India’s largest passenger vehicle player, Maruti Suzuki India Limited, is expected to post healthy revenue and net profit growth in the December quarter, on the back of a favourable product mix and improved volumes.

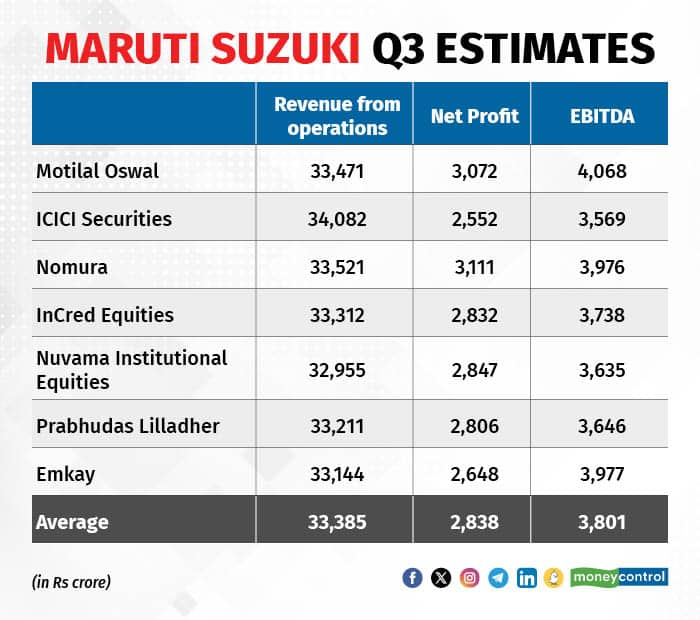

The 4-wheeler major’s profit is expected to increase 21 percent on-year to Rs 2,838 crore for October to December quarter, according to an average of seven brokerage firms’ estimates. Its revenue from operations is projected to rise 15 percent on-year to Rs 33,385 crore, estimates suggest. The company clocked a profit after tax of Rs 2,351.3 crore during the same period last year.

Follow our market blog for all the live action

At 1:30 pm, the counter was training at Rs 10,007, up 0.2 percent from the previous close on the NSE. In the last year, the stock has given a return over 13.5 percent, lagging the Nifty which gave a return of 21 percent during the same period.

Analysts suggest that the revenue growth would be aided by an improvement in volumes and a higher realisation of 6.3 percent YoY due to price hikes and a richer product mix for the company.

This, in turn, could give a boost to the Wagon-R makers’ earnings before interest, tax, depreciation and amortisation (EBITDA), which is expected to increase 34 percent on-year to Rs 3,801 crore. It reported an EBITDA of Rs 2,833 crore during the corresponding quarter of the previous year.

However, on a quarter-on-quarter basis, the EBITDA margin is expected to decline about 100 basis points to 11.9 percent largely due to higher discounts and weak operating leverage.

“Going ahead, factors such as a superior product mix due to a higher share of utility vehicles, operating leverage due to normalised semiconductor availability, and cost optimisation are likely to continue”, KRChoksey said in a recent note on the company.

Analysts at Nuvama Institutional Equities suggest that the company’s passenger vehicle segment will grow by 13 percent on-year. On the other hand, Mahindra and Mahindra have outpaced the industry with a passenger vehicle revenue growth of 26 percent YoY for MM’s auto division. “Japanese Yen’s depreciation against the INR is also a positive for the company”, it stated in a report.

Maruti reported a 1.28 percent decline in total sales at 1,37,551 units in December 2023. The company had posted total sales of 1,39,347 units in the same month a year ago.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.