Consumer staples companies have largely met Street expectations in the current earnings season, though a granular look at the numbers reveals some stress points in the sector.

Companies managements and analysts have been flagging near-term challenges facing the organised FMCG segment for quite some time and many of these concerns are clearly there to see in the September quarter numbers.

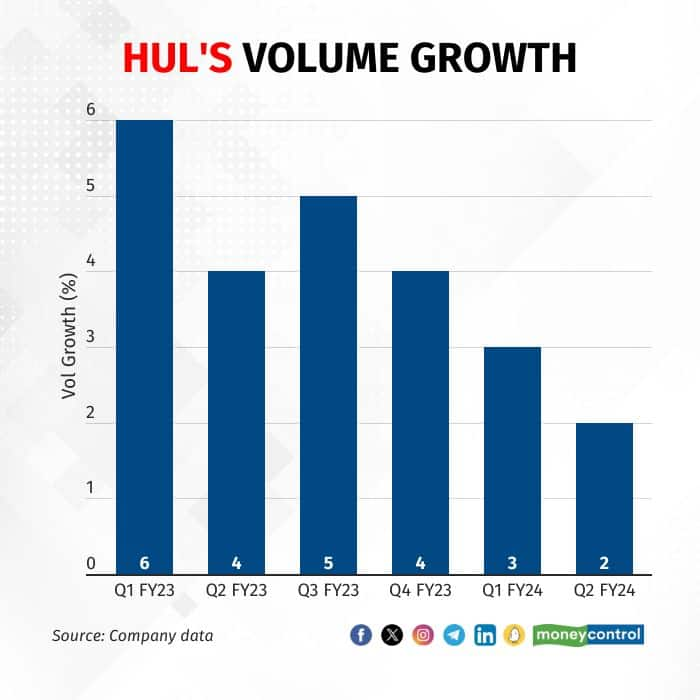

India’s largest FMCG firm Hindustan Unilever — considered a proxy for the broader consumer trends in the country — raised a huge red flag at the start of the earnings season after it reported an anaemic volume growth of just 2 percent in the September quarter.

“Volume growth recovery was below expectations due to subdued rural performance and increased competitive intensity from small players in select categories,” analysts at ICICI Securities said.

Also read: HSBC says HUL 'five-year market laggard' now, downgrades to HoldHUL CEO and MD Rohit Jawa, too, highlighted the rural-urban imbalance in demand recovery.

“Urban and within that modern trade and large packs are leading growth for the FMCG market. On the other hand, rural demand remained subdued, with volumes continuing to decline marginally on a two-year basis,” he said during HUL’s earnings call.

The company’s management also said the full benefit of product price cuts was yet to be reflected, given the high-priced inventory (both channel and household).

The fact that lower product prices are yet to induce customers to consume more partly reflects a tough macro environment, analysts at Jefferies said.

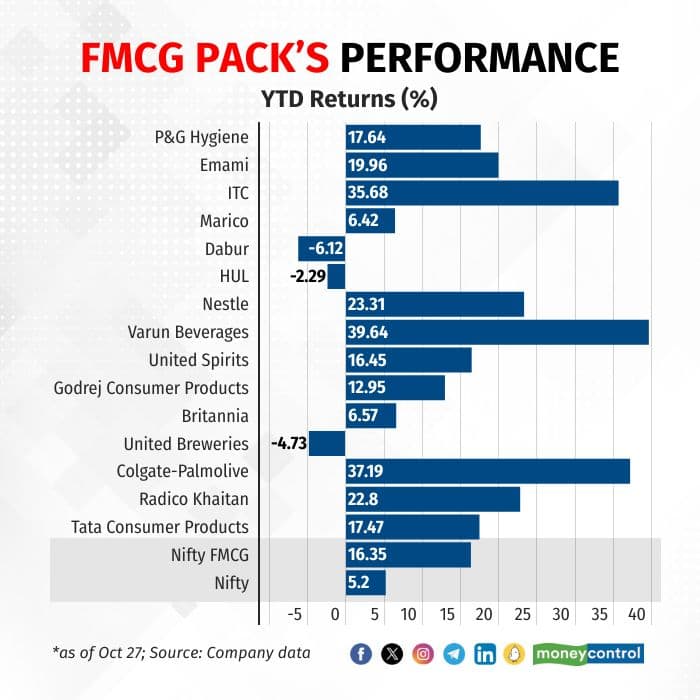

This is not to say the problem is limited to just HUL.

