BUSINESS

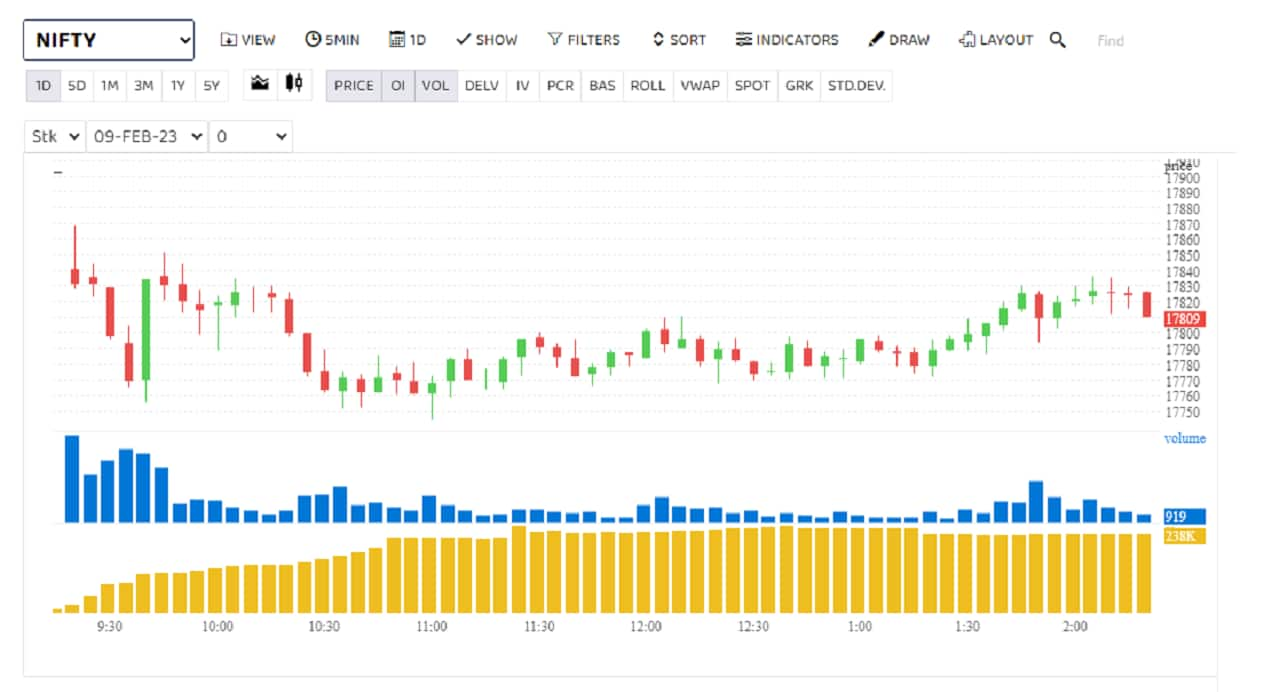

F&O Manual: Setup appears weak despite buying, 17,800 is the level to watch

Adani Enterprises is seeing a short buildup, a bearish sign where open interest rise and price fall. Ambuja Cement, another Adani Group company, is seeing long unwinding, indicating that the stock has likely made a top

BUSINESS

F&O Manual: Weakness continues in Nifty; buying opportunity in Auro Pharma

On the option front, 17,800 has seen most call writing as the strike emerged as the resistance. The same strike saw put unwinding as they shifted to lower strikes. Call writing was also seen at 17,900 and 18,000.

BUSINESS

F&O Manual | Bears harden the grip on market, select banks see heavy short buildup

Put writers were largely absent, which signals that bears are more active in the market.

BUSINESS

F&O Manual: Setup weak as traders prefer selling on rise; metals show bearishness

Bank Nifty traded flat. For the index, 41,500 seems to be the battle zone as traders are keen in taking neutral trades as of early morning.

BUSINESS

Zomato Gold crosses 900K members in a month, will not hit profitability plans

Zomato said the plan will have a negative impact on revenue in the short term. However, it is confident that other streams of revenue will make up for the loss.

