Ruchi Agrawal

Moneycontrol Research

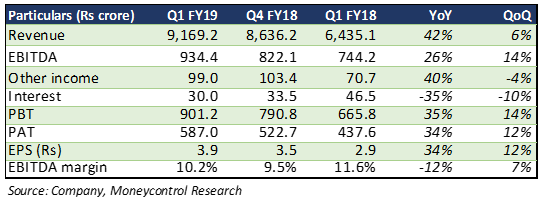

Petronet LNG (PLNG) reported a healthy set of Q1 numbers, with a 42 percent year-on-year (YoY) increase in revenue, led by higher volumes at the Dahej terminal due to increased downstream demand and closure of Dabhol terminal on account of the monsoon. Earnings before interest, tax, depreciation, and amortisation (EBITDA) grew 26 percent YoY. The company was able to usher in substantial reduction in interest cost and other expenses sequentially.

Result snapshot

Strong volumes drive growth

The company reported a 15 percent YoY growth in volumes to 220.2 trillion British thermal units (tBTU). Of this, 214 tBTU was from the Dahej terminal, where capacity utilisation stood at 111 percent. Kochi terminal volumes stood around 6 tBTU and utilisation at 10 percent, which was a slight improvement YoY and sequentially.

Kochi terminal utilisation expected to improve

After several hiccups in the past months for installation and commissioning of the Kochi-Mangalore pipeline, progress seems to be on track now and is scheduled to be completed by Q4 FY19. Demand and utilisation from the Kochi terminal is highly dependent on this pipeline, which would provide strong connectivity. Volumes are expected to grow substantially after the pipeline work is complete. We expected significant economies of scale, which would help improve margin. We expect some time lag between pipeline completion and actual ramping up of volumes.

Capacity expansion to drive growth

The company is expanding capacity at its Dahej facility to 17.5 million tonne per annum (mtpa) from 15 mtpa, which would get completed between March and June next year. Given the deficit supply situation in the market, the management is confident that additional capacity would be fully booked and plans to expand capacity by 2.5 mtpa after the first round of expansion.

International expansion on cards

The management has been eyeing expansion in the international arena for quite a while, with talks of expansion in Bangladesh, Sri Lanka and Qatar. In Bangladesh, the company is in the final approval phase and its expansion plans seem on track. Capex outlay for the 7.5 million tonne capacity Bangladesh land‐based terminal is around $100 million.

The Sri Lankan expansion is subject to many approvals and would take time before it comes on stream. The company is studying feasibility of setting up a floating storage regasification unit (FSRU) at a cost of around $300 million. The Sri Lankan terminal (around 2.5-3 MT) is planned to be set up in a consortium with Japan’s Mitsubishi and Sojitz Corporation (37.5 percent each) and the Sri Lankan government (15 percent). The expansion at Qatar is uncertain, with no visibility on timelines.

Threat from competition

Threat to Dahej volumes with the commissioning of a new 5 MT terminal in Mundra (owned by Gujarat State Petronet and Adani Group) has been doing rounds for the past few months. However, the management mitigated concerns saying: 1) Operations at Mundra are not expected to begin until March; 2) Regas tariffs at Dahej are very competitive and it still remains the preferred terminal; 3) The terminal is already operating at over 100 percent utilisation, with immense demand in the market to absorb additional capacity.

Expansion through the CGD route

The company has submitted bids for seven regions (all in Southern India) in the latest city gas distribution (CGD) bidding round. The company expects incremental demand of 1 mtpa if it is awarded these regions. An additional capex of around Rs 6,700 crore is expected in the next 8 years, if they are awarded all seven regions. This huge capex could be a cause for concern and might impact profitability in the initial phase. Incremental demand stands to benefit from the underutilised Kochi terminal. Downstream integration would also stand to be beneficial in the longer run.

Outlook

We see bright prospects for the regasification business as gas demand is expected to ramp up and owing to limited growth in domestic production. Despite increasing competition in coming years, the company’s capacity remains fully tied up, majority of which is with long term contracts. With capacity expansion on cards, we see higher volumes and cost benefits. The stock is trading 18 percent below its 52-week high at FY19e price-to-earnings of 14.7 times. With continued shortage of LNG domestically and capacity expected to boost future volume, we see the stock as a steady long term performer.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!