HSBC has downgraded its rating on Hindustan Unilever Limited (HUL) to "Hold" and reduced the target price from Rs 2,950 to Rs 2,700 per share. HUL has been a five-year market laggard now, in part due to unwinding of a significant past re-rating phase, HSBC said.

HSBC's target price indicates 8.6 percent upside from HUL's last closing price of Rs 2,486 on the NSE. Over the past five years, HUL share price has appreciated by 59 percent while other consumer staple stocks such as Britannia and Nestle have given higher returns.

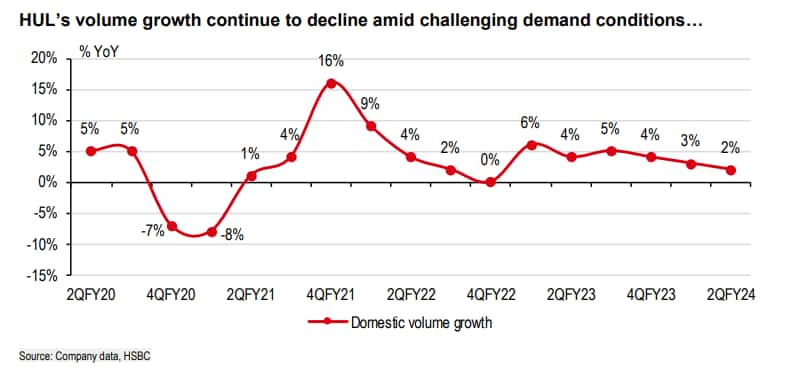

Its lackluster performance in the second quarter of the year has further contributed to its struggles, and the weakness continues to persist in its portfolio. HSBC sees limited upside potential for HUL unless there is a significant shift towards risk-averse market sentiment.

Follow our live blog for all the market action

Why HSBC sees limited upside?

HUL's price-to-earnings ratio jumped from 40x in 2017 to 60x, which is now unwinding. "Growth has come down and structural margin expansion prospects have waned. Hence, this de-rating phase will persist," wrote HSBC analyst Amit Sachdeva.

With increased competition from regional and local players, India's largest fast-moving consumer goods (FMCG) company HUL is also witnessing market share loss in the mass end of the segment.

"The number of local players that have come in the market have just increased. In tea, small players' market value has grown 1.4 times that of large players. In detergent, small players' market value has grown 6 times that of large players," said Rohit Jawa, Chief Executive Officer of Hindustan Unilever after Q2 FY24 earnings.

To this, chief financial officer Ritesh Tiwari added that they are passing on the benefit of declining raw material costs largely by cutting prices on its packs, rather than increasing grammage.

"Homecare’s growth, which steered HUL’s overall performance until now, has peaked due to a high base and rising competition from local/regional companies and is creating a growth overhang," said HSBC.

Meanwhile, foods growth hasn’t been encouraging for many quarters, and beauty and personal care segment has its own challenges, added Amit Sachdeva.

Q2 results

HUL, on October 19, reported a standalone net profit of Rs 2,717 crore for the September quarter, up 3.86 percent from the year-ago period. Underlying volume growth came in at 2 percent.

Also Read: HUL Q2 results: Earnings beat street estimates; net profit up 3.86% on-year

Analysts had expected price cuts, royalty payments and ad spends to weigh on profits. Brokerages had flagged tepid rural demand as consumers grappled with inflationary pressures.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.