F&O Manual: Volatility to continue, deploy cross calendar spread on Nifty, say analysts

On the option front, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes.

1/6

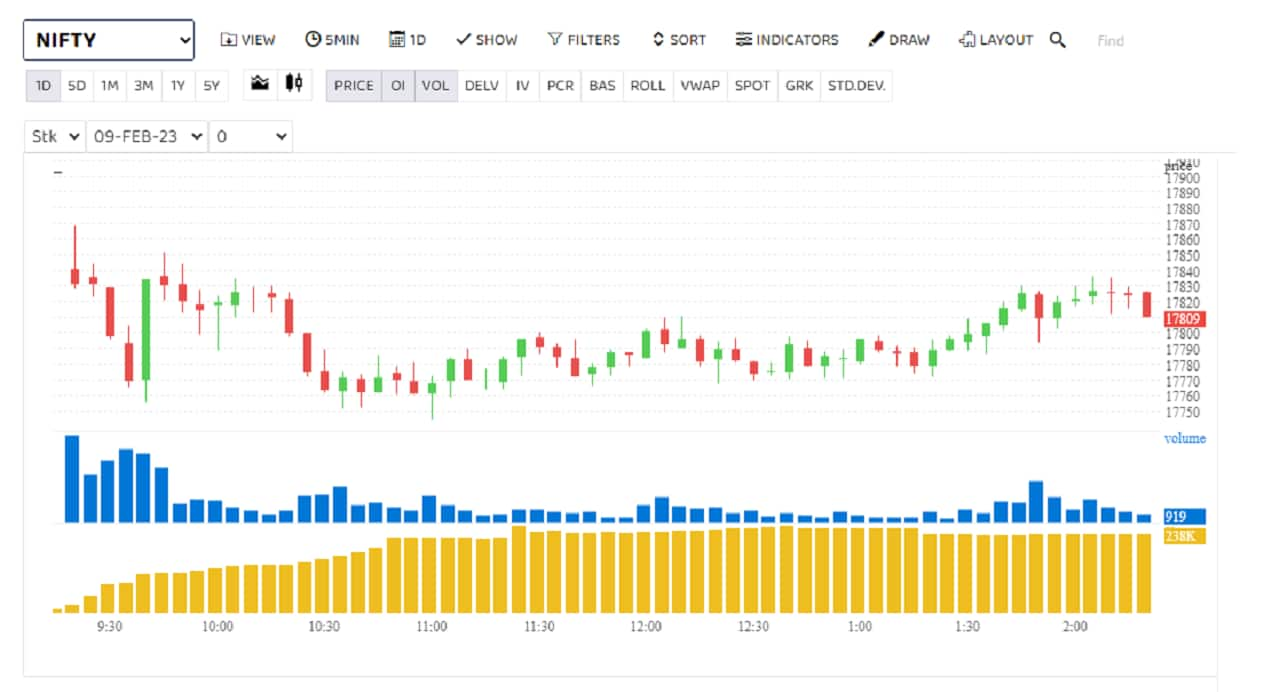

Markets continued to show weakness especially given weak Asian cues and cautious approach from the investors ahead of the RBI's credit policy. Nifty closed down half a percent or 89 points at 17,764.60. Analysts believe markets may continue to witness bouts of intra-day volatility due to lack of any fresh positive triggers in the global arena. (Blue bars show volume and golden bars open interest (OI).)

2/6

On the option front, 17800 remains the most immediate hurdle for the index. Call writers were also active at 17,900 and 18,000 strikes. “Looking at the above data, a safe and balanced strategy to enter for the short term would be to Buy the 17500 PE of March 29th expiry and sell the 17300 PE of the Feb 23rd expiry. This is a cross calendar spread in Nifty that will work even if the markets stays flat as well as when it moves to the downside. Traders can sell the 17300 PE of March end as well post expiry in Feb to take advantage of the sideways movement if it happens,” said Rahul Ghose, Founder & CEO – Hedged, an algorithm-powered advisory platform. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

3/6

Bank Nifty also closed with cuts. The index faced range-bound trading between 41000-42000 levels where the bulls and the bears were active. “The index to resume the up move must surpass the level of 42,000 on the upside on a closing basis. The undertone remains bullish and one should keep a buy-on-dip approach with immediate strong support at the 41500-41400 zone," said Kunal Shah, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

4/6

Navin Fluorine saw massive long buildup as open interest rose 27 percent to highest in the quarter. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Vodafone Idea, Indus Towers and Zydus Life were others that saw heavy ong buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/6

Interglobe Aviation saw massive short buildup. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

6/6

MCX, Jindal Steel, Piramal Enterprises and Divi’s Labs were others that saw short buildup. (Percentage reflect change in futures price during the day.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!