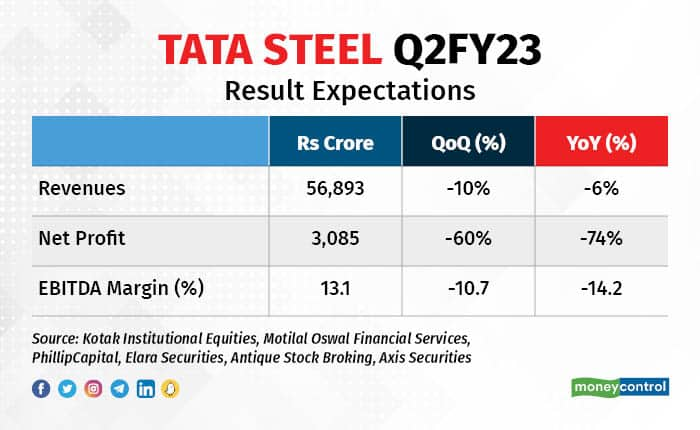

Tata Steel is expected to witness its consolidated profit after tax (PAT), for the quarter ended September 2022, plummet by a massive 70 percent on year when it declares its quarterly results on October 31. Compared to the preceding quarter, the fall is expected to be 60 percent.

At the same time, consolidated revenues are expected to decline 6 percent on-year and 10 percent quarter-on-quarter (QoQ).

According to a poll of brokerages conducted by Moneycontrol, the PAT for India’s largest steel producer is expected to be around Rs 3,000 crore, and consolidated revenues about Rs 56,900 crore.

The Tata group company had registered a consolidated PAT of Rs 11,918 crore for the corresponding quarter last year on revenues of Rs 60,283 crore.

The consolidated PAT for the previous quarter came in at Rs 7,765 crore, on revenues of Rs 63,430 crore.

It was a double whammy for the steel major as realisation moved southwards amid a global meltdown in commodity prices, even as the decline in volumes in Europe were negated by an increase in domestic volumes. But the jump in input costs severely dented the margins and profitability for the quarter.

Brokerage views

Production and deliveries

Per provisional data provided by the company, the steel production for the reported quarter stood at 7.51 metric tonnes (MT), down 3 percent year-on-year (YoY), and deliveries at 7.1 MT were down 4 percent compared to the year-ago period.

Tata Steel India's deliveries stood at 4.91 MT, up 7 percent YoY and up 18 percent QoQ post de-stocking by dealers in Q1FY23 due to falling steel prices. Deliveries at Tata Steel Europe were down 12 percent on-year as well as QoQ at 1.9 MT.

Realisation

The global meltdown in commodity prices, especially ferrous metals, is expected to result in a double-digit decline in steel prices for the quarter for Tata Steel. Additionally, the duty on exports hurt the industry as a whole.

“We estimate steel realisation to decline 16 percent QoQ (6 percent YoY), led by front-ended price cuts during the quarter,” said a report from the research firm Kotak Institutional Equities Research.

Revenue

The revenue is expected to be impacted by lower steel prices and lower sales in Europe, partially offset by higher sales volumes at the Indian operations.

EBITDA

The earnings before interest, taxes, depreciation and amortisation (EBITDA) is expected to fall sharply due to a lower top-line and higher raw material costs.

According to analysts at Axis Securities, “Raw material prices are likely to get inflated due to higher coking coal prices.”

Consequently, EBITDA margins are likely to contract both on a yearly basis as well as QoQ.

Experts expect the EBITDA/ton for the India business to decline 41 percent QoQ to Rs 12,566/ton, a YoY drop of 61 percent.

They estimate the Europe EBITDA/ton to be $106/ton, down 50 percent on-year and 71 percent sequentially due to lower prices and higher energy costs.

Focus areas

Investors may focus on the management’s guidance on Tata Steel’s European operations, and the impact of the depreciating GBP. The management’s guidance will also be important in relation to the impending transition to green steel in Europe, and how it aims to address the technology and financing issues for the same.

Analysts at the brokerage firm Motilal Oswal Financial Services await details on the revival of Neelachal Ispat Nigam Ltd (NINL), and timelines pertaining to the reopening of its iron ore mine and blast furnace.

Tata Steel closed Rs 2.6 lower at Rs 101.6 at The National Stock Exchange (NSE) on October 28. The stock has fallen ~22 percent over the past year, but has generated returns of ~7 percent over the past month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.