BUSINESS

F&O Manual: Market remains flat; collar strategy in Bank Nifty can work, say analysts

For Nifty, 17,900 can emerge as the new battle zone for next week’s expiry.

BUSINESS

F&O Manual: Directionless market spoils the fun for traders; L&T, Adani stocks in focus

Traders in such situations like to stick to neutral trades that involve buying or selling puts and call simultaneously. Several traders told Moneycontrol that it was difficult to find suitable trading opportunities.

BUSINESS

Taking Stock: Nifty rises 150 points to close above 17,850; Adani Group stocks zoom

Metal stocks shone during the day while cement stocks buzzed due to likely review of taxes during the upcoming GST Council meeting.

MARKETS

FDI flow strong, FPI inflows improving, says RBI Governor Shaktikanta Das

RBI Governor Shaktikanta Das also asserted that India’s external debt ratios are low by international standards.

MARKETS

RBI's repo rate hike dampens homebuyers' sentiment; realty stocks slide

Real estate companies have month after month posted strong growth in bookings despite rise in repo rates. It will be interesting to see if the latest rate hike will derail that trend.

BUSINESS

F&O Manual | Traders turn long on Nifty, Bank Nifty as market bounces back

Heavy call winding was seen at 17,800 and lower strikes as the trader shifted their positions higher. On the other hand, put writers converged at 17,800 on the ongoing weekly expiry.

BUSINESS

F&O Manual: Deploy double debit spreads on Bank Nifty as volatility cools off

On Nifty, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes. Some put writers were present at 17,700 strike as that still remains the biggest support to the index.

BUSINESS

Taking stock: Sensex slides for second straight day; Nifty closes below 17,750

Auto and FMCG sectors, which saw profit booking by traders, were the biggest drags on the indices

BUSINESS

F&O Manual: Nifty flattish as traders refrain from taking directional trades

Adani Group stocks bounced back after the promoters released some of the pledged shares and Adani Transmission announced a good set of numbers.

BUSINESS

F&O Manual: Volatility to continue, deploy cross calendar spread on Nifty, say analysts

On the option front, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes.

BUSINESS

F&O Manual | Traders wait on sidelines hoping a rebound later in the day

Among stocks, apart from Vodafone Idea, Indus Towers also saw huge long buildup as bulls converged.

BUSINESS

Adani stocks continue to unnerve traders; set up still weak for Adani Enterprises

Stock market wrap: Rajesh Sriwastava, a Bengaluru-based derivative trader who had taken a short position Adani Enterprises, is maintaining his position. He said he has not noticed many shorts being covered.

BUSINESS

Taking stock: Sensex, Nifty make a smart recovery as investor confidence returns

The market reacted positively to credit rating agencies reposing faith in Adani group companies, the overnight rally in US stock markets and low-level buying at home

BUSINESS

F&O Manual: Traders expect selloff in afternoon amid Adani rout

On the options front, 17700 level saw heavy call writing as it emerged as the key hurdle for the index. Call writing was also seen at 17,800 and 17,900 strikes. Meanwhile, 17600 level saw put writing.

BUSINESS

F&O Manual: Setup weak as traders maintain shorts; 17,600 is the battle zone

Volatility remains high, with India VIX at 16. Infrastructure, metals and oil and gas are seeing a short buildup, while cement, technology and telecom see a long buildup

BUSINESS

F&O Manual: Volatility very high, experts to take a call after market opens tomorrow

Volatility will be high as February 2 is the weekly expiry and the market will also react to the US Fed outcome

BUSINESS

Budget 2023: Tax tweaks, record capex lift Sensex, Nifty higher

Finance Minister Nirmala Sitharaman also focussed on capital expenditure, affordable housing, small and medium enterprises.

BUSINESS

F&O Manual: Expect high volatility on budget day; buy on dips, say analysts

On the options front, call writing shifted to 17,900 from 17,800 level, a signal that traders are expecting some bounce-back from current levels

BUSINESS

Indian markets more expensive compared to global peers, finds Economic Survey 2023

The Economic Survey added that though the valuation is still lower as compared to its own last five-year average.