Healthcare services major Apollo Hospitals Enterprise is all set to release its July-September numbers on November 6. The company is expected to increase its net profit by more than half, aided by improved average revenue per occupied bed (ARPOB) and reduced losses at its digital Apollo 24/7 arm.

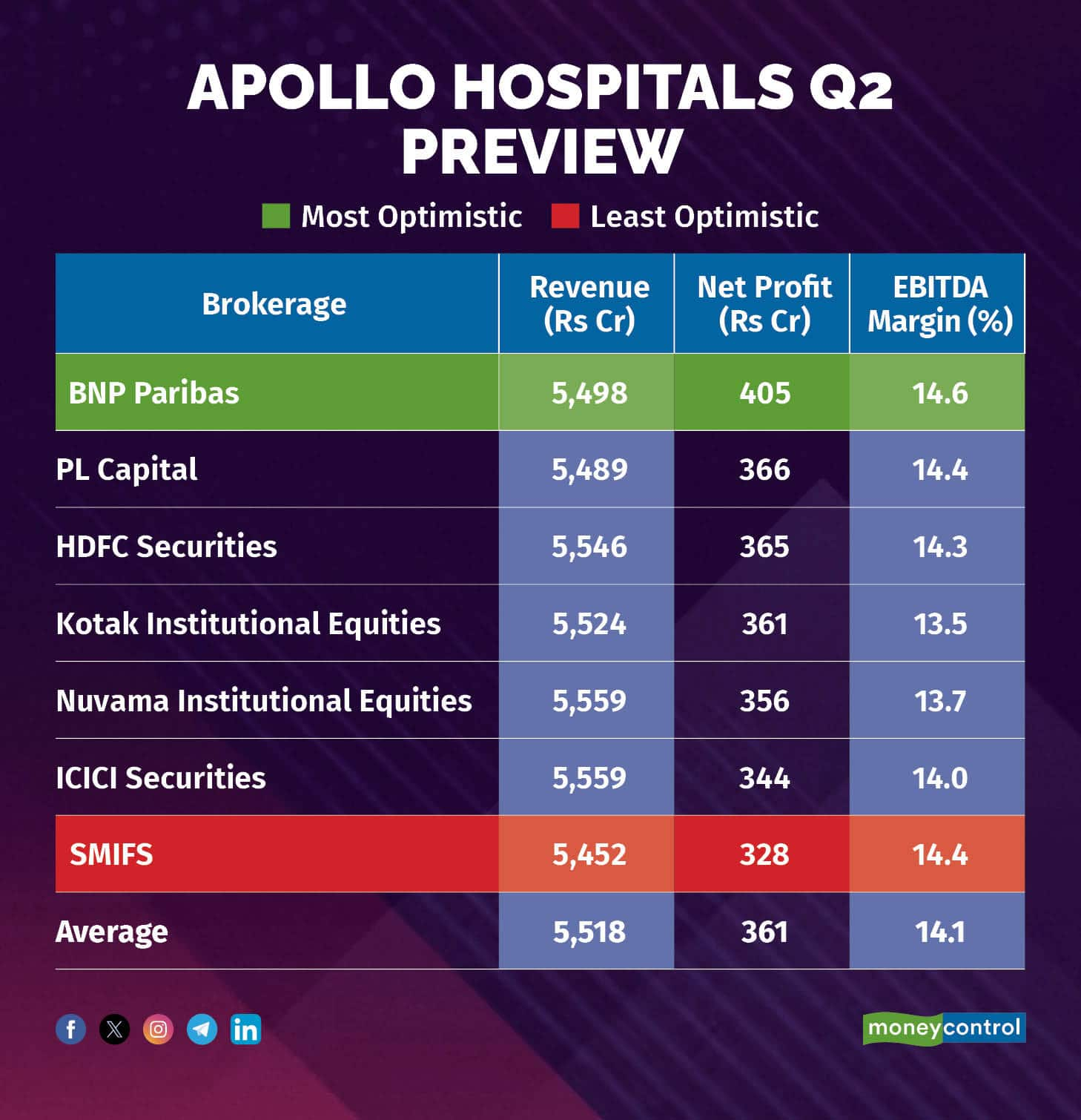

According to a Moneycontrol poll of seven brokerages, Apollo Hospitals' net profit is expected to surge close to 55 percent to Rs 361 crore in the July-September quarter, up from Rs 233 crore reported in the same period last fiscal. Revenue is also pegged to grow nearly 14 percent to Rs 5,518 crore in Q2 of FY25, compared to Rs 4,847 crore in the corresponding quarter last year.

Operational performance is also likely to see a sizeable improvement, as forecasts suggest the EBITDA margin for Q2 will reach 14.14 percent, expanding from 12.9 percent in the same quarter of the previous fiscal.

Earnings forecasts from analysts polled by Moneycontrol vary within a range of 33 percent, with the most optimistic estimate from BNP Paribas predicting a steep 73 percent surge in Apollo Hospitals' net profit. On the other hand, the most cautious outlook from SMIFS projects a nearly 41 percent increase in net profit for the company. However, a common thread in earnings forecasts for Apollo Hospitals is that brokerages across the board foresee strong bottom-line growth in the quarter under review.

What factors are impacting the earnings?

Apollo Hospitals is set to deliver strong growth in the September quarter, led by an improvement in its ARPOBs due to a change in payor mix, double-digit growth in its flagship hospitals business, and reduced expenses at its Apollo 24/7 arm.

Improved ARPOBs: Along with steady occupancy levels of around 68 percent, the company is expected to witness an increase in its ARPOBs, which will support bottom-line growth. Estimates from Nuvama Institutional Equities suggest that Apollo's ARPOBs are likely to grow 6 percent year-over-year to Rs 61,007. On a sequential basis, this reflects a 3 percent growth.

Steady hospitals business: Benefiting from favorable seasonality, Apollo's flagship hospitals business is likely to report healthy mid-teens year-over-year growth. Nuvama expects this growth to be driven by a mix of healthy volumes and ARPOB improvement.

Reduced 24/7 losses: SMIFS expects sales for Apollo HealthCo, which houses Apollo's 24/7 business, to grow 14 percent year-over-year, driven by growth in pharmacy distribution sales due to store expansion, as well as traction in 24/7. Meanwhile, brokerages anticipate Apollo 24/7's losses to remain stable at around Rs 125 crore—flat on a quarterly basis but lower on a year-over-year basis—contributing to the company's overall margin expansion.

What to look out for in the quarterly show?

Analysts will closely watch for updates on Apollo's plans for bed additions and new hospitals. In addition, the company's guidance for occupancy levels in the coming quarters will be on the radar. Any outlook from the company regarding the expected breakeven of newly added beds will also be in focus.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.