Bajaj Finance, India's largest non-banking lender, is on April 25 expected to announce a robust set of fiscal forth quarter earnings, driven by growth in assets under management (AUM).

Analysts predict a 22 percent year-on-year jump in net profit, led by credit growth but caution that higher cost of funds could dampen the margin outlook.

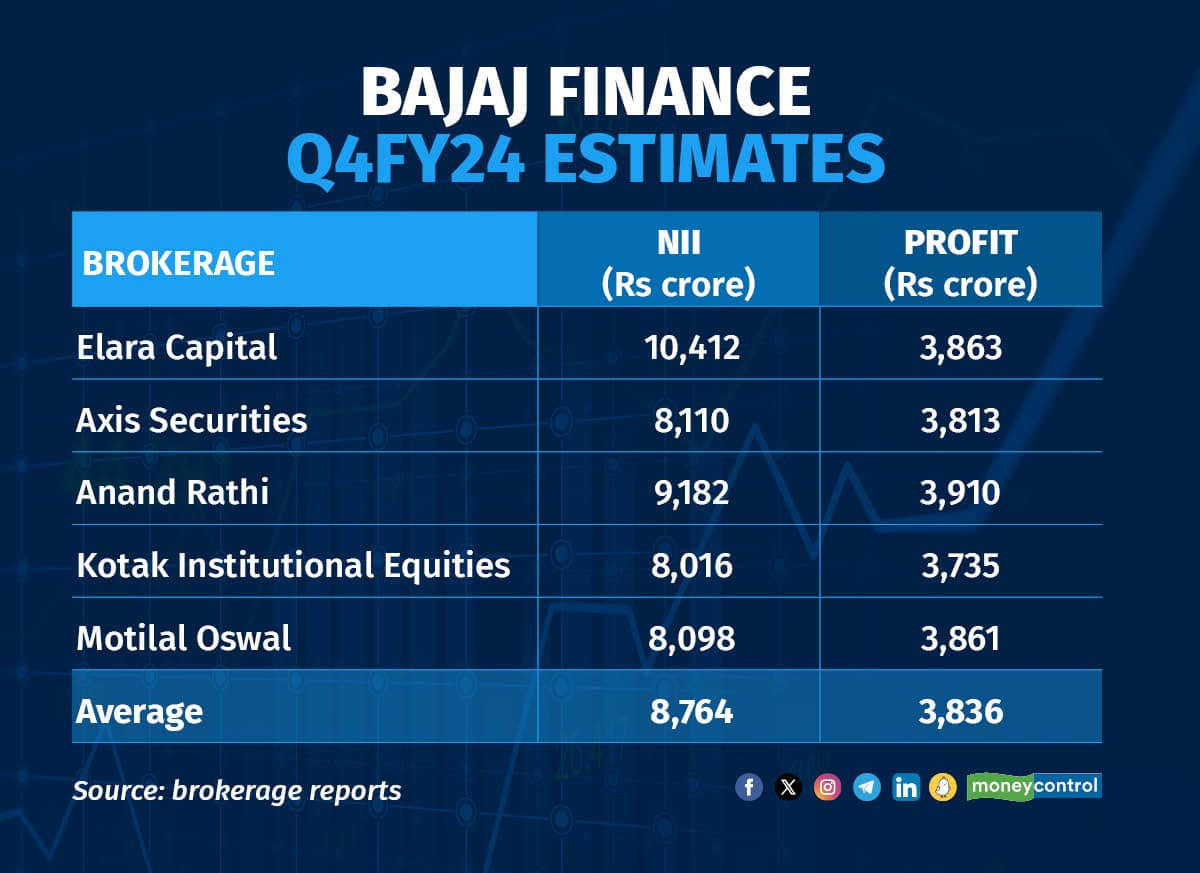

According to an average estimate of five brokerages, Bajaj Finance's net profit is likely to rise 22 percent to Rs 3,836 crore in Q4FY24 from the year-ago period.

Net interest income (NII), the difference between the income the bank earned from its lending activities and the interest paid to depositors, is expected to climb 40 percent to Rs 8,764 crore.

Healthy AUM growth to bolster Q4 profitability

Strong credit offtake is expected to drive Bajaj Finance's AUM growth. This would result in higher net income, and higher net profit, analysts said.

ALSO READ: Buy Bajaj Finance; target of Rs 9000: Emkay Global Financial

In its Q4 business update, Bajaj Finance reported a 34 percent YoY growth in AUM to Rs 3.3 lakh crore, surpassing its revised FY24E growth guidance of 29-31 percent.

New loans booked were up 4 percent, while customer franchises saw a 21 percent YoY growth.

Rising cost of funds to spoil Bajaj Finance's margin profile

Analysts cautioned that the rising cost of funds could impact Bajaj Finance's margin performance. An increase in the cost of funds could translate to higher borrowing costs for the lender.

Kotak Institutional Equities analysts anticipate a 47 basis points (bps) YoY contraction in net interest margin (NIM) to 10 percent.

One basis point in one-hundredth of a percentage point.

ALSO READ: Bajaj Finance arm Bajaj Housing Finance picks Kotak, Axis, BofA, JM Fin and SBI Caps for mega IPO

"We model a moderate increase in credit costs to 1.8 percent for Q4FY24 (1.4-1.6 percent in the previous four quarters) as guided by management in the last earnings call," the brokerage said.

Investors will also closely monitor the management's commentary on the sustainability of growth momentum and the expansion of new products.

Stock up 7% in a month, limited upside likely

The Bajaj Finance stock has surged more than 7 percent in the past month, outpacing the 1.5 percent rise in the benchmark Nifty 50.

Valuation-wise, the stock is trading at 4.1x of FY26F BVPS and upside is limited, analysts at Nomura said.

"At this valuation, we await more clarity around subjects like regulatory concerns (ban on eCOM/Insta EMI Card, concerns on unsecured loans), potential management transition, listing of its housing finance subsidiary," they said. They have a "neutral" call on the counter, with a target price of 7,500 a share.

On April 24, the stock closed at Rs 7,317.15 on the National Stock Exchange, up 0.79 percent from the previous close.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!