The Tata group’s consumer staples firm is set to report its earnings for the first quarter of the current fiscal year on July 30. The domestic tea, salts, and NourishCo products are set to outperform.

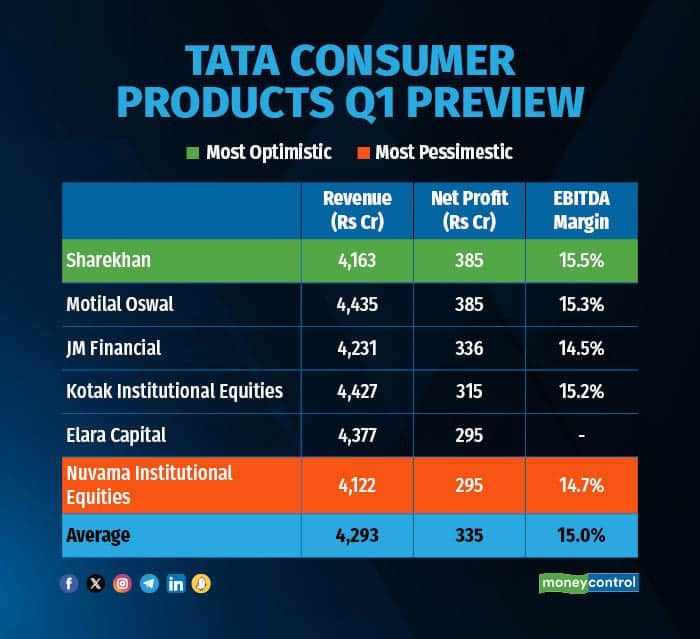

According to a Moneycontrol poll of six brokerages, Tata Consumer is likely to report revenue at Rs 4,293 crore, surging 14 percent on-year compared to Rs 3,741 in the June quarter of FY24.

Net profit is likely to come in at Rs 335 crore from Rs 321.8 crore from the corresponding quarter last year, higher by four percent.

There is a serious divergence in the earnings estimates of different analysts polled by Moneycontrol. The most optimistic estimate sees TCPL’s net profit jumping almost 20 percent on-year, but the most pessimistic projection suggests that net profit might sink 8.3 percent.

What factors are impacting the earnings?

Companies having summer-centric products, such as Tata Consumer, are expected to post better revenue growth compared to other FMCG companies, noted Sharekhan.

India Foods business: The segment is expected to grow 13 percent on-year with 9 percent volumes. The salt portfolio will clock volume growth of about seven percent on-year; salt has done well since pricing has now been completely absorbed and launches have done well. Tata Sampann is expected to turn in 30–35 percent YoY revenue growth, said Nuvama Institutional Equities.

International business: Stable volumes and pricing growth drive healthy growth in international business. The segment has done well and is expected to grow 11 percent on-year. The UK and Canada have seen strong volume growth and US Coffee has turned positive by volumes and sales both.

Margins: Kotak Institutional Equities predicted that consolidated GM will expand 445 bps on-year to 46.6 percent, aided by lagged impact of pricing interventions in international markets, softening RM costs, favorable commodity price movements (in non-branded business) and consolidation of margin-accretive acquisitions.

What to look out for in the quarterly show?

Analysts will closely monitor demand in metro areas and tier-3 towns. Tea and coffee prices are also key monitorables, as coffee prices surge to record highs. The impact of the raw material pricing on margins will be closely watched, as well as the growing competitive pressure from unorganized players.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.