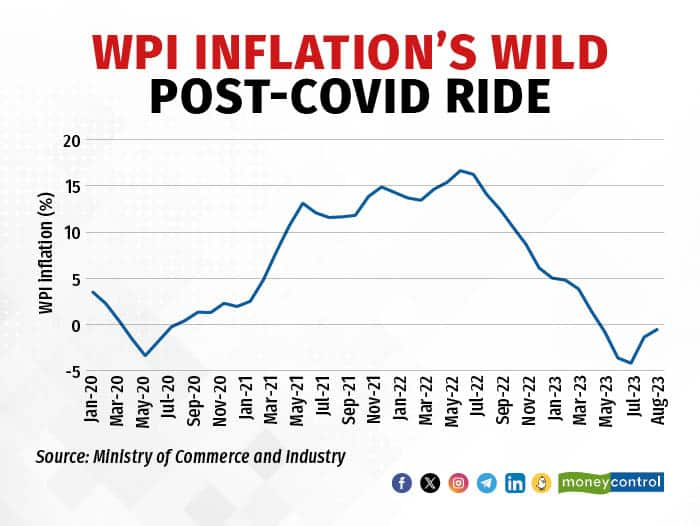

India's wholesale inflation likely rose above zero for the first time in six months in September thanks to an unfavourable base effect as well as a rise in domestic prices. According to the median of estimates of six economists, Wholesale Price Index (WPI) inflation may have jumped to 0.7 percent last month.

WPI inflation stood at -0.52 percent in August and 10.55 percent in September 2022.

Also Read: How a 10-year bond crashed and burnt out in just 8 monthsThe Ministry of Commerce and Industry will release wholesale inflation data for September on October 16.

One of the chief drivers of wholesale inflation in September was an unfavourable base effect, with the all-commodities index of the WPI having fallen by 0.8 percent month-on-month (MoM) in September 2022—the period that forms the base for the calculation of last month’s inflation figure.

An unfavourable base effect has been key in helping drive up WPI inflation from June's seven-and-a-half-year low of -4.12 percent—later revised to -4.18 percent—with the all-commodities index having fallen MoM in July 2022, August 2022, and September 2022.

| ORGANISATION | ESTIMATE FOR SEPTEMBER WPI INFLATION |

| Motilal Oswal Financial Services | 0.1% |

| Kotak Mahindra Bank | 0.53% |

| ICRA | 0.6% |

| L&T Finance | 0.78% |

| Nomura | 0.9% |

| India Ratings | 1.1% |

"Besides an unfavourable statistical base, a sharp surge in select domestic food prices and global energy prices in September appear to be the main contributory factors for this 'trend-reversal'," noted Rupa Rege Nitsure, group chief economist at L&T Finance.

Positivity is keyWhile it may seem counterintuitive, a rise in inflation—especially wholesale inflation—is necessary for the government.

While making the budget, the finance ministry assumes a number for nominal GDP growth for the year—10.5 percent, in the case of 2023-24. The difference in real and nominal growth is called the GDP deflator, which is a combination of wholesale and retail inflation, with the former accounting for a larger share.

WPI inflation has averaged -2.1 percent in April-August 2023 against 15.0 percent in the first five months of 2022-23, while headline retail inflation has averaged 5.5 percent in the first half of this year—down from 7.2 percent in the same period last year—and is expected to decline further in the coming months. As such, economists see the chance of nominal GDP growth in the current financial year falling below the budget assumption of 10.5 percent.

These calls have been somewhat backed by latest GDP data. While India's real GDP growth surged to a four-quarter high of 7.8 percent in April-June, nominal growth cooled to 8 percent, the lowest in nine quarters.

The last time India's nominal GDP grew at a slower pace was when it rose by just 6.3 percent in October-December 2020, the year that was hit the hardest by the coronavirus pandemic.

Also Read: Nominal growth could be 50 bps higher than Budget assumption, says Fin Min sourceThe nominal GDP growth assumed by the finance ministry in the budget determines estimates such as the fiscal deficit and growth in tax collections. If the actual nominal GDP growth exceeds what was assumed, it can provide greater room to meet the fiscal deficit target, expressed as a percentage of GDP. Similarly, lower nominal growth can make meeting the fiscal deficit target more difficult and can lead to weaker-than-projected growth in tax collections.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.