New Delhi-headquartered Eicher Motors Limited is set to release its earnings report for the first quarter of FY26 on July 31. Analysts expect a solid pickup in revenue on strong volumes and price hikes undertaken by the company. However, margins are expected to witness a sharp decline during the quarter.

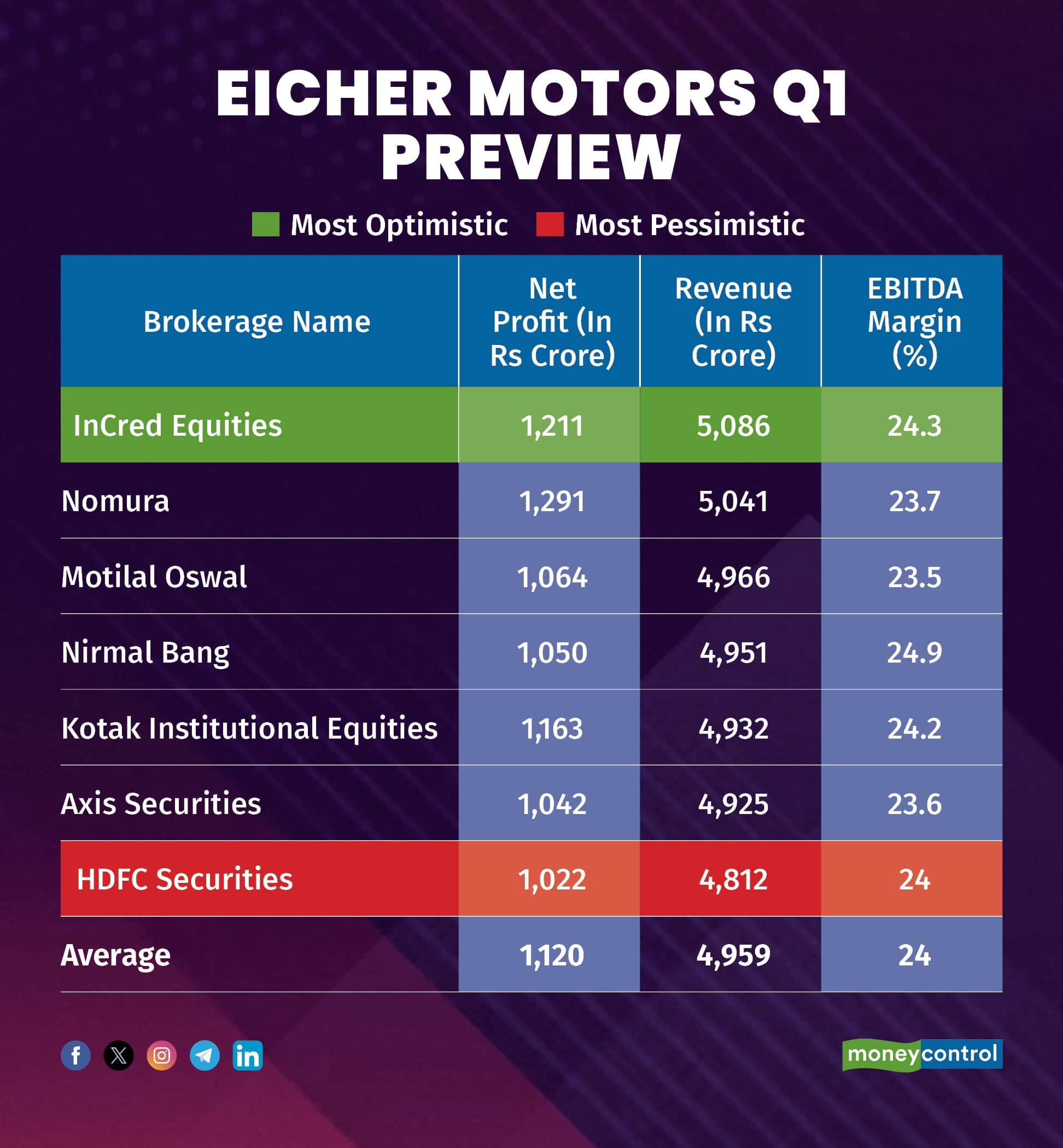

According to a Moneycontrol poll of seven brokerage firms, the Royal Enfield-maker is anticipated to record a 17.2 percent year-on-year increase in revenue, reaching Rs 4,959 crore. Net profit is projected to rise 3 percent to Rs 1,120 crore from Rs 1,088 crore in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price.

What factors could affect Eicher Motors' earnings?

Strong volumes: The company registered a 17 percent increase in volumes to 2.65 lakh vehicles, compared with 2.26 lakh units sold in the same quarter of the previous year.

EBITDA contraction: The EBITDA margin is expected to decline by nearly 400 basis points year-on-year during the quarter. Margins are expected to be weighed down by elevated marketing expenses and costs associated with new product launches, partly offset by operating leverage benefits.

Commodity Pressures Persist: The company is likely to gain from price hikes taken over the past year and an increasing share of exports. However, persistent commodity inflation continues to drive up input costs, potentially limiting the full benefit to margins.

What to look out for in the quarterly show?

Investors will be keen to understand retail demand trends and the actual impact of marketing spends on sales performance. Commentary on the outlook for international markets will also be closely tracked. Guidance on FY26 production plans, along with management’s view on commodity cost headwinds or tailwinds during the quarter, will be important. Additionally, the market will look for updates on upcoming model launches.

Eicher Motors' stock price was trading at Rs 5,459, higher by 1.4 percent from the last close on the NSE. Eicher Motors shares have risen 13 percent since the beginning of the year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!