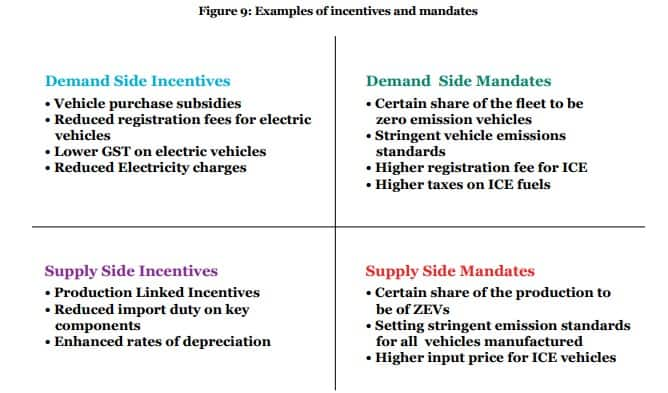

NITI Aayog has in a latest report on the adoption of electric mobility, released on August 4, shared key steps required to unlock the transition, suggesting an approach of moving from incentives to mandates or disincentives, among other aspects.

The report said the continuation of incentives provided to OEMs alone may not help reach the target of 30% EV sales in the next five years, and Centre may need to shift away towards mandates and disincentives, in a phased manner.

"...it is time to give a stronger push for the shift by introducing some gentle mandates and disincentives which will help signal the required direction more firmly. These could be over and above the incentives that currently prevail," the report said. In order to avoid any strong backlash, these mandates could be 'limited to only a certain segment of the vehicle fleet' and need not be extremely stringent to start with. The transition policy's focus is to gradually shift away from financial incentives for public buses, government fleets, and urban freight vehicles.

"These are fewer in number and would be easier to manage, besides offering higher public benefits. Limiting mandates and disincentives to such vehicles to begin with may not attract opposition but would at the same time, signal the future direction for all," the report said.

Another aspect mentioned in the report is the focus on a 'subset' of vehicle fleet, based on potential benefits from transitioning to electric. "...benefits from transitioning vehicles to electric accrue based on how intensively they are used. Therefore, priority should be accorded to transitioning vehicles that cover a larger number of vehicle kilometre in a day and those which do not require a widely distributed network of charging infrastructure." According to the report, personal cars come lower down in the priority as they have relatively small share of vehicle fleet, and the daily usage too is relatively low.

With this idea, NITI Aayog has backed the need to focus on saturation in limited geographies, rather than an even distribution across India, said the report titled 'Unlocking a $200 Billion Opportunity: Electric Vehicles in India'.

Read More: Niti Aayog examining lifecycle emissions of EVs: Report

The report added that there should is a need to enable financing options for e-buses and e-trucks, as CVs constitute a miniscule 4 percent of the vehicle fleet but contribute over half of the CO2 and PM emissions in India.

Another approach recommended by NITI Aayog is to incentivise services delivered rather for the assets procured. "The financial support under the FAME program, has largely focused on subsidising assets. Thus, the capital cost of vehicles has been subsidised instead of the number of kilometres run by such vehicles and charging assets have been subsidised instead of the charging service provided by them," the report added.

Read More: Foreign automakers prefer state-level EV schemes over central policy

The focus of NITI Aayog is also on decoupling the cost of battery from the vehicle. Batteries make up almost 40 percent of the capital cost of an EV, hence such decoupling will help reduce the capital cost of the vehicle. " This will give greater confidence to vehicle owners and financiers as the capital cost comes down. However, this will require a completely new kind of battery leasing eco system to evolve, wherein vehicle owners lease batteries and pay on a monthly basis, or on a per-km of use basis instead of paying a high capital cost," said NITI Aayog.

The report also backs efforts in scaling up R&D in battery technologies in India, which would improve the energy density of batteries, reduce costs and cut down on their import dependence. NITI Aayog goes on to say that India could emerge as a global leader in batteries if it 'moves fast enough'.

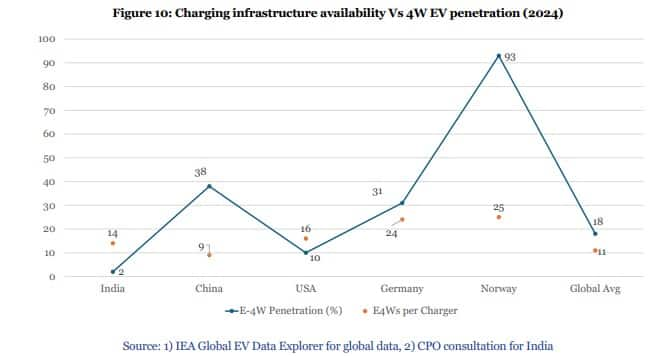

Another aspect on which the report made a suggestion was the availability of EV charging infrastructure, compared to the EV penetration in India. Citing China and Norway's example, NITI Aayog said, "China with only 9 cars per charging station (meaning a relatively high availability of charging stations) has a relatively high level of EV penetration. This is also the situation in the US and Germany. This would appear to be logical situation, as easier charging would make it easier for consumers to buy EVs. However, Norway with 25 cars per charging station (meaning a relatively poor availability of charging infrastructure compared to many others) has a 93% EV penetration." The reason for this, the report said, is early adoption of zero emission mandates and ambitious goals, as Norway started shifting to EVs as early as in 1994.

Read More: India's EV ambition in the fast lane, market share can touch 7 percent in two years, says CareEdge

The report called for a more strategic scaling of charging infrastructure in India, along highways, priority corridors, as also streamlining of sanctioning power connections by distribution companies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.