New Delhi [India], September 8: Most investors used to place trades by calling a broker or visiting a branch a decade ago. Now, the entire experience is completely different. With modern online trading platforms, portfolio tracking, orders, quotes, and charts are now put into one screen, usually on phones. A mobile-first mindset, lower costs, and easier onboarding have pulled millions of people who are participating in the market for the first time into the ecosystem, which is reshaping how India trades now.

What Changed and Why It Matters

Three of these shifts majorly stand out:

1. Opening of accounts is faster now with e-signing and digital KYC.

2. Aided by instant banking rails, fund transfers and payments are simpler now.

3. Mobile interfaces have matured with built-in learning sections, clean layouts, and clearer order forms, reducing friction for newcomers.

The changes listed above don’t eliminate market risks, but they do remove process barriers. Without jumping between multiple websites, investors who previously found trading intimidating can now review market depth, place an order, and track positions in minutes.

Data Snapshot

The trend is clear: more accounts opening, increased mobile activity, and greater participation outside big cities. Over time, the share of trades made on mobile and online platforms has gone from about 40% in earlier phases to over 80% today. The profile of new investors has also changed—initially mainly from big cities, now more people from smaller towns and cities are joining in. Faster onboarding is another change; what used to take days can now often be completed in the same day or even within moments.

Even without exact figures, the pattern is obvious—digital platforms have made investing as simple as a tap or a click.

What All a Modern Platform Packs In

Research, execution, and tracking in one place – this is what a capable online trading platform brings together. These are some of the common elements you will see today:

The best trading app is simply the one that makes these features feel intuitive and stable during busy market hours for many users.

Costs, Transparency, & Access

Digital competition has increased transparency while pulling down explicit costs (such as brokerage on certain segments). Fees, fills, and order status are now visible in near real time. Another thing that’s equally important is that access has widened: investors from smaller towns can open an account, transfer funds, and start exploring the market without any physical paperwork or travel needed.

Simple Feature Check

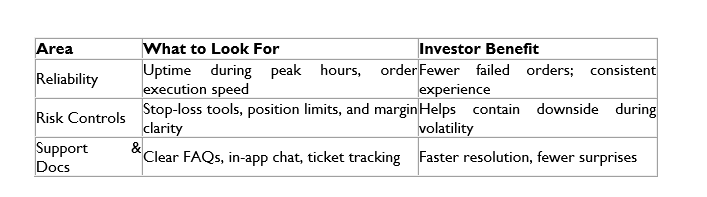

While evaluating the landscape broadly, you can think about it practically like this:

.

.

These are factors that often shape daily usage.

Risks and Responsibilities Stay the Same

The fundamentals remain the same despite the convenience that has come in

Digital rails do remove friction from the process, but not the risk from the product.

The Road Ahead

Indian trading platforms are adding new features like smarter chart tools, more detailed analytics, voice command options, and better links with bank accounts and tax tools. Regulators are also making updates to improve transparency, platform security, and protect investors, especially as most trading happens on mobile devices. As more people from outside big cities start trading, these platforms will likely make their interfaces easier to use, while also offering more advanced features for experienced users.

Bottom Line

Online trading has become more user-friendly, moving away from relying solely on brokers. Now, most people choose apps that are reliable, simple to use, and easy to understand—especially when the market is changing quickly. Although new features are always added, the main goal stays the same: to combine research, trading, and tracking in one straightforward app. This way, investors can make decisions without being pushed into specific products or strategies.

Moneycontrol journalists were not involved in the creation of the article.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.