percent in FY20. This rose to 2.22 percent in FY21 and 2.39 percent in FY22. Of course, this last figure may change, and most likely decline depending on the revised estimate for the current financial year. What is clear is that there is plenty of room for the government to raise its capital spending.

It goes without saying that the government is not solely responsible for driving public capital expenditure - states play an important role too. According to the Reserve Bank of India's estimates, the multiplier for central government capital expenditure is higher.

According to the central bank, a one rupee increase in the Centre's capital expenditure boosts output by Rs 2.45 in the first year and by Rs 3.14 in the second year. In comparison, a Re 1 increase in states' capital expenditure leads to a Rs 2 increase in output.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.