Most states and Union Territories (UTs) recorded more than 14 percent growth in their Goods and Services Tax (GST) revenues in July - the first month of the post-compensation era - data released on August 1 by the finance ministry showed.

As per the data (external link), only 11 states and UTs saw their GST revenue rising by less than 14 percent in July. These included small regions such as Daman and Diu and Tripura but also large states like Madhya Pradesh and Punjab.

| State/UTs with sub-14% growth in GST revenues | ||

| July 2022 GST revenue (in Rs crore) | YoY change | |

| Jammu and Kashmir | 432 | 0% |

| Himachal Pradesh | 746 | 12% |

| Punjab | 1,733 | 13% |

| Chandigarh | 176 | 4% |

| Delhi | 4,327 | 13% |

| Bihar | 1,264 | -1% |

| Tripura | 63 | -3% |

| Odisha | 3,652 | 1% |

| Chattisgarh | 2,695 | 11% |

| Madhya Pradesh | 2,966 | 12% |

| Daman and Diu | 0 | -66% |

However, this five-year compensation period ended on June 30, with states asking the Centre to continue compensating them for any shortfall in revenues for another two to five years as they feared a hit to their finances amid the economic weakness caused by the coronavirus pandemic.

While the Centre did not respond one way or the other to states' request, its stance has largely been that it would fulfill what the law said. As for what would happen beyond June 30, the talk from finance ministry has been that states were unlikely to require any compensation, as their GST revenues would rise by roughly 14 percent anyway. Data released today seems to back the Centre, with 25 states and UTs witnessing at least 14 percent increase in their GST revenue.

| State/UTs with at least 14% growth in GST revenues | ||

| July 2022 GST revenue (in Rs crore) | YoY change | |

| Uttarakhand | 1,390 | 26% |

| Haryana | 6,791 | 27% |

| Rajasthan | 3,671 | 17% |

| Uttar Pradesh | 7,074 | 18% |

| Sikkim | 249 | 26% |

| Arunachal Pradesh | 65 | 18% |

| Nagaland | 42 | 48% |

| Manipur | 45 | 20% |

| Mizoram | 27 | 27% |

| Meghalaya | 138 | 14% |

| Assam | 1,040 | 18% |

| West Bengal | 4,441 | 28% |

| Jharkhand | 2,514 | 22% |

| Gujarat | 9,183 | 20% |

| Dadra and Nagar Haveli | 313 | 38% |

| Maharashtra | 22,129 | 17% |

| Karnataka | 9,795 | 45% |

| Goa | 433 | 43% |

| Lakshadweep | 2 | 69% |

| Kerala | 2,161 | 29% |

| Tamil Nadu | 8,449 | 34% |

| Puducherry | 198 | 54% |

| Andaman and Nicobar Islands | 23 | 26% |

| Telangana | 4,547 | 26% |

| Andhra Pradesh | 3,409 | 25% |

| Ladakh | 20 | 54% |

To be sure, the growth in GST collections has been helped by high inflation as well as a relatively lower base, with collections in the last two years adversely affected by the hit to economic activity and consumption due to the coronavirus pandemic.

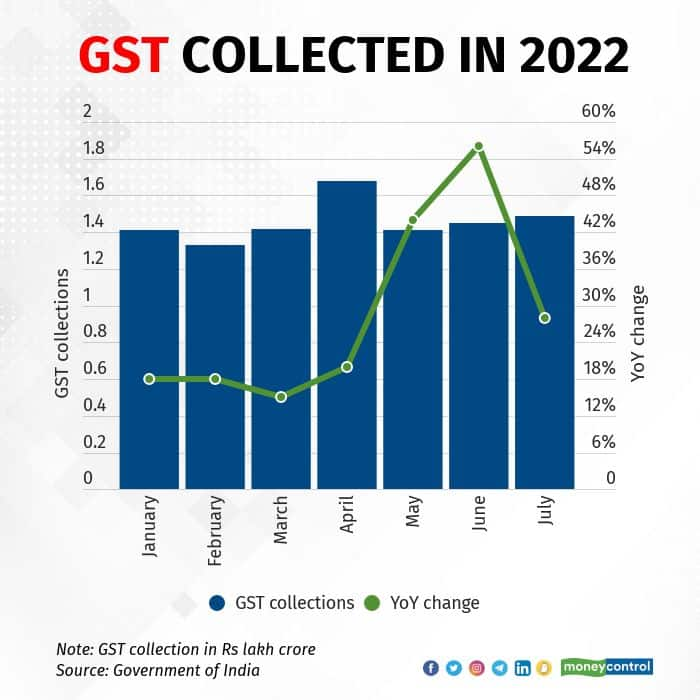

Overall, total GST collected in July was Rs 1.49 lakh crore, which took the average monthly collection for FY23 to Rs 1.51 lakh crore.

"The new normal of Rs 1.4 lakh crore seen during the past few months accompanied the fact that all major states have shown a growth in excess of 15 percent over the last year," noted MS Mani, a partner at Deloitte India.

This, according to Mani, indicated that economic activity had stabilised and leakages plugged, which should provide "some comfort to states which have just come out of the guaranteed compensation period and are concerned about their revenue mobilisation abilities".

According to Aditi Nayar, chief economist at ICRA, Central GST for FY23 may exceed the Budget target of Rs 6.6 lakh crore by Rs 1.15 lakh crore. If all states and UTs benefit similarly, the debate on compensation may end quickly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.