Infrastructure, financials, energy and real estate companies led earnings growth for India Inc. during the December-quarter as the government’s capex cycle coupled with healthy margins boosted their Q3 numbers.

Within financials, large private sector banks benefitted from healthy loan demand even as the rising cost of funds weighed on their profitability. A contrasting trend was seen in consumer staples, where declining raw material inflation was offset by anemic volume growth, especially in the rural markets.

IT companies expectedly delivered weak numbers due to macroeconomic headwinds in the US and Europe, their biggest markets. The slowdown in discretionary spending and delays in deal conversions are expected to persist this year, according to analysts.

Also Read: For Indian IT, 2023 was one of the worst years since Global Financial Crisis

Hits and misses

“The 3QFY24 corporate earnings scorecard has been in line so far, with heavyweights such as HDFC Bank, Tata Steel, ICICI Bank, JSW Steel, and Reliance Industries driving the aggregate. The earnings spread has been decent, with 64 percent of our coverage universe either meeting or exceeding profit expectations. However, growth has primarily been led by the BFSI, metals, oil and gas, and auto sectors,” Motilal Oswal said in a recent note.

Global brokerage firm Jefferies noted that earnings upgrades were substantially more than downgrades.

Meaningful EPS upgrades were seen in energy public sector units, cement and pharma (generics), while notable cuts were seen in select companies such as Jubilant Foods, Laurus Labs, Tech Mahindra, Voltas, and life insurance players.

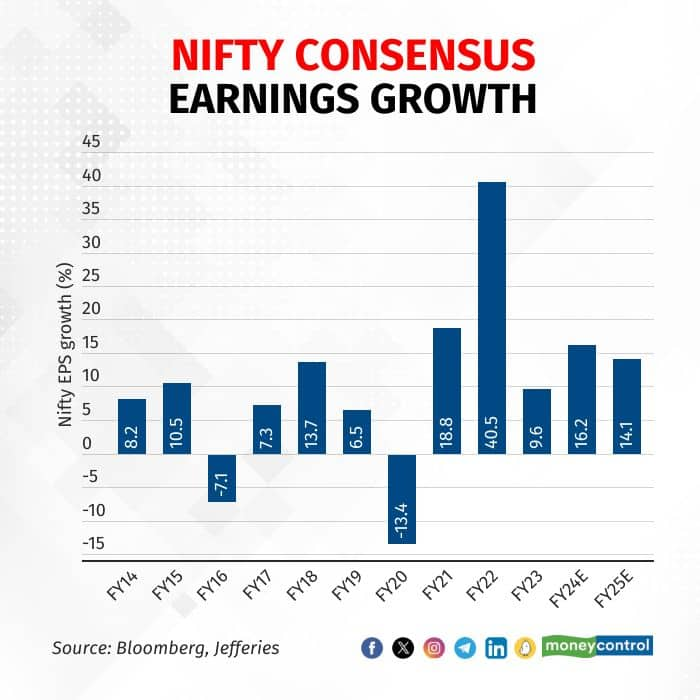

“Nifty consensus earnings for FY24/25 have seen earnings changes of -1.1 percent/-1.0 percent during the results season. Earnings growth at 16 percent/14 percent is built in for FY24/FY25,” Jefferies added.

Real estate companies reaped the benefits of strong pre-sales and firm demand. DLF and Macrotech Developers clocked a 25 percent on-year jump in PAT.

State-owned oil refining companies Indian Oil, Bharat Petroleum and Hindustan Petroleum had a standout quarter due to healthy marketing margins as a freeze on petrol and diesel prices despite a fall in input crude oil prices helped recover losses incurred when rates were high in 2022-23.

The great divide

A key trend that emerged from the Q3 show was the K-shaped recovery in the economy – robust demand in urban markets but continuing sluggishness in rural India.

Case in point – the contrasting fortunes of India’s biggest car company and biggest FMCG firm.

Maruti Suzuki posted a 33 percent on-year jump in Q3 net profit to Rs 3,130 crore, blowing past estimates of about Rs 2,800 crore. Revenue increased 15 percent to Rs 33,309.7 crore amid strong sales of utility vehicles, which eclipsed entry-level cars as the biggest growth driver for domestic automakers.

“The small car segment continued to remain muted and passenger vehicles sales volumes fell 16 percent YoY. Aided by a strong SUV lineup, the company’s market share in the SUV segment improved to ~21 percent,” analysts at Geojit said.

Hindustan Unilever, on the other hand, clocked standalone net profit growth of 0.55 percent y-o-y to Rs 2,519 crore, while revenue dipped 0.38 percent to Rs 14,928 crore.

Analyst call tracker: HUL, Asian Paints among struggling giants in consumption space

At its post-earnings call, the management said the Q3 demand trend was similar to that in Q2, with urban growing ahead of rural. It plans more premium product launches, which is growing 2.5x its mass portfolio.

“Due to lower agriculture yields and uncertainty of future crop outputs, rural consumer sentiment remains subdued. Consequently, the anticipated buoyancy from the festive season did not materialise. The dualism we've seen in the recent past continues, with certain parts of the market recovering faster than the rest,” Hindustan Unilever MD Rohit Jawa said on the earnings call.

Other consumer staples companies witnessed a similar trend. Biscuit maker Britannia Industries said the rural area remains a concern, and its strategy will be focused on driving market share gains.

“We expect earnings growth to be lower due to moderate volume growth (low-to-mid single digits) given the prolonged delay in rural recovery and an increase in competitive intensity from regional/unorganised players,” analysts at Nomura noted.

While the December quarter delivered margin expansion due to softer raw material prices, consumption companies’ short-term outlook is more dependent on premiumisation than rural demand recovery, analysts said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.