Colgate-Palmolive’s Q2 volumes were flat against analysts’ expectations of mid-single-digit growth.

Nestle India, too, had a weaker-than-expected topline trajectory, with domestic revenue growth slowing to 10 percent YoY compared to 15 percent in the previous quarter and more than 20 percent in Q1 CY2023.

Also read: Nestle India’s rural play: Teaching customers to drink coffee, augmenting distributionAs per Jefferies' calculations, even this 10 percent revenue growth was price-led, with the underlying volume mix at just 3 -4 percent, similar to the previous quarter but weaker than historic trends of high-single digits.

Win Some, Lose SomeThey say no good deed goes unpunished. Tweaking this aphorism for the FMCG market — no good news is without some negative consequences.

Take raw material prices.

While the topline growth was muted for FMCG firms across the board, cooling commodity prices led to a hefty jump in their gross margins (280 basis points QoQ for HUL, 180 bps for Nestle and 40 bps for Colgate).

One basis point is one-hundredth of a percentage point.

But lower raw material costs had an unintended consequence – the re-entry of many smaller and regional brands.

Regional brands have been eating away the market share of the listed players for the some time now. However, the Covid pandemic and subsequent disruptions in the supply chain forced many of these smaller players out of the reckoning.

But with input price inflation declining and many consumers prioritising affordability, the regional brands are giving a tough fight to the industry giants.

“The FMCG market continues to witness heightened competitive intensity. As we spoke during June quarter results, we are seeing the resurgence of small and regional players in select categories and price-points, many of whom had vacated the market during the peak of inflation. For instance, when you look at tea or detergent bars, smaller players are growing significantly ahead of large players,” HUL’s Jawa said.

The price of palm oil, a key ingredient for FMCG products like soap, has fallen more than 33 percent from a year back. Crude oil, a raw material for detergents, is also trading at less than $90 a barrel compared to a high of $112 last year.

The rising competition has fanned another headwind for FMCG players – rising advertising spends.

In a note on HUL, ICICI Securities said while raw material cost pressure continued to decline meaningfully for most of the commodities except milk, coffee and barley, leading to gross margin expanding by 690 bps YoY to 52.7 percent, “these benefits have been re-invested towards higher advertising and promotion spends… due to increased media intensity and to support new product launches.”

HUL’s advertising and promotion (A&P) spends vaulted 65 percent YoY in the September quarter.

Similarly, ITC, too, said that competition from regional players was up as commodity prices eased and it stepped up investments in marketing.

Road AheadManagements have exuded confidence that volumes will recover and the domestic FMCG industry has a long runway for growth.

“India’s per capita FMCG consumption when compared to other similar economies is significantly low and within that rural is highly under indexed,” Jawa said.

Penetration levels for many of HUL’s large categories were still very low. Premiumisation would accelerate as India becomes becomes more affluent and more urban. “The more affluent population is expected to double by 2027, naturally their per capita FMCG consumption is much higher at about 1.5 to 2 times compared to the national average,” the HUL chief executive added.

For the near term though, raw material prices will be the key monitorable.

“Uneven rain and rain deficit is expected to impact production of maize, sugar, oilseeds and spices that may have an adverse impact on pricing. Coffee continues to be volatile because of the global supply deficit.

"The weather during the harvest of Indian robusta crop may impact production. Upcoming winter weather may impact wheat production. Healthy milk flush is expected in winter which is expected to keep prices stable,” Nestle India said in its earnings statement.

Companies are also relying on innovative product launches (like millet-based items) and expanding distribution networks to achieve accelerated growth.

But for some players, including the industry bellwether, the road to recovery is expected to be long and tortuous. “We expect HUL to see weak earnings growth in the near term, as volume growth recovery is gradual, price growth comes off, and margin recovery is capped by a ramp-up in ad-spends and higher competition,” Jefferies said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.