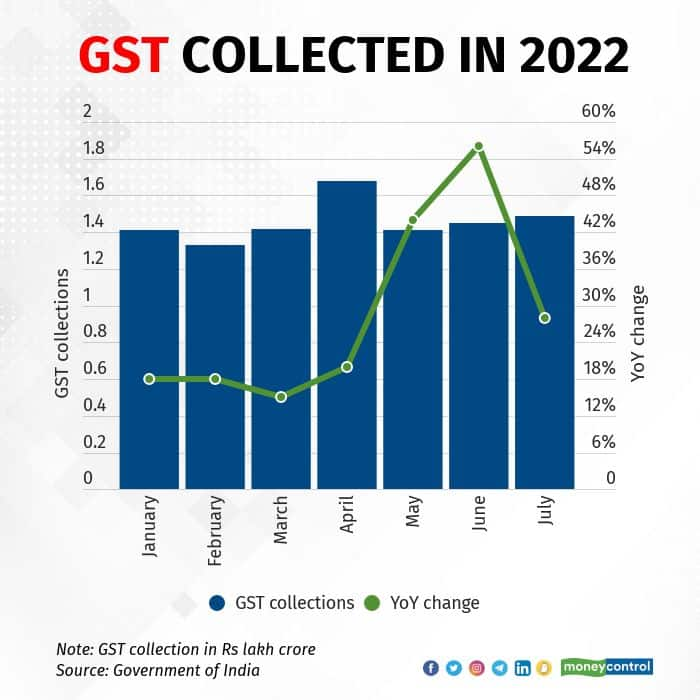

India collected Rs 1.49 lakh crore in Goods and Services Tax (GST) in July, posting an increase of 28 percent from the same month last year, the finance ministry said on August 1.

Compared to the money collected in June, the July GST mop-up was 3 percent higher.

"For five months in a row now, the monthly GST revenues have been more than Rs 1.4 lakh core, showing a steady increase every month," the finance ministry said in a statement.

Of the total GST collections, Central GST was Rs 25,751 crore, while State GST was Rs 32,807 crore. Integrated GST was Rs 79,518 crore and cess was Rs 10,920 crore.

The government settled Rs 32,365 crore to Central GST and Rs 26,774 crore to State GST from Integrated GST. As such, post settlement, the total revenue of the Centre and the States in July was Rs 58,116 crore and Rs 59,581 crore, respectively.

At Rs 1.49 lakh crore, the July GST mop-up is the new second-highest amount collected in a month, pipping the June number by 3 percent.

The highest-ever GST collected in a month is Rs 1.68 lakh crore and was achieved earlier this year in April.

So far this financial year, monthly GST collections have averaged Rs 1.51 lakh crore, 22 percent higher than the monthly average for FY22.

"Better reporting, coupled with economic recovery, has been having a positive impact on the GST revenues on a consistent basis. During the month of June 2022, 7.45 crore e-way bills were generated, which was marginally higher than 7.36 crore in May 2022," the finance ministry said.

In response to a question in the Lok Sabha, Minister of State for Finance Pankaj Chaudhary said on August 1 that the recent revision in GST rates "is expected to further boost government's revenue collections".

At its 47th meeting in late June, the GST Council approved certain rate changes to correct the inverted duty structure for some items and remove exemptions on others.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.