Indian benchmark indices are trading positively, with Nifty around the psychological mark of 23,000 amid volatility.

Option writers are positioned for calls at 24,000 and 23,500, and for puts at 23,000 and 22,500. According to experts, the approximate weekly range based on ATM pricing of Nifty is 22,700-23,700.

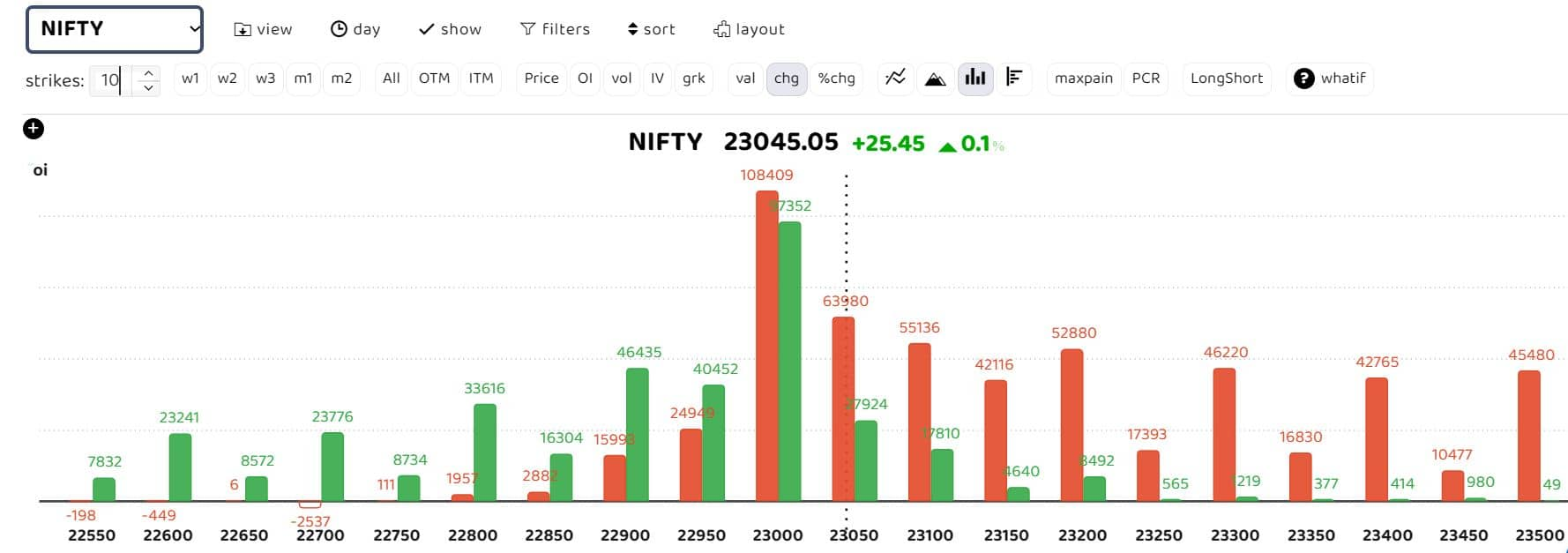

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing seen across 22,350 to 23,500 levels. According to Akshay Bhagwat, Senior Vice President of Derivative Research at JM Financial, "Option writers are positioned in call options at 24,000 and 23,500, and in put options at 23,000 and 22,500. Major open interest additions were noted at the 24,000 call strikes and in put at 23,000. The approximate weekly range based on ATM pricing is 22,700-23,700."

"Actionable levels are: positive with buy view above 22,800, neutral in the 22,600-22,800 zone, and weak below 22,575. The daily view indicates a positive outlook while above 22,800, with targets at 23,125/23,200, and support levels in case of dips at 22,900 (support 1) and 22,800 (support 2), " he added.

Bank Nifty

JM Financial: The derivatives and technical parameters indicate a positive setup for Bank Nifty to test 49,500 in the short term and likely to test 50,000 in the coming fortnight. In the case of price retracements, immediate supports stand at 48,540 and 48,222, with a strong support base at 48,000, which is unlikely to be breached anytime soon. The weekly range is 48,000-49,500/50,000.

Also read: Option strategy of the day| Maruti makes higher high and higher lows formation

Trading Approach Recommended by JM Financial:

- Buy on dips in two tranches at 48,500 and 48,200

- Target: 49,500/50,000

- Stop Loss: 48,000 on a closing basis or 47,850 for intraday swings.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!