Reliance Industries Ltd is expected to report robust earnings growth in the September quarter (Q2 FY26) on improved refining margins and sustained growth in its consumer businesses, Reliance Retail and Jio.

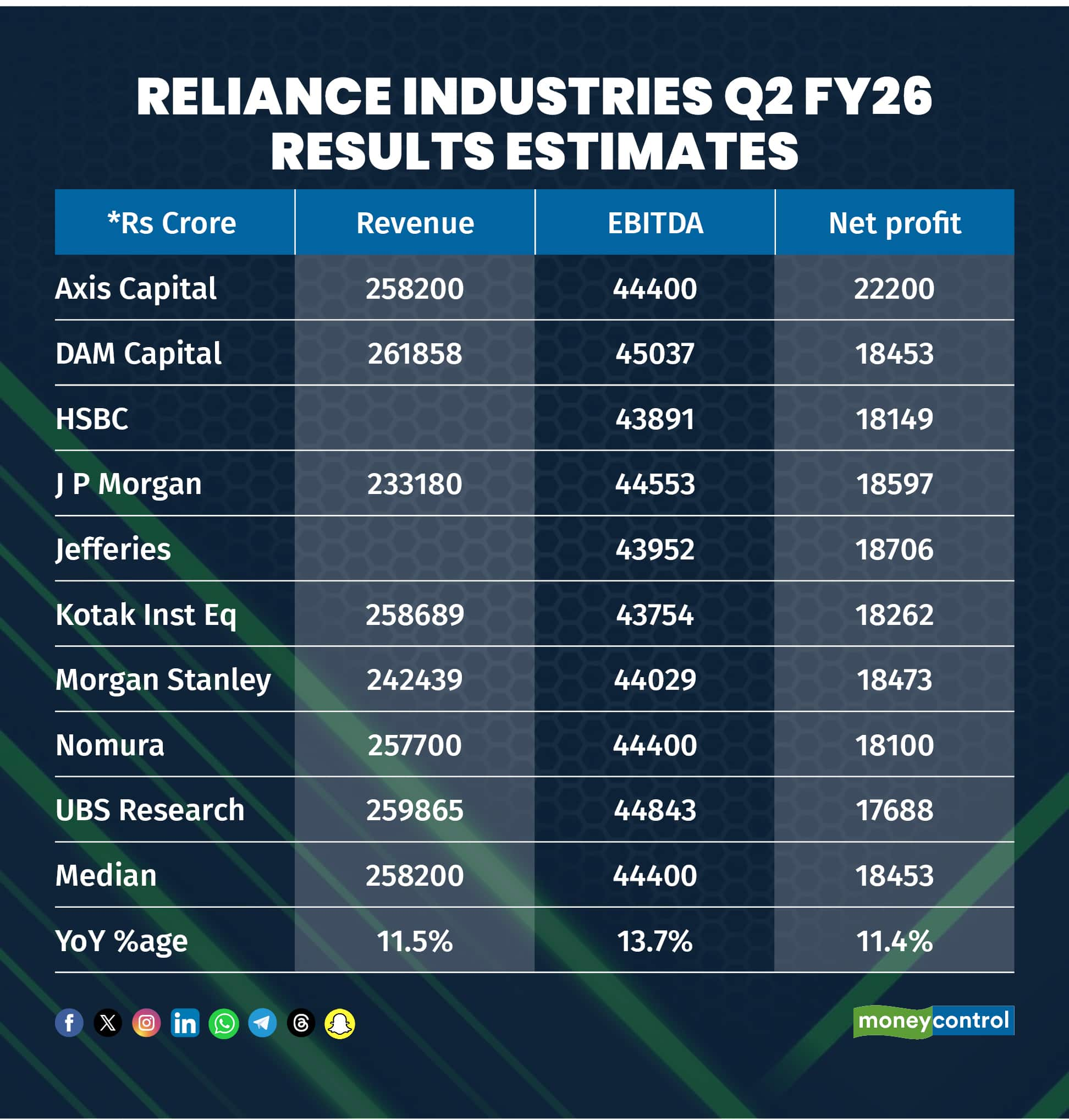

Net profit is expected to rise 11 percent from a year earlier to about Rs 18,450 crore for the September quarter, according to the median of nine analysts' estimates. RIL's consolidated EBITDA is seen climbing 14 percent to Rs 44,400 crore, supported by gains in the oil-to-chemicals, retail, and digital services businesses.

Reliance Industries Q2 FY26 Results Estimates

Reliance Industries Q2 FY26 Results Estimates

Axis Capital and UBS expect Reliance’s O2C EBITDA to grow over 20 percent YoY, while JPMorgan estimates an even higher growth at 26 percent, supported by better cracks and improved margins. HSBC also forecasts a solid quarter for the O2C segment, citing supportive refining margins and steady overall performance within the energy business.

Brokerages said the O2C segment’s resilience and broadly stable petrochemical spreads are expected to support Reliance’s consolidated performance during the quarter.

In digital services, UBS and Nomura project around 15-16 percent EBITDA growth on-year, underpinned by continued subscriber additions and modest gains in average revenue per user (ARPU).

Brokerages, including Morgan Stanley and HSBC, said that such updates could serve as a positive long-term re-rating trigger for the stock, reinforcing RIL’s positioning in next-generation digital and energy infrastructure, rather than influencing this quarter’s earnings.

Most houses -- including UBS, Axis Capital, Kotak, HSBC and Morgan Stanley -- maintain Buy or Overweight ratings with target prices ranging from Rs 1,700 to Rs 1,780, reflecting continued confidence in the company’s diversified earnings profile and gradual improvement in its energy-to-consumer mix. Investors will watch the guidance on telecom tariffs, retail momentum and progress on its new-energy initiatives.